Region:Global

Author(s):Shubham

Product Code:KRAC0707

Pages:83

Published On:August 2025

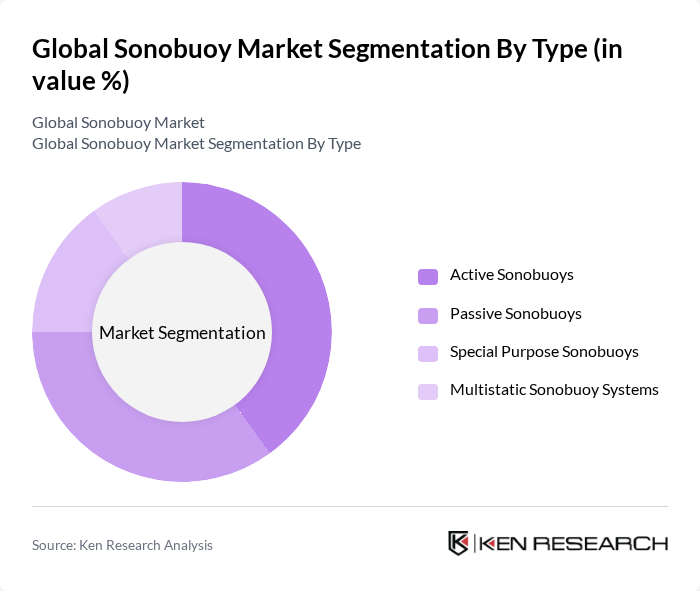

By Type:The sonobuoy market is segmented into Active Sonobuoys, Passive Sonobuoys, Special Purpose Sonobuoys, and Multistatic Sonobuoy Systems. Active Sonobuoys emit acoustic energy to detect and localize submarines, Passive Sonobuoys provide stealthy detection by listening for acoustic signatures, Special Purpose Sonobuoys address functions such as bathythermographic profiling and command/control relay, and Multistatic Sonobuoy Systems coordinate multiple source/receiver nodes to enhance detection performance against quiet submarines and in challenging acoustic conditions .

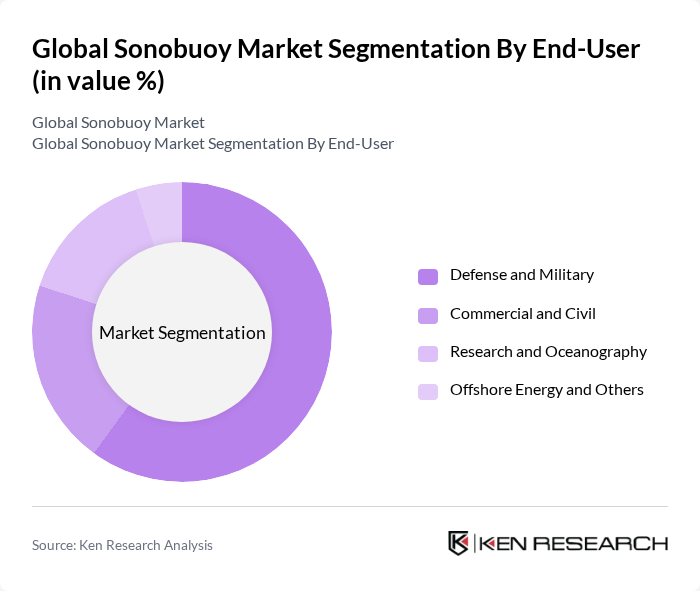

By End-User:The market is segmented into Defense and Military, Commercial and Civil, Research and Oceanography, and Offshore Energy and Others. The Defense and Military segment is the largest due to increased ASW activity, P-8A/P-3C and allied maritime patrol aircraft operations, and growing undersea threat perceptions. Commercial and Civil demand grows with environmental monitoring and maritime safety needs, while Research and Oceanography leverage sonobuoys for ocean profiling and acoustic research; offshore energy participants apply acoustic sensing for site assessment and environmental baselining .

The Global Sonobuoy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ultra Maritime (formerly Ultra Electronics Maritime), Sparton Corporation (Elbit Systems of America), ERAPSCO (Ultra Maritime and Sparton JV), Thales Group, L3Harris Technologies, Lockheed Martin Corporation, Leonardo S.p.A., Saab AB, Kongsberg Gruppen ASA, General Dynamics Corporation, Raytheon (RTX Corporation), Northrop Grumman Corporation, Naval Group, Bharat Electronics Limited (BEL), China State Shipbuilding Corporation (CSSC) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the sonobuoy market appears promising, driven by technological advancements and increasing defense expenditures. As nations prioritize maritime security, the integration of sonobuoys with unmanned systems is expected to enhance operational efficiency. Furthermore, the shift towards environmentally friendly technologies will likely spur innovation, leading to the development of sustainable sonobuoy solutions. These trends indicate a dynamic market landscape, with significant opportunities for growth and collaboration in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Active Sonobuoys Passive Sonobuoys Special Purpose Sonobuoys Multistatic Sonobuoy Systems |

| By End-User | Defense and Military Commercial and Civil Research and Oceanography Offshore Energy and Others |

| By Application | Anti-Submarine Warfare (ASW) Training and Exercise Oceanographic and Environmental Monitoring Search and Rescue (SAR) |

| By Deployment Method | Free-Fall Launch Cartridge/Pneumatic Launch Spring Launch Systems Unmanned Aerial Systems (UAS) Deployment |

| By Size Class | Size A Size B Size C Others |

| By Region | North America (U.S., Canada) Europe (U.K., France, Germany, Russia, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Rest of APAC) Latin America Middle East & Africa |

| By Technology | Bathythermograph (BT) Directional Command Activated (DICASS) Directional Frequency Analysis and Recording (DIFAR) Low Frequency Analysis and Recording (LOFAR) Data Link Communications and Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Sonobuoy Applications | 100 | Defense Procurement Officers, Military Analysts |

| Commercial Marine Research | 75 | Marine Biologists, Oceanographic Researchers |

| Environmental Monitoring Initiatives | 60 | Environmental Scientists, Policy Makers |

| Sonobuoy Technology Development | 80 | R&D Managers, Product Development Engineers |

| Training and Simulation Programs | 50 | Training Coordinators, Simulation Specialists |

The Global Sonobuoy Market is valued at approximately USD 520 million, driven by increased defense budgets, advancements in underwater surveillance technology, and rising maritime security concerns.