Region:Global

Author(s):Shubham

Product Code:KRAB0743

Pages:98

Published On:August 2025

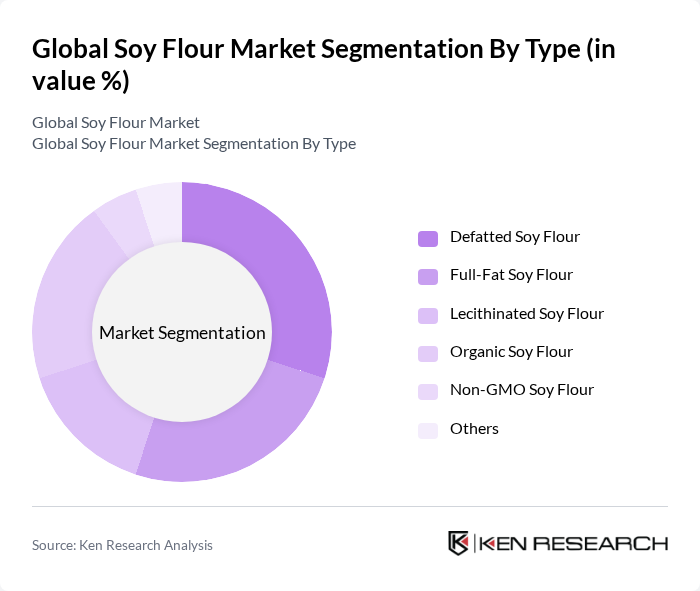

By Type:The soy flour market is segmented into Defatted Soy Flour, Full-Fat Soy Flour, Lecithinated Soy Flour, Organic Soy Flour, Non-GMO Soy Flour, and Others. Each type serves different consumer needs and applications, influencing market dynamics significantly. Defatted soy flour is preferred for its high protein and low-fat content, while full-fat soy flour is valued for its energy density. Lecithinated soy flour is used for its emulsification properties in processed foods. Organic and non-GMO segments are gaining traction due to rising demand for clean-label and traceable ingredients.

The Defatted Soy Flour segment is currently dominating the market due to its high protein content and low-fat properties, making it a preferred choice among health-conscious consumers and food manufacturers. This type of soy flour is widely used in protein supplements, bakery products, and meat alternatives, aligning with the growing trend of plant-based diets. The increasing awareness of health benefits associated with soy consumption further drives the demand for defatted soy flour, solidifying its position as the leading sub-segment in the market.

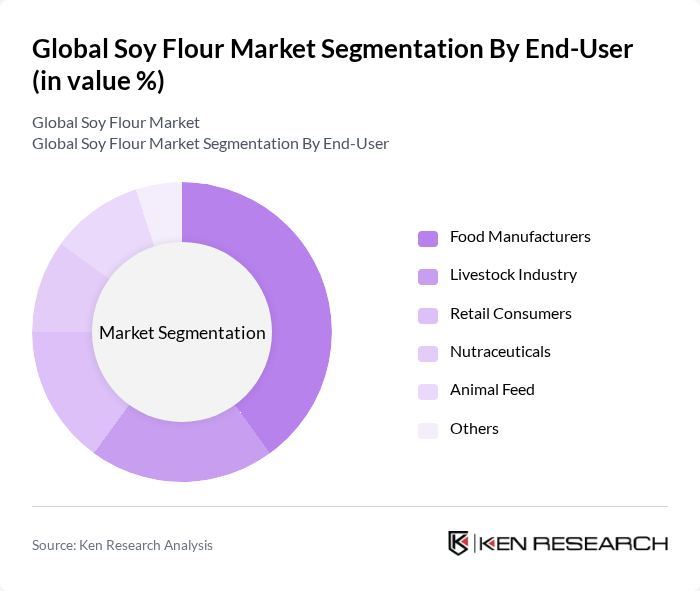

By End-User:The market is segmented based on end-users, including Food Manufacturers, Livestock Industry, Retail Consumers, Nutraceuticals, Animal Feed, and Others. Each end-user category has distinct requirements and influences the demand for soy flour differently. Food manufacturers are the largest consumers, using soy flour in bakery, snacks, and meat alternatives. The livestock industry and animal feed sectors utilize soy flour for its protein content, while nutraceuticals and retail consumers drive demand for specialty and health-focused products.

The Food Manufacturers segment leads the market, driven by the increasing incorporation of soy flour in various food products such as baked goods, snacks, and meat alternatives. The growing trend of health and wellness among consumers has prompted food manufacturers to seek high-protein, low-fat ingredients, making soy flour an attractive option. Additionally, the versatility of soy flour in enhancing texture and nutritional value in food products further solidifies its dominance in the market.

The Global Soy Flour Market is characterized by a dynamic mix of regional and international players. Leading participants such as Archer Daniels Midland Company (ADM), Cargill, Incorporated, Bunge Limited, Wilmar International Limited, CHS Inc., The Scoular Company, AGT Food and Ingredients Inc., SunOpta Inc., Soja Protein A.D., Ruchi Soya Industries Limited, Ingredion Incorporated, Hain Celestial Group, Inc., NutraBlend Foods, LLC, Fuji Oil Holdings Inc., Devansoy Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the soy flour market appears promising, driven by increasing consumer demand for plant-based proteins and health-conscious food options. Innovations in food processing technologies are expected to enhance the quality and versatility of soy flour, making it more appealing to manufacturers. Additionally, the expansion into emerging markets, particularly in Asia and Africa, will provide new growth avenues, as these regions show a rising interest in plant-based diets and health foods.

| Segment | Sub-Segments |

|---|---|

| By Type | Defatted Soy Flour Full-Fat Soy Flour Lecithinated Soy Flour Organic Soy Flour Non-GMO Soy Flour Others |

| By End-User | Food Manufacturers Livestock Industry Retail Consumers Nutraceuticals Animal Feed Others |

| By Application | Bakery Products Processed Foods Meat Alternatives Snacks and Confectionery Sauces and Dressings Nutritional Supplements Animal Feed Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales Others |

| By Region | North America (United States, Canada, Mexico) Europe (United Kingdom, Germany, France, Russia, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (UAE, Saudi Arabia, Rest of Middle East & Africa) |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturing Sector | 100 | Product Development Managers, Quality Assurance Specialists |

| Animal Feed Production | 60 | Feed Formulators, Procurement Managers |

| Health and Nutrition Products | 50 | Nutritionists, R&D Managers |

| Export and Trade Analysis | 40 | Export Managers, Trade Analysts |

| Retail and Consumer Insights | 60 | Market Researchers, Category Managers |

The Global Soy Flour Market is valued at approximately USD 3.6 billion, driven by increasing demand for plant-based protein sources and the growing popularity of gluten-free and vegan diets. This market is expected to continue expanding as consumer preferences shift towards healthier food options.