Region:Global

Author(s):Dev

Product Code:KRAB0397

Pages:100

Published On:August 2025

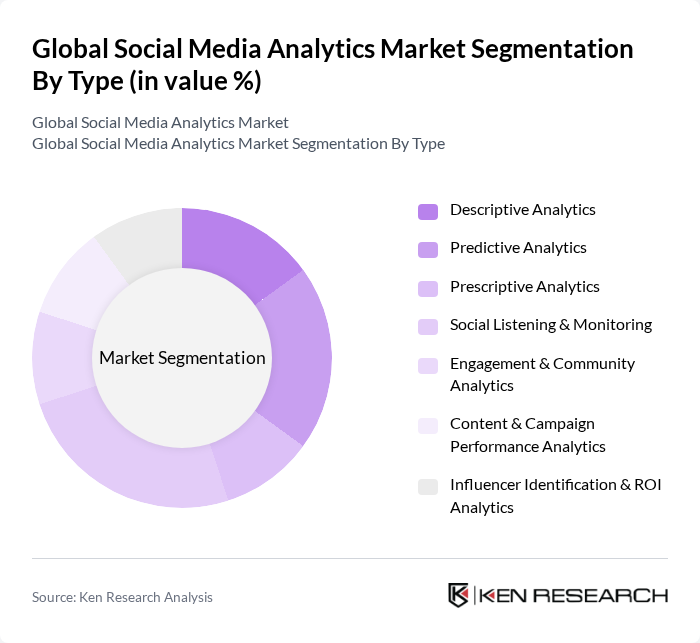

By Type:The market is segmented into various types of analytics, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Social Listening & Monitoring, Engagement & Community Analytics, Content & Campaign Performance Analytics, and Influencer Identification & ROI Analytics. Each of these sub-segments plays a crucial role in helping businesses understand and leverage social media data effectively .

The Social Listening & Monitoring segment is currently dominating the market due to the increasing need for brands to understand public sentiment and feedback in real-time. Companies are investing in tools for mention tracking, sentiment/emotion analysis, and rapid response across platforms, supported by AI/ML advances and the rise of short-form video and influencer-driven conversations that require continuous monitoring for brand reputation management .

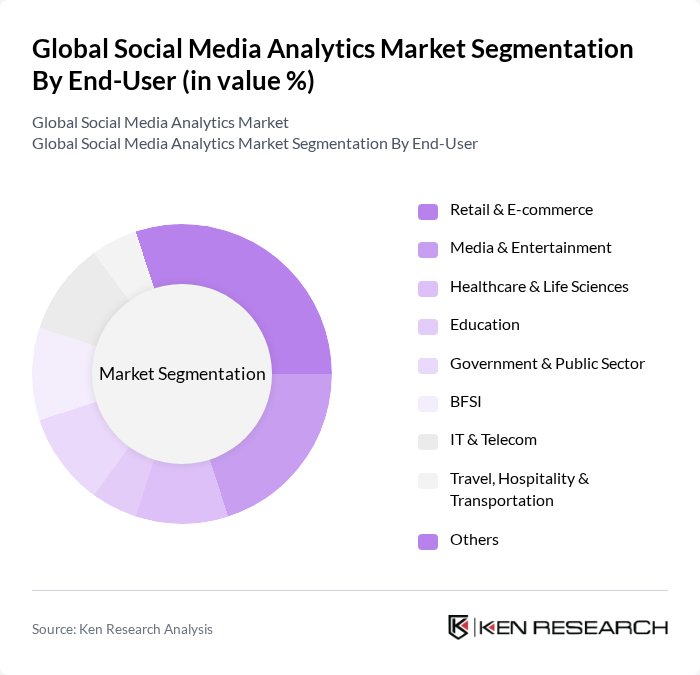

By End-User:The market is segmented by end-users, including Retail & E-commerce, Media & Entertainment, Healthcare & Life Sciences, Education, Government & Public Sector, BFSI, IT & Telecom, Travel, Hospitality & Transportation, and Others. Each sector utilizes social media analytics to enhance customer engagement, improve service delivery, and drive strategic initiatives. Adoption is notably strong in retail, media, and technology-driven sectors given their high digital marketing intensity and social commerce use cases .

The Retail & E-commerce sector is leading the market due to the increasing reliance on social media for customer acquisition, social commerce, and loyalty programs. Retailers leverage analytics for audience segmentation, conversion attribution, and campaign optimization across influencer and short-video ecosystems, with strong adoption in North America and Europe where digital ad spend and omnichannel commerce are mature .

The Global Social Media Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sprout Social, Inc., Hootsuite Inc., Brandwatch (a Cision company), Meltwater, Talkwalker, NetBase Quid, Inc., Buffer, Inc., Emplifi (formerly Socialbakers), Synthesio (a Ipsos company), Keyhole, Inc., Zoho Social (Zoho Corporation), Falcon.io (Brandwatch Social Media Management), Agorapulse, Iconosquare, Sprinklr, Adobe (Social & Experience Cloud), Salesforce (Social Studio legacy/partners), Khoros, Oracle (Oracle Social Cloud legacy/partners), Brand24 contribute to innovation, geographic expansion, and service delivery in this space.

The future of social media analytics in the None region is poised for significant transformation, driven by technological advancements and evolving consumer behaviors. As businesses increasingly prioritize real-time analytics and predictive modeling, the demand for sophisticated tools will rise in future. Additionally, the integration of AI will enhance data interpretation, enabling companies to derive actionable insights more efficiently. This evolution will foster a more data-centric approach to marketing, ultimately improving customer engagement and satisfaction across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Social Listening & Monitoring Engagement & Community Analytics Content & Campaign Performance Analytics Influencer Identification & ROI Analytics |

| By End-User | Retail & E-commerce Media & Entertainment Healthcare & Life Sciences Education Government & Public Sector BFSI IT & Telecom Travel, Hospitality & Transportation Others |

| By Application | Brand Management & Reputation Customer Engagement & Support Market Research & Consumer Insights Competitive Intelligence Crisis & Risk Management Campaign Measurement & Attribution Customer Segmentation & Targeting Sales Lead Generation & Social Commerce Others |

| By Deployment Mode | Cloud-Based On-Premises Hybrid |

| By Sales Channel | Direct (Vendor) Sales Online Self-Serve Channel Partners & Resellers Managed Service Providers (MSPs) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription (Tiered/Per-seat) Usage-Based (Pay-Per-Use/Volume) Freemium Enterprise/Custom |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Social Media Marketing Agencies | 120 | Marketing Directors, Social Media Strategists |

| Brand Managers in Consumer Goods | 100 | Brand Managers, Digital Marketing Executives |

| Analytics Tool Providers | 80 | Product Managers, Data Scientists |

| SMEs Utilizing Social Media Analytics | 70 | Business Owners, Marketing Managers |

| Academic Researchers in Digital Marketing | 60 | Research Scholars, Professors in Marketing |

The Global Social Media Analytics Market is valued at approximately USD 10.2 billion, reflecting strong enterprise adoption for marketing, customer engagement, and competitive intelligence, supported by advancements in AI and machine learning for analytics.