Region:Global

Author(s):Rebecca

Product Code:KRAA1384

Pages:98

Published On:August 2025

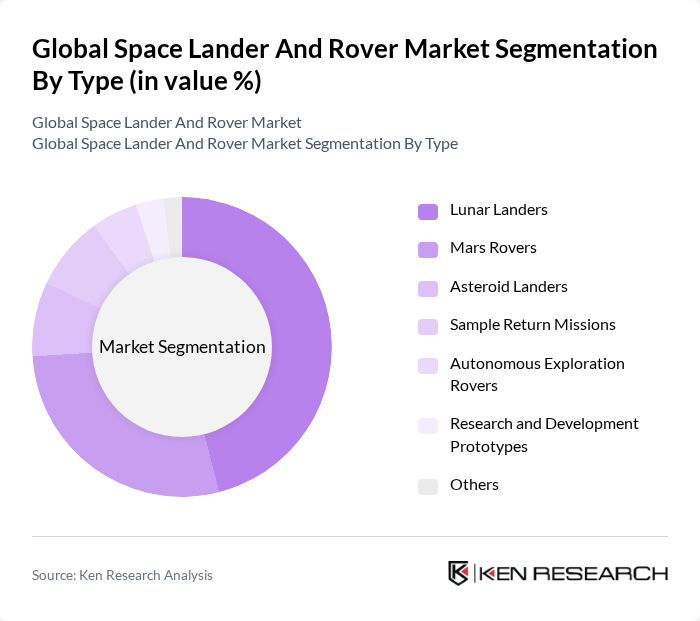

By Type:The market is segmented into various types, including Lunar Landers, Mars Rovers, Asteroid Landers, Sample Return Missions, Autonomous Exploration Rovers, Research and Development Prototypes, and Others. Among these,Lunar Landerscurrently account for the largest share of market revenue, driven by renewed global focus on lunar missions through programs like Artemis, Chang’e, and commercial payload delivery. Mars Rovers remain a significant segment due to ongoing and planned Mars exploration. The demand for advanced rovers capable of scientific research, technology demonstrations, and autonomous operations is accelerating growth across all segments.

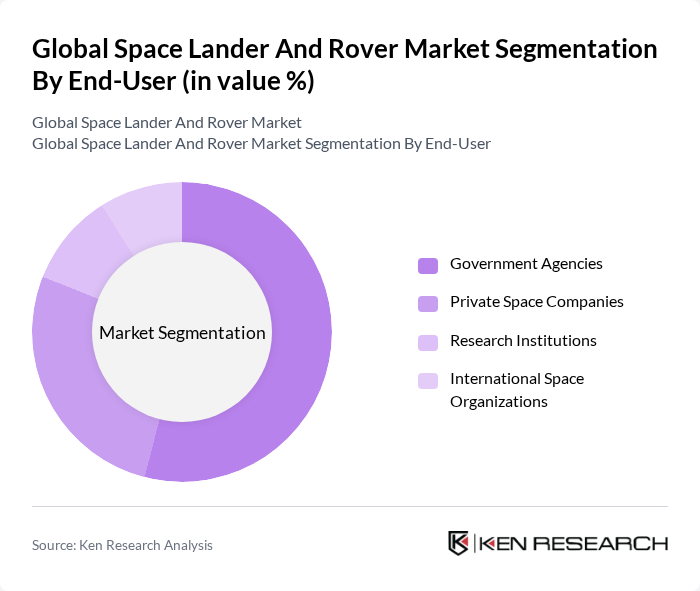

By End-User:The market is categorized by end-users, including Government Agencies, Private Space Companies, Research Institutions, and International Space Organizations.Government Agenciesare the leading end-users, primarily due to their substantial budgets and long-term space exploration plans. However, the increasing collaboration between government entities and private companies, especially for lunar surface delivery and mobility, is rapidly enhancing the development and deployment of landers and rovers.

The Global Space Lander And Rover Market is characterized by a dynamic mix of regional and international players. Leading participants such as NASA (National Aeronautics and Space Administration), SpaceX, Lockheed Martin, Northrop Grumman, Boeing, ESA (European Space Agency), ISRO (Indian Space Research Organisation), JAXA (Japan Aerospace Exploration Agency), Blue Origin, Planet Labs, Arianespace, Rocket Lab, Sierra Nevada Corporation, Maxar Technologies, Astrobotic Technology, iSpace (Japan), China National Space Administration (CNSA), Firefly Aerospace, Airbus Defence and Space, Thales Alenia Space contribute to innovation, geographic expansion, and service delivery in this space.

The future of the space lander and rover market is poised for transformative growth, driven by technological advancements and increased collaboration between public and private sectors. As governments and private companies invest heavily in lunar and Mars missions, the demand for innovative landers and rovers will rise. Additionally, the integration of AI and robotics will enhance operational efficiency, enabling more complex missions. The focus on sustainability and planetary defense will further shape the landscape, creating new opportunities for market participants.

| Segment | Sub-Segments |

|---|---|

| By Type | Lunar Landers Mars Rovers Asteroid Landers Sample Return Missions Autonomous Exploration Rovers Research and Development Prototypes Others |

| By End-User | Government Agencies Private Space Companies Research Institutions International Space Organizations |

| By Application | Scientific Research Resource Exploration Technology Demonstration Planetary Defense |

| By Payload Capacity | Small Payloads Medium Payloads Large Payloads |

| By Launch Vehicle Type | Heavy-Lift Launch Vehicles Medium-Lift Launch Vehicles Small-Lift Launch Vehicles |

| By Mission Type | Lunar Surface Exploration Mars Surface Exploration Asteroids and Comet Exploration |

| By Funding Source | Government Funding Private Investment International Collaborations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Space Agencies | 60 | Program Managers, Mission Directors |

| Private Aerospace Companies | 50 | R&D Engineers, Business Development Managers |

| Academic Research Institutions | 40 | Astrophysicists, Space Scientists |

| Space Technology Consultants | 40 | Industry Analysts, Technology Advisors |

| International Space Collaborations | 45 | Project Coordinators, Policy Makers |

The Global Space Lander and Rover Market is valued at approximately USD 1.0 billion, driven by advancements in technology and increased government funding for lunar and Martian missions, alongside growing interest from private companies in space exploration.