Region:Global

Author(s):Shubham

Product Code:KRAD0675

Pages:84

Published On:August 2025

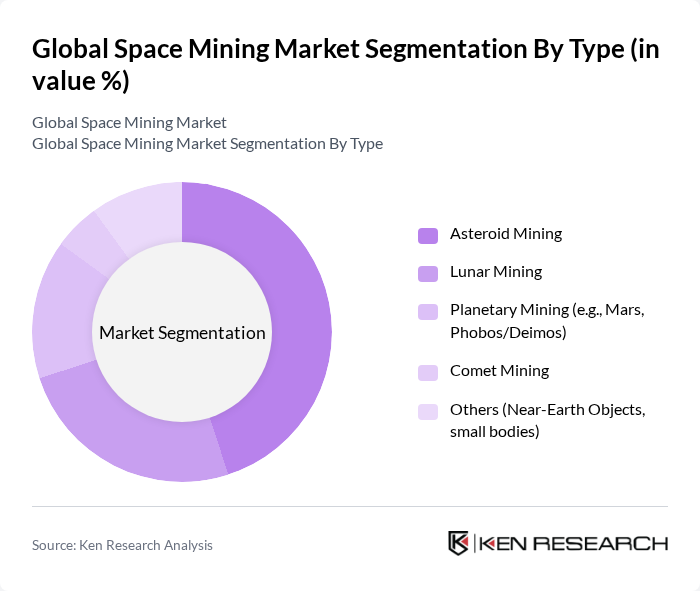

By Type:The space mining market is segmented into various types, including Asteroid Mining, Lunar Mining, Planetary Mining (e.g., Mars, Phobos/Deimos), Comet Mining, and Others (Near-Earth Objects, small bodies). Among these, Asteroid Mining is widely profiled as a leading strategic focus due to the abundance of valuable resources such as platinum group metals and water, alongside lower gravity wells that can reduce mission delta-v for certain targets; in parallel, Lunar Mining is gaining traction due to near-term ISRU prospects around polar volatiles and regolith-based materials for construction and propellant production .

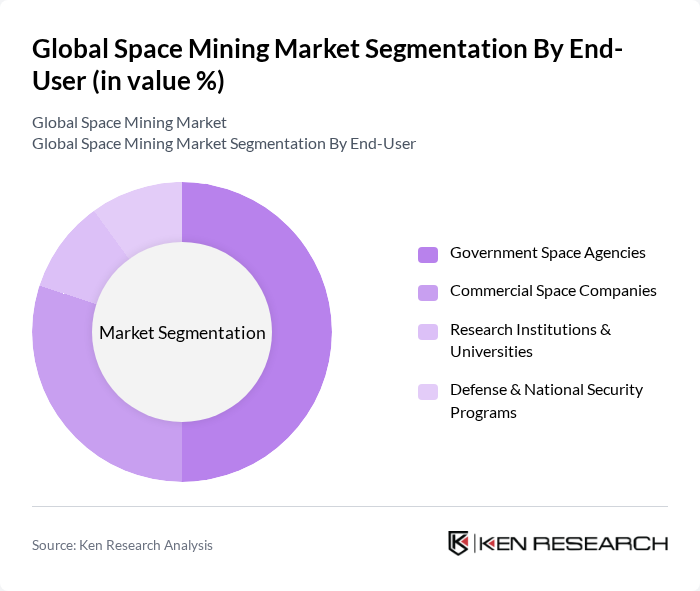

By End-User:The end-user segmentation includes Government Space Agencies, Commercial Space Companies, Research Institutions & Universities, and Defense & National Security Programs. Government Space Agencies are the leading segment, supported by substantial funding for lunar and asteroid prospecting, ISRU technology maturation, and payload delivery services that de-risk commercial participation; agency–startup partnerships and CLPS-style task orders are central to current market activity .

The Global Space Mining Market is characterized by a dynamic mix of regional and international players. Leading participants such as AstroForge, TransAstra Corporation, ispace, inc. (Japan), Lunar Outpost, OffWorld, Inc., Motiv Space Systems, Masten Space Systems, Honeybee Robotics, Asteroid Mining Corporation, Karman+ (Karman Plus), Planetary Resources, Inc. (legacy assets), Deep Space Industries (legacy, now part of Bradford Space), NASA (National Aeronautics and Space Administration), European Space Agency (ESA), Luxembourg Space Agency (LSA) contribute to innovation, geographic expansion, and service delivery in this space .

The future of space mining appears promising, driven by technological advancements and increasing collaboration among nations. As countries invest in space exploration, the potential for resource extraction from asteroids and the Moon is becoming more viable. Innovations in robotics and automation are expected to enhance operational efficiency, while partnerships between private companies and government agencies will likely accelerate the development of sustainable mining practices, ensuring a balanced approach to resource utilization in space.

| Segment | Sub-Segments |

|---|---|

| By Type | Asteroid Mining Lunar Mining Planetary Mining (e.g., Mars, Phobos/Deimos) Comet Mining Others (Near-Earth Objects, small bodies) |

| By End-User | Government Space Agencies Commercial Space Companies Research Institutions & Universities Defense & National Security Programs |

| By Resource Type | Water/Ice (for propellant and life support) Platinum Group Metals (PGMs) Industrial Metals (Nickel, Iron, Cobalt) Silicates & Regolith (construction feedstock) Rare Earth Elements |

| By Mission Type | Prospecting/Reconnaissance Robotic Extraction & Processing Human-Assisted Operations Sample Return & Demonstration Missions |

| By Funding Source | Government Funding & Grants Venture Capital & Private Equity Public-Private Partnerships Strategic Corporate Investments |

| By Technology Used | Robotic Mining Systems & Manipulators Autonomous Navigation, AI & Machine Learning Remote Sensing & In