Global Solid Control Equipment Market Overview

- The Global Solid Control Equipment Market is valued at USD 3.6 billion, based on a five-year historical analysis. Growth is primarily driven by the increasing demand for efficient waste management solutions in the oil and gas industry, alongside a rising focus on environmental sustainability and regulatory compliance. Technological advancements, such as the integration of automation and real-time monitoring, are further enhancing the performance and efficiency of solid control equipment, supporting market expansion .

- Key players in this market include the United States, Canada, and China, which dominate due to extensive oil and gas exploration activities and significant investments in mining and construction sectors. The presence of established companies and advanced technological capabilities in these regions further strengthens their leadership in the solid control equipment market .

- In 2023, the U.S. government updated regulations on waste management in the oil and gas sector, mandating the use of advanced solid control equipment to reduce environmental impact. The Resource Conservation and Recovery Act (RCRA), administered by the U.S. Environmental Protection Agency (EPA), establishes comprehensive requirements for the management, treatment, and disposal of drilling waste, including operational thresholds and standards for solid control equipment .

Global Solid Control Equipment Market Segmentation

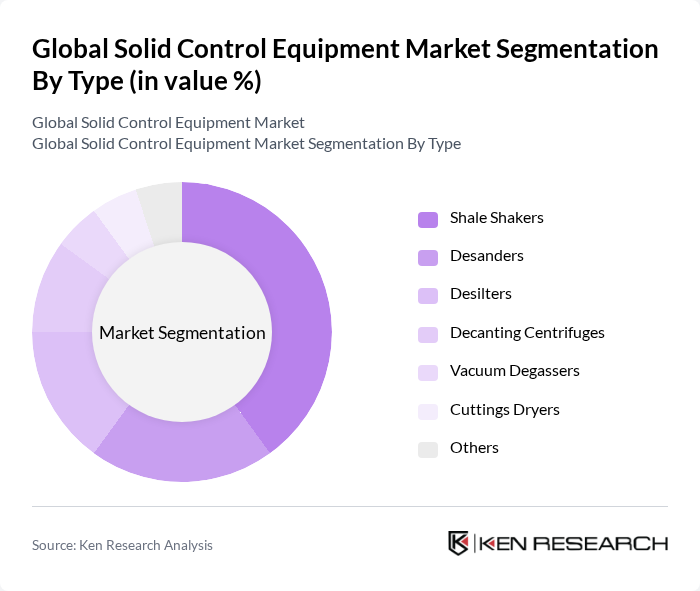

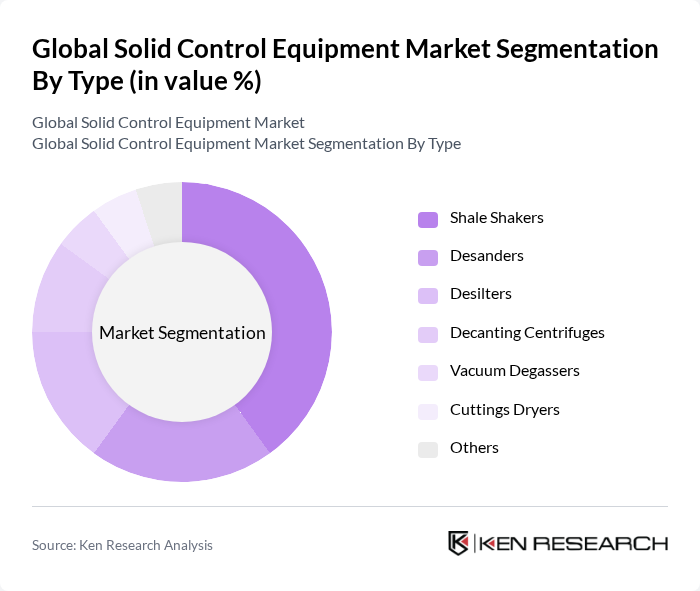

By Type:The solid control equipment market is segmented into shale shakers, desanders, desilters, decanting centrifuges, vacuum degassers, cuttings dryers, and others. Shale shakers remain the most dominant sub-segment, given their essential role in the initial phase of drilling operations, where they separate solids from drilling fluids. The surge in shale gas extraction and horizontal drilling activities has significantly increased the demand for shale shakers. Desanders and desilters are critical for managing larger and finer particles, respectively, while decanting centrifuges are increasingly adopted for efficient solid-liquid separation, vital for waste management across oil & gas and mining industries .

