Region:Global

Author(s):Shubham

Product Code:KRAD0745

Pages:80

Published On:August 2025

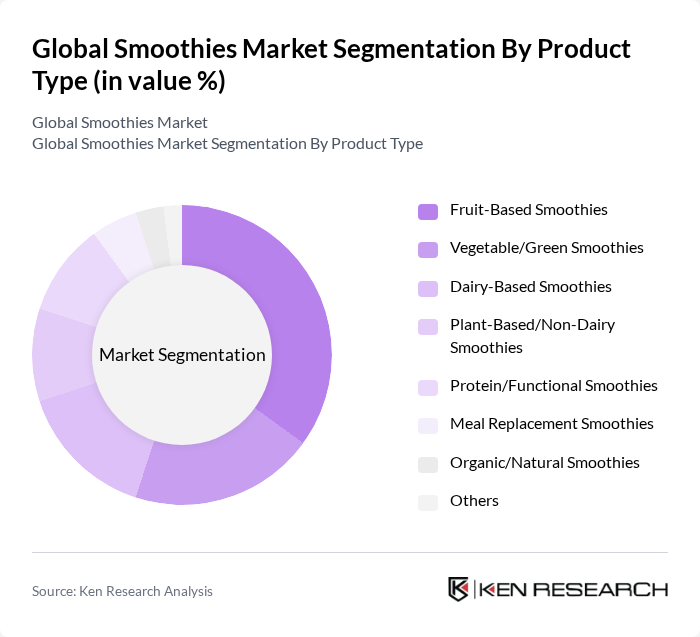

By Product Type:The product type segmentation of the smoothies market includes various categories that cater to different consumer preferences and dietary needs. The dominant sub-segment is Fruit-Based Smoothies, which appeal to a wide audience due to their natural sweetness and flavor variety. Vegetable/Green Smoothies are gaining traction among health-conscious consumers seeking nutrient-dense options. Dairy-Based Smoothies remain popular for their creamy texture, while Plant-Based/Non-Dairy Smoothies are increasingly favored by vegans and lactose-intolerant individuals. Protein/Functional Smoothies are on the rise, driven by fitness enthusiasts and wellness users seeking added benefits such as protein, fiber, probiotics, and vitamins. Organic/Natural Smoothies are also gaining popularity as consumers prioritize clean-label products with fewer additives. Overall, the market is characterized by a diverse range of offerings that cater to various dietary preferences, with ready-to-drink formats and foodservice bars both advancing innovation .

By Consumer Group:The consumer group segmentation highlights the diverse demographics driving the smoothies market. Health-Conscious Consumers are the largest segment, motivated by the desire for nutritious and convenient meal options. Fitness & Sports Nutrition Users are also significant, as they seek smoothies that provide protein and energy for workouts. Millennials & Gen Z are increasingly influential, favoring trendy flavors and innovative products. Families & Kids represent a growing market, with parents seeking healthy snacks for their children. Seniors & Wellness-Focused consumers are turning to smoothies for their health benefits, particularly for digestion and immunity. This segmentation reflects the broad appeal of smoothies across various age groups and lifestyles, with North America showing especially strong adoption across these cohorts .

The Global Smoothies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Smoothie King Franchises, Inc., Jamba (formerly Jamba Juice), Naked Juice Company (PepsiCo), Bolthouse Farms, Inc., Innocent Drinks (The Coca?Cola Company), Tropicana Brands Group, Dole plc, Suja Life, LLC, Daily Harvest, Inc., Evolution Fresh (Bolthouse Farms), Pressed Juicery, Inc. (Pressed), Huel Ltd, Koia, Inc., Vega (Danone SA), Sambazon, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smoothie market appears promising, driven by evolving consumer preferences towards health and convenience. As the trend for plant-based diets continues to rise, the demand for innovative smoothie options incorporating superfoods and functional ingredients is expected to grow. Additionally, the expansion of e-commerce platforms will facilitate greater access to smoothie products, allowing brands to reach a wider audience. Companies that adapt to these trends and invest in sustainable practices will likely thrive in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Fruit-Based Smoothies Vegetable/Green Smoothies Dairy-Based Smoothies Plant-Based/Non-Dairy Smoothies Protein/Functional Smoothies Meal Replacement Smoothies Organic/Natural Smoothies Others |

| By Consumer Group | Health-Conscious Consumers Fitness & Sports Nutrition Users Millennials & Gen Z Families & Kids Seniors & Wellness-Focused Others |

| By Distribution Channel | Smoothie Bars & QSRs Supermarkets/Hypermarkets Convenience & Drug Stores Online Retail & D2C Subscriptions Specialty & Health Food Stores Others |

| By Packaging Type | PET & Glass Bottles Tetra Pak/Cartons Pouches Cans Frozen Cups & Kits Others |

| By Flavor Profile | Berry Tropical Green/Vegetable Citrus Mixed Fruit & Seasonal Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Smoothie Sales | 120 | Store Managers, Sales Directors |

| Health and Wellness Trends | 100 | Nutritionists, Fitness Trainers |

| Consumer Preferences in Smoothies | 140 | Health-conscious Consumers, Millennials |

| Ingredient Sourcing and Supply Chain | 80 | Procurement Managers, Supply Chain Analysts |

| Market Entry Strategies for New Brands | 70 | Entrepreneurs, Business Development Managers |

The Global Smoothies Market is valued at approximately USD 13.5 billion, reflecting a significant growth trend driven by increasing health consciousness and the demand for convenient nutrition options among consumers.