Region:Global

Author(s):Dev

Product Code:KRAA1549

Pages:88

Published On:August 2025

By Type:The smokeless tobacco market is segmented into various types, including Chewing Tobacco, Snuff, Snus, Nicotine Pouches, Dissolvable Tobacco, and regional forms like Gutka, Khaini, and Zarda. Among these, Chewing Tobacco and Snuff are the most popular due to their traditional use and cultural significance in many regions. Chewing Tobacco, particularly in loose leaf and plug forms, has a strong consumer base in countries like India and the U.S. Snuff, especially moist snuff, is gaining traction due to its convenience and discreet usage.

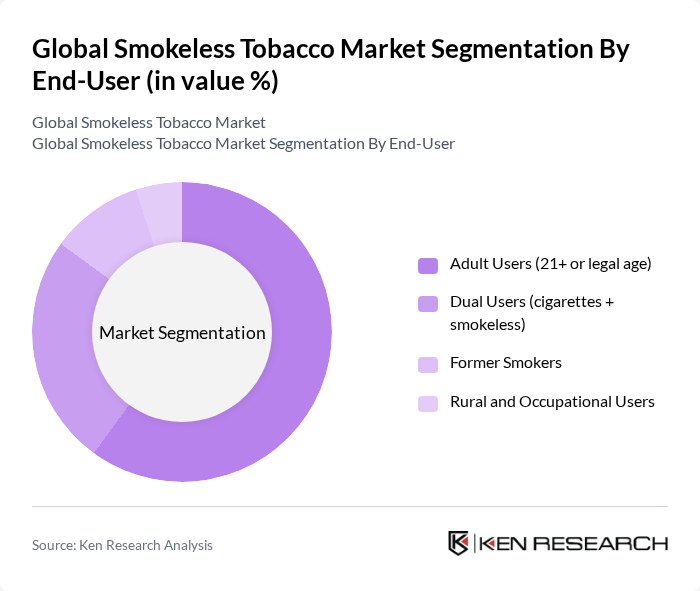

By End-User:The end-user segmentation includes Adult Users, Dual Users, Former Smokers, and Rural and Occupational Users. Adult Users represent the largest segment, driven by the cultural acceptance of smokeless tobacco in various regions. Dual Users, who consume both cigarettes and smokeless products, are also significant, as they often seek alternatives to reduce health risks. The Former Smokers segment is growing as individuals look for less harmful options to quit smoking.

The Global Smokeless Tobacco Market is characterized by a dynamic mix of regional and international players. Leading participants such as Altria Group, Inc. (U.S.), British American Tobacco p.l.c. (UK), Philip Morris International Inc. (Switzerland), Imperial Brands PLC (UK), Japan Tobacco Inc. (Japan), Swedish Match AB (Sweden) — a Philip Morris International company, Reynolds American Inc. (U.S.) — a subsidiary of British American Tobacco, ITC Limited (India), Godfrey Phillips India Ltd. (India), DS Group (Dharampal Satyapal Ltd.) (India), Scandi Standard Snus/Swedish Match brands (General, ZYN) — see respective owners, Skruf Snus AB (Sweden) — a subsidiary of Imperial Brands, Scandinavian Tobacco Group A/S (Denmark), Swedish Match North America LLC (U.S.), National Tobacco Company, L.P. (U.S.), Turning Point Brands, Inc. (U.S.), Mac Baren Tobacco Company A/S (Denmark), Orkla ASA (Norway) — owner of Jordan snus (legacy/selected markets), GN Tobacco Sweden AB (Sweden), KT&G Corporation (South Korea) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smokeless tobacco market in None appears promising, driven by evolving consumer preferences and innovative product offerings. As health awareness continues to rise, the demand for reduced-risk products is expected to grow, with manufacturers focusing on developing safer alternatives. Additionally, the expansion of e-commerce and retail channels will enhance product accessibility, allowing for greater market penetration. Companies that adapt to these trends and invest in consumer education will likely thrive in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Chewing Tobacco (loose leaf, plug, twist) Snuff (moist snuff/dip, dry snuff) Snus Nicotine Pouches (tobacco-free) Dissolvable Tobacco (lozenges, strips, sticks) Gutka, Khaini, Zarda & Other Regional Forms |

| By End-User | Adult Users (21+ or legal age) Dual Users (cigarettes + smokeless) Former Smokers Rural and Occupational Users |

| By Distribution Channel | Convenience Stores & Gas Stations Supermarkets/Hypermarkets Tobacconists & Specialty Stores Online (D2C brand sites, marketplaces, age-gated platforms) Duty-Free & Travel Retail |

| By Packaging Type | Pouches (snus/pouches, nicotine pouches) Tins/Cans Sachets Bulk & Refill Packs |

| By Flavor | Mint/Menthol Tobacco/Original Fruit & Confectionery Spices/Herbal (cardamom, clove, masala) Unflavored |

| By Price Range | Value/Low Mid Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Smokeless Tobacco | 120 | Smokeless Tobacco Users, Health-Conscious Consumers |

| Retail Insights on Smokeless Tobacco Sales | 100 | Store Managers, Tobacco Product Distributors |

| Health Impact Perceptions | 80 | Healthcare Professionals, Public Health Advocates |

| Market Trends and Regulatory Impact | 70 | Industry Analysts, Regulatory Affairs Specialists |

| Consumer Awareness and Education | 90 | Community Leaders, Educational Program Coordinators |

The Global Smokeless Tobacco Market is valued at approximately USD 2122 billion. This valuation is based on a five-year analysis and reflects the increasing consumer preference for smokeless alternatives due to health concerns associated with traditional smoking.