Region:Global

Author(s):Geetanshi

Product Code:KRAC0119

Pages:86

Published On:August 2025

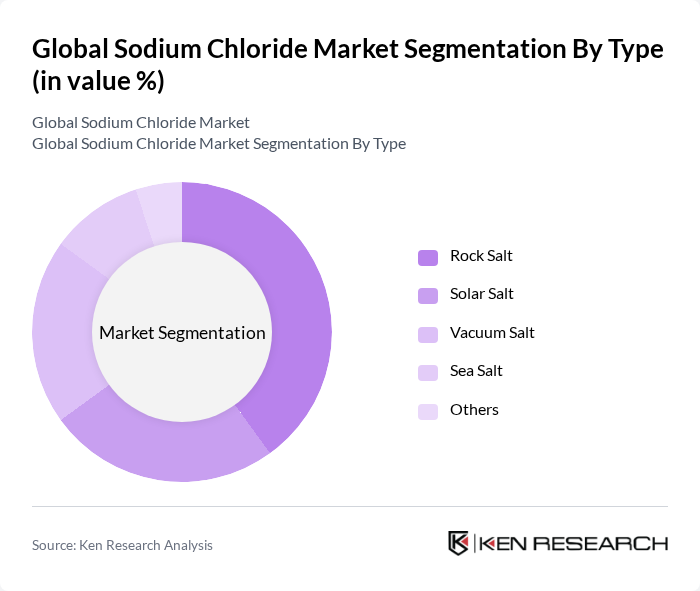

By Type:The sodium chloride market is segmented into Rock Salt, Solar Salt, Vacuum Salt, Sea Salt, and Others. Rock Salt remains the most widely used type due to its high availability and cost-effectiveness, especially in de-icing and industrial applications. Solar Salt is increasingly adopted in regions with high evaporation rates and is favored for its lower environmental impact. Vacuum Salt is preferred in food and pharmaceutical applications for its high purity and consistency. The Others category includes specialty and gourmet salts used in niche applications .

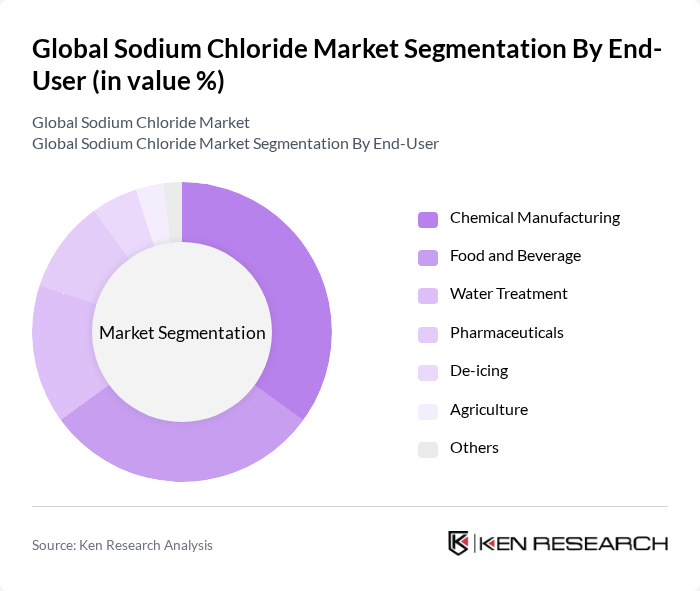

By End-User:The sodium chloride market serves a diverse range of end-user industries, including Chemical Manufacturing, Food and Beverage, Water Treatment, Pharmaceuticals, De-icing, Agriculture, and Others. Chemical Manufacturing is the largest consumer, utilizing sodium chloride as a key raw material for chlorine, caustic soda, and other chemicals. The Food and Beverage industry is a major segment, driven by demand for salt in food preservation, flavoring, and processing. Water Treatment and Pharmaceuticals are also significant consumers, reflecting the importance of sodium chloride in purification and medical applications .

The Global Sodium Chloride Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Incorporated, Compass Minerals International, Inc., K+S Aktiengesellschaft, Tata Chemicals Limited, Nouryon, Solvay S.A., China National Salt Industry Corporation, INEOS Group Limited, Occidental Petroleum Corporation, Mitsui & Co., Ltd., Sudwestdeutsche Salzwerke AG, Dampier Salt Limited, Cheetham Salt Limited, Salins Group, Swiss Salt Works AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sodium chloride market appears promising, driven by increasing applications across various industries. Innovations in production techniques are expected to enhance efficiency and reduce environmental impact, aligning with global sustainability goals. Additionally, the rising health consciousness among consumers is likely to spur demand for high-quality, food-grade sodium chloride, particularly in the food and beverage sector. As these trends evolve, the market is poised for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Rock Salt Solar Salt Vacuum Salt Sea Salt Others |

| By End-User | Chemical Manufacturing Food and Beverage Water Treatment Pharmaceuticals De-icing Agriculture Others |

| By Application | Chemical Intermediates (e.g., Chlor-alkali, Soda Ash) Food Processing & Preservation Water Softening & Treatment De-icing & Snow Removal Pharmaceuticals Animal Feed Others |

| By Distribution Channel | Direct Sales Distributors/Wholesalers Online Sales Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Medium Price High Price |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Industry | 100 | Procurement Managers, Quality Assurance Specialists |

| Pharmaceutical Applications | 80 | Regulatory Affairs Managers, Production Supervisors |

| Water Treatment Facilities | 70 | Operations Managers, Environmental Compliance Officers |

| Chemical Manufacturing | 90 | Product Development Managers, Supply Chain Analysts |

| De-icing and Road Maintenance | 50 | Logistics Coordinators, Municipal Procurement Officers |

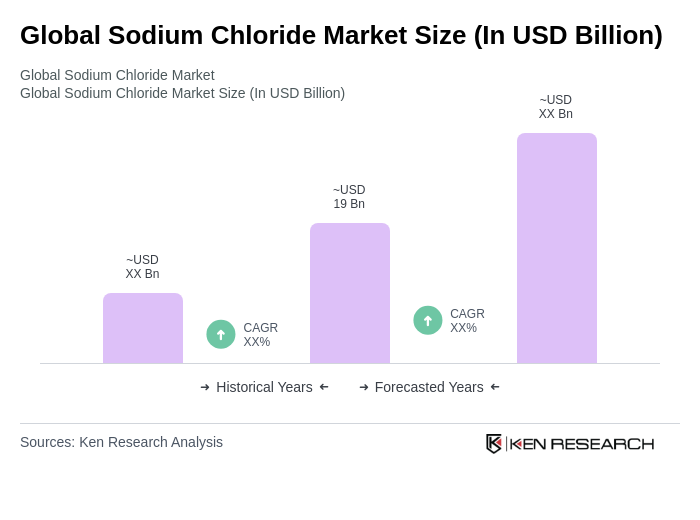

The Global Sodium Chloride Market is valued at approximately USD 19 billion, driven by increasing demand across various sectors such as chemical manufacturing, food processing, water treatment, and pharmaceuticals.