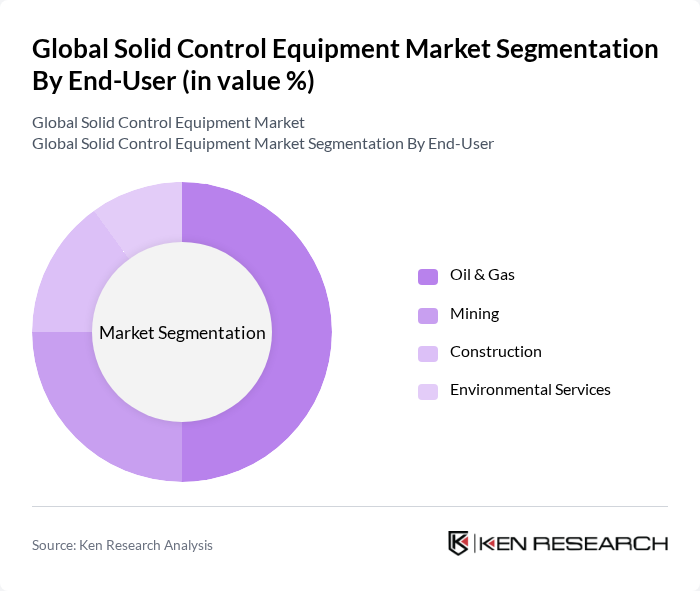

By End-User:The solid control equipment market is segmented by end-user into oil & gas, mining, construction, and environmental services. The oil & gas sector is the largest end-user, driven by continuous exploration and production activities and the adoption of advanced drilling techniques. The mining industry also contributes significantly, as solid control equipment is essential for managing waste and ensuring compliance with environmental regulations. The construction sector is increasingly adopting solid control solutions to manage site waste, while environmental services are leveraging innovative technologies for enhanced waste management .

Global Solid Control Equipment Market Competitive Landscape

The Global Solid Control Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schlumberger Limited, Halliburton Company, Baker Hughes Company, National Oilwell Varco, Inc. (NOV Inc.), Weatherford International plc, Derrick Equipment Company, GN Solids Control, Kosun Machinery Co., Ltd., Elgin Separation Solutions, Brightway Energy Machinery Co., Ltd., Kayden Industries, Brandt (a division of NOV), MI SWACO (a Schlumberger company), SWACO, and Aker Solutions ASA contribute to innovation, geographic expansion, and service delivery in this space .

Global Solid Control Equipment Market Industry Analysis

Growth Drivers

- Increasing Demand for Efficient Drilling Operations:The global oil and gas sector is projected to invest approximately $1.5 trillion in exploration and production activities in future. This surge in investment is driven by the need for efficient drilling operations, which solid control equipment significantly enhances. Efficient drilling reduces operational downtime and increases productivity, making solid control systems essential for companies aiming to optimize their drilling processes and maximize resource extraction.

- Technological Advancements in Solid Control Systems:The solid control equipment market is witnessing rapid technological advancements, with investments in R&D expected to reach $200 million in future. Innovations such as automated separation technologies and real-time monitoring systems are enhancing the efficiency and effectiveness of solid control processes. These advancements not only improve operational efficiency but also reduce waste, aligning with industry trends towards sustainability and cost-effectiveness in drilling operations.

- Rising Environmental Regulations:In response to increasing environmental concerns, governments worldwide are implementing stricter regulations on waste management and emissions. In future, it is estimated that compliance costs for oil and gas companies could rise to $50 billion globally. This regulatory landscape is driving the adoption of advanced solid control equipment, which helps companies meet environmental standards while minimizing their ecological footprint, thus fostering market growth.

Market Challenges

- High Initial Investment Costs:The initial capital required for solid control equipment can be substantial, often exceeding $1 million for advanced systems. This high upfront cost poses a significant barrier for smaller operators and can deter investment in new technologies. As companies weigh the benefits against these costs, many may delay or forgo necessary upgrades, hindering overall market growth and technological advancement in the sector.

- Fluctuating Oil Prices:The volatility of oil prices, which can swing from $40 to $100 per barrel, creates uncertainty in the oil and gas industry. This unpredictability affects capital expenditure decisions, leading companies to adopt a cautious approach towards investing in solid control equipment. As a result, many firms may prioritize short-term operational needs over long-term investments in technology, impacting the overall growth of the solid control equipment market.

Global Solid Control Equipment Market Future Outlook

The future of the solid control equipment market appears promising, driven by ongoing technological innovations and increasing environmental awareness. Companies are expected to invest more in automation and IoT integration, enhancing operational efficiency and data management. Additionally, the focus on sustainability will likely lead to the development of eco-friendly solid control solutions, aligning with global trends towards greener practices. As the industry adapts to these changes, the demand for advanced solid control systems is anticipated to grow significantly.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets, particularly in Asia and Africa, are expected to see a surge in oil and gas exploration activities, with investments projected to reach $300 billion in future. This growth presents significant opportunities for solid control equipment manufacturers to establish a foothold in these regions, catering to the increasing demand for efficient drilling technologies.

- Development of Eco-Friendly Solid Control Solutions:The rising emphasis on sustainability is driving the demand for eco-friendly solid control solutions. Companies are increasingly seeking technologies that minimize waste and environmental impact. In future, the market for green solid control technologies is expected to grow by $150 million, providing manufacturers with opportunities to innovate and capture a share of this expanding segment.