Region:Global

Author(s):Dev

Product Code:KRAC0392

Pages:96

Published On:August 2025

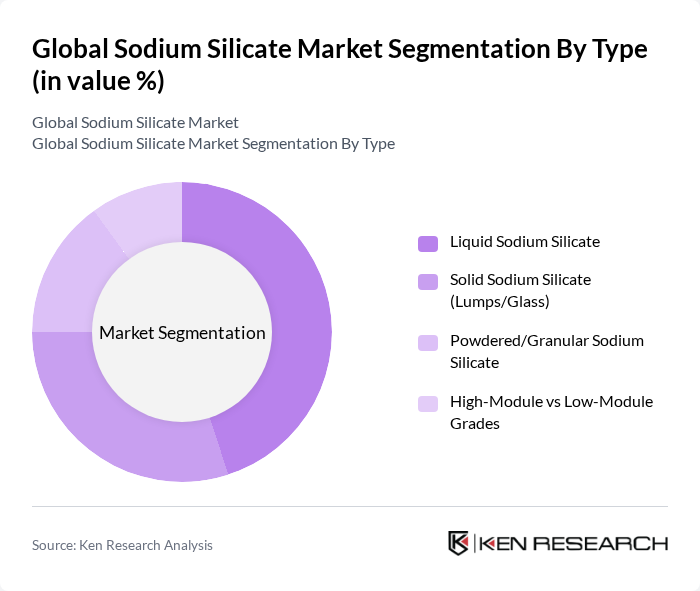

By Type:The sodium silicate market can be segmented into four main types: Liquid Sodium Silicate, Solid Sodium Silicate (Lumps/Glass), Powdered/Granular Sodium Silicate, and High-Module vs Low-Module Grades. Among these, Liquid Sodium Silicate is the most widely used due to its extensive applications in detergents and cleaning agents. The demand for Solid Sodium Silicate is also significant, particularly in construction and industrial applications. The Powdered/Granular form is gaining traction in niche applications, while the distinction between High-Module and Low-Module grades caters to specific industrial needs.

By Application:The applications of sodium silicate are diverse, including Detergents & Cleaning Agents, Pulp & Paper, Construction Chemicals (Binders, Sealants, Curing), Water Treatment & Drilling Fluids, Silica Derivatives (Zeolites, Precipitated Silica, Silica Gel), Foundry & Refractories, Adhesives & Coatings, and Others. The Detergents & Cleaning Agents segment is the largest, driven by the growing consumer preference for effective cleaning solutions. Construction Chemicals also represent a significant portion of the market, fueled by ongoing infrastructure projects globally.

The Global Sodium Silicate Market is characterized by a dynamic mix of regional and international players. Leading participants such as PQ Corporation, BASF SE, Evonik Industries AG, CIECH S.A., Tokuyama Corporation, Nippon Chemical Industrial Co., Ltd., Kiran Global Chem Limited, Oriental Silicas Corporation, W.R. Grace & Co., Merck KGaA, Sibelco, Nirma Limited, OCI Company Ltd., C. Thai Chemicals Co., Ltd., C. S. A. Chemical Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sodium silicate market appears promising, driven by increasing applications across diverse industries and a strong push towards sustainability. As manufacturers adopt advanced production technologies, efficiency will improve, allowing for better cost management. Additionally, the growing trend of eco-friendly products will likely enhance sodium silicate's appeal, particularly in construction and automotive sectors. Strategic partnerships and collaborations will further bolster innovation, ensuring that the market remains competitive and responsive to evolving consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Sodium Silicate Solid Sodium Silicate (Lumps/Glass) Powdered/Granular Sodium Silicate High-Module vs Low-Module Grades |

| By Application | Detergents & Cleaning Agents Pulp & Paper Construction Chemicals (Binders, Sealants, Curing) Water Treatment & Drilling Fluids Silica Derivatives (Zeolites, Precipitated Silica, Silica Gel) Foundry & Refractories Adhesives & Coatings Others |

| By End-User | Industrial Manufacturing Construction & Infrastructure Pulp & Paper Mills Water Utilities & Environmental Services Oil & Gas and Mining Household & Institutional Cleaning Others |

| By Distribution Channel | Direct (Contract) Sales Distributors/Traders Online/B2B Platforms Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Rest of APAC) Middle East & Africa South America |

| By Packaging Type | Bulk (Tankers, IBCs) Bags/Sacks (25–1000 kg) Custom/Returnable Packaging |

| By Price Range | Low Price Medium Price High Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Detergent Manufacturing | 100 | Production Managers, R&D Heads |

| Construction Materials | 80 | Project Managers, Procurement Specialists |

| Automotive Applications | 70 | Quality Control Managers, Product Engineers |

| Glass and Ceramics Industry | 60 | Manufacturing Supervisors, Technical Directors |

| Food and Beverage Sector | 50 | Food Safety Managers, Process Engineers |

The Global Sodium Silicate Market is valued at approximately USD 5 billion, reflecting a robust growth trajectory driven by increasing demand across various applications, including detergents, construction, and water treatment.