Region:Global

Author(s):Dev

Product Code:KRAD0584

Pages:87

Published On:August 2025

By Type:The smoke ingredient market can be segmented into various types, including Liquid Smoke (aqueous condensates), Smoke Powder (encapsulated/adsorbed), Smoke Oil/Fractions (oil-soluble), Natural Smoke Extracts (clean-label), Smoke Flavor Blends & Seasonings, and Wood Source Variants (hickory, mesquite, apple, maple, beech). Among these, Liquid Smoke is gaining traction due to its versatility and ease of use in various food applications .

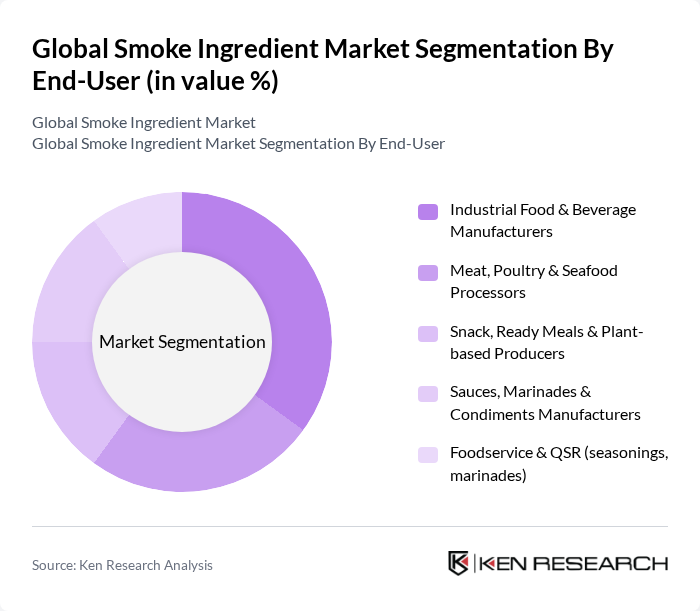

By End-User:The market can also be segmented by end-user categories, which include Industrial Food & Beverage Manufacturers, Meat, Poultry & Seafood Processors, Snack, Ready Meals & Plant-based Producers, Sauces, Marinades & Condiments Manufacturers, and Foodservice & QSR (seasonings, marinades). The Industrial Food & Beverage Manufacturers segment is currently leading due to the high demand for processed and flavored food products and the use of smoke ingredients to deliver consistent flavor and shelf-life benefits at scale .

The Global Smoke Ingredient Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kerry Group plc (Red Arrow Products), Symrise AG, Givaudan SA, International Flavors & Fragrances Inc. (IFF), Azelis Group NV, Besmoke Ltd, FRUTAROM Savory Solutions GmbH (an IFF brand), Dempsey Corporation, Redbrook Ingredient Services, A.C. Legg, Inc., MSK Lebensmitteltechnik (WIBERG brand, part of Frutarom/IFF), Kalsec Inc., Essentia Protein Solutions, Colgin Liquid Smoke, Baumer Foods, Inc. (Crystal Hot Sauce – smoke flavor lines) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the smoke ingredient market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for natural and organic products continues to rise, manufacturers are likely to invest in innovative smoke flavoring techniques. Additionally, the expansion into emerging markets, particularly in Asia-Pacific, is expected to create new growth avenues. Companies that adapt to these trends and focus on sustainable sourcing will likely gain a competitive edge in the evolving landscape of food ingredients.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Smoke (aqueous condensates) Smoke Powder (encapsulated/adsorbed) Smoke Oil/Fractions (oil-soluble) Natural Smoke Extracts (clean-label) Smoke Flavor Blends & Seasonings Wood Source Variants (hickory, mesquite, apple, maple, beech) |

| By End-User | Industrial Food & Beverage Manufacturers Meat, Poultry & Seafood Processors Snack, Ready Meals & Plant-based Producers Sauces, Marinades & Condiments Manufacturers Foodservice & QSR (seasonings, marinades) |

| By Application | Flavoring & Aroma Enhancement Color Development (Maillard/surface) Shelf-life/Antioxidant Function Surface Treatment/Atomization/Injection Clean-label Replacer for Traditional Smoking |

| By Distribution Channel | Direct (manufacturers to processors) Distributors/Ingredient Blenders E-commerce/B2B Marketplaces Retail/Wholesale (small formats) Private Label/Contract Manufacturing |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Bulk (drums, IBCs, sacks) Intermediate (pails, bags-in-box) Retail/Small Pack (bottles, sachets) Customized/Private Label |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Companies | 120 | Product Development Managers, Flavor Technologists |

| Smoke Flavor Manufacturers | 90 | Operations Managers, Quality Assurance Specialists |

| Retail Food Chains | 60 | Purchasing Agents, Category Managers |

| Regulatory Bodies | 40 | Food Safety Inspectors, Compliance Officers |

| Flavoring Ingredient Distributors | 70 | Sales Managers, Supply Chain Coordinators |

The Global Smoke Ingredient Market is valued at approximately USD 85 million, based on a five-year historical analysis. This valuation reflects the growing demand for smoke flavors in processed and ready-to-eat foods, among other factors.