Region:Global

Author(s):Shubham

Product Code:KRAA1716

Pages:81

Published On:August 2025

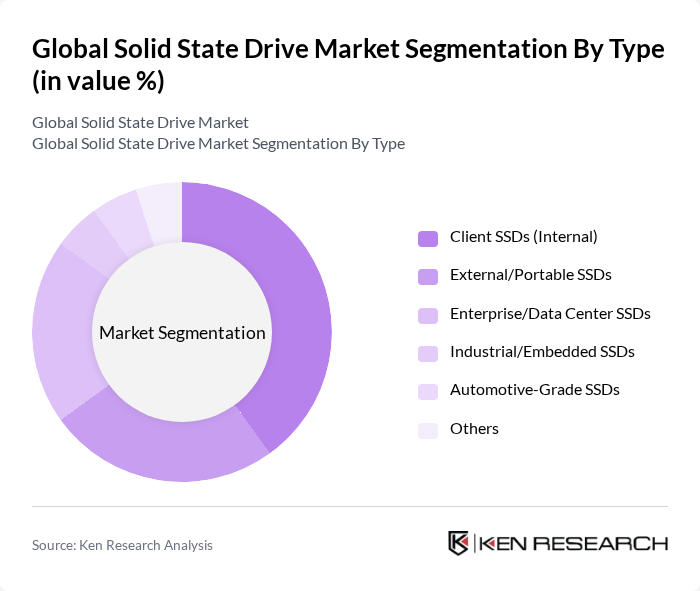

By Type:The market is segmented into various types of solid-state drives, including Client SSDs (Internal), External/Portable SSDs, Enterprise/Data Center SSDs, Industrial/Embedded SSDs, Automotive-Grade SSDs, and Others. Client SSDs (Internal) remain a leading segment as PC OEMs and consumers continue shifting from HDDs to NVMe SSDs for faster boot/load times, responsiveness, and durability; falling NAND prices and broader NVMe adoption have reinforced this preference in mainstream laptops and desktops.

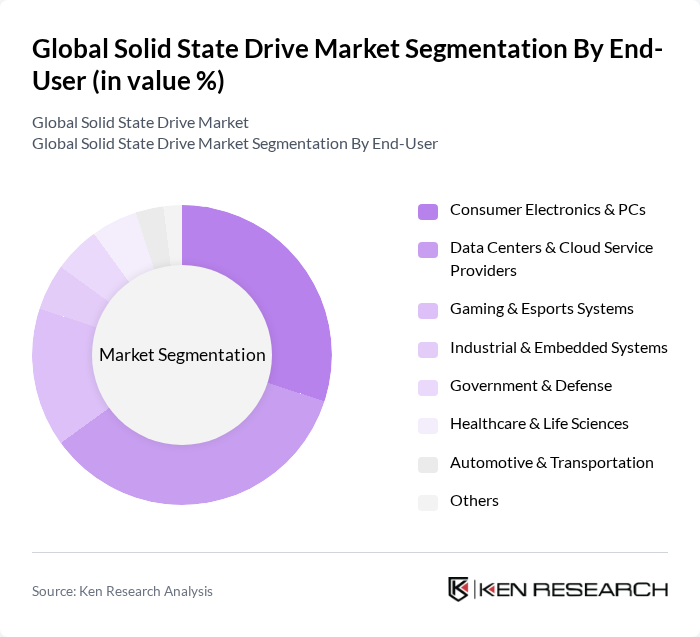

By End-User:The end-user segmentation includes Consumer Electronics & PCs, Data Centers & Cloud Service Providers, Gaming & Esports Systems, Industrial & Embedded Systems, Government & Defense, Healthcare & Life Sciences, Automotive & Transportation, and Others. The Data Centers & Cloud Service Providers segment is currently leading the market, supported by hyperscale and enterprise workloads that require low-latency, high-throughput NVMe SSDs for cloud computing, virtualization, AI/ML training and inference, and analytics.

The Global Solid State Drive Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., Western Digital Corporation, Kingston Technology Company, Inc., Micron Technology, Inc. (Crucial), Seagate Technology Holdings plc, SK hynix Inc. (including Solidigm), Kioxia Corporation, ADATA Technology Co., Ltd., Transcend Information, Inc., Corsair Gaming, Inc. (Corsair), PNY Technologies, Inc., Team Group Inc., Silicon Power Computer & Communications Inc., Biwin Storage Technology Co., Ltd. (BIWIN), Mushkin Enhanced MFG, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the SSD market appears promising, driven by technological advancements and increasing data demands. As NVMe technology becomes more prevalent, SSDs will continue to offer enhanced performance, catering to sectors like gaming and cloud computing. Additionally, the integration of AI in storage solutions is expected to optimize data management and efficiency. Companies are likely to invest in innovative SSD technologies, ensuring they remain competitive in a rapidly evolving landscape, while addressing sustainability concerns through energy-efficient designs.

| Segment | Sub-Segments |

|---|---|

| By Type | Client SSDs (Internal) External/Portable SSDs Enterprise/Data Center SSDs Industrial/Embedded SSDs Automotive-Grade SSDs Others |

| By End-User | Consumer Electronics & PCs Data Centers & Cloud Service Providers Gaming & Esports Systems Industrial & Embedded Systems Government & Defense Healthcare & Life Sciences Automotive & Transportation Others |

| By Application | Personal Computing (Laptops/Desktops) Enterprise Storage (Servers/All-Flash Arrays) Cloud & Hyperscale Edge & Embedded Systems Gaming Consoles & PCs AI/ML & HPC Workloads Others |

| By Distribution Channel | Online Retail & Marketplaces Offline Retail (Electronics/IT Stores) Direct Sales (OEMs/Enterprise) Distributors & VARs Others |

| By Form Factor | inch inch mSATA M.2 (2280/22110) U.2/U.3 Add-in Card (AIC: HHHL/FHHL) Others |

| By Interface | SATA SAS PCI Express (NVMe) Others |

| By Capacity | Under 500 GB GB – 1 TB TB – 2 TB Above 2 TB |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Market | 120 | Product Managers, Marketing Directors |

| Enterprise Storage Solutions | 100 | IT Managers, Data Center Administrators |

| Automotive Applications | 80 | Automotive Engineers, R&D Managers |

| Cloud Computing Services | 100 | Cloud Architects, Service Delivery Managers |

| Gaming Industry | 80 | Game Developers, Hardware Engineers |

The Global Solid State Drive Market is valued at approximately USD 62 billion, reflecting significant growth driven by the increasing demand for high-speed data storage solutions across various sectors, including consumer electronics and data centers.