Region:Global

Author(s):Dev

Product Code:KRAC0517

Pages:80

Published On:August 2025

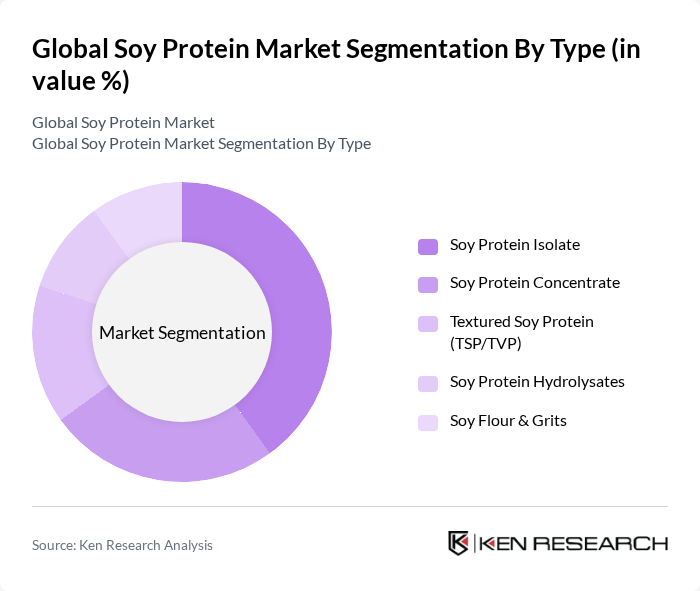

By Type:The soy protein market is segmented into various types, including Soy Protein Isolate, Soy Protein Concentrate, Textured Soy Protein (TSP/TVP), Soy Protein Hydrolysates, and Soy Flour & Grits. Among these, Soy Protein Isolate is the leading subsegment due to its high protein content and versatility in food applications. It is widely used in protein supplements, meat alternatives, and dairy substitutes, catering to the growing demand for high-protein diets.

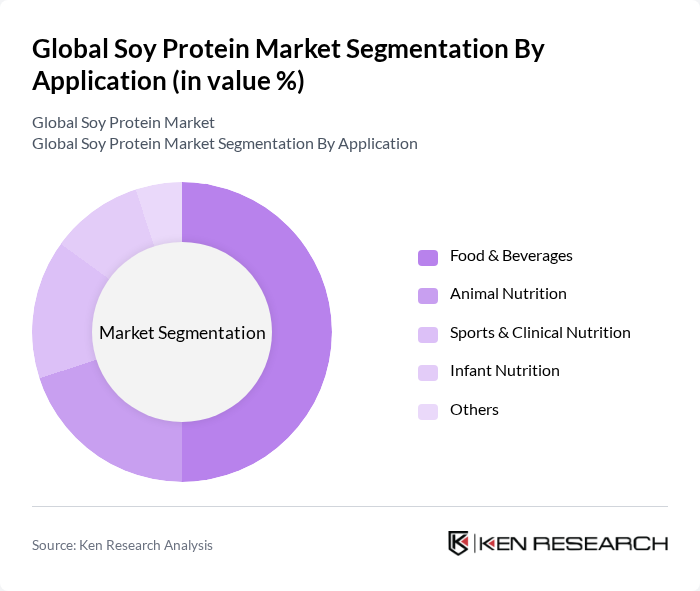

By Application:The applications of soy protein are diverse, including Food & Beverages, Animal Nutrition, Sports & Clinical Nutrition, Infant Nutrition, and others. The Food & Beverages segment is the most significant, driven by the rising trend of plant-based diets and the incorporation of soy protein in various food products such as meat analogs, dairy alternatives, and ready-to-drink nutrition products. This segment's growth is fueled by increasing consumer awareness of health and wellness.

The Global Soy Protein Market is characterized by a dynamic mix of regional and international players. Leading participants such as Archer Daniels Midland Company (ADM), Cargill, Incorporated, Bunge Global SA, Wilmar International Limited, CHS Inc., Kerry Group plc, DuPont Nutrition & Biosciences (IFF), The Scoular Company, Fuji Oil Holdings Inc., Shandong Yuxin Bio-Tech Co., Ltd., Shandong Wonderful Industrial Group Co., Ltd., Gushen Biotechnology Group Co., Ltd., Sinoglory Enterprise Group Co., Ltd., Ruchi Soya Industries Limited (Patanjali Foods Limited), SunOpta Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the soy protein market appears promising, driven by increasing consumer awareness of health benefits and sustainability. Innovations in product formulations and the expansion of soy protein applications in meat alternatives are expected to enhance market growth. Additionally, the rise of e-commerce platforms is facilitating access to soy protein products, allowing manufacturers to reach a broader audience. As the market evolves, adaptability and responsiveness to consumer trends will be crucial for success.

| Segment | Sub-Segments |

|---|---|

| By Type | Soy Protein Isolate Soy Protein Concentrate Textured Soy Protein (TSP/TVP) Soy Protein Hydrolysates Soy Flour & Grits |

| By Application | Food & Beverages (Bakery, Meat Analogs/Extenders, Dairy Alternatives, RTD/RTM Nutrition) Animal Nutrition (Poultry, Aquafeed, Swine, Pet Food) Sports & Clinical Nutrition (Supplements, Medical Foods) Infant Nutrition & Early Life Others (Cosmetics, Industrial) |

| By End-User | Food & Beverage Manufacturers Nutraceutical & Dietary Supplement Companies Animal Feed Producers Retail/Private Label Brands Foodservice & QSR |

| By Distribution Channel | B2B (Direct/Contract Manufacturing, Distributors) Modern Trade (Supermarkets/Hypermarkets) Specialty & Health Stores Online (D2C, Marketplaces) Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Nature | Conventional Organic |

| By Product Form | Powder Liquid Textured/Chunks/Granules Bars, Capsules & Tablets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Manufacturers | 120 | Product Development Managers, R&D Directors |

| Dietary Supplement Companies | 90 | Marketing Managers, Quality Assurance Specialists |

| Animal Feed Producers | 70 | Procurement Managers, Nutritionists |

| Health and Wellness Retailers | 60 | Store Managers, Category Buyers |

| Research Institutions and Universities | 50 | Researchers, Professors in Food Science |

The Global Soy Protein Market is valued at approximately USD 10.0 billion, reflecting a significant demand for soy protein ingredients driven by the adoption of plant-based diets and health-focused consumption trends across various food and beverage categories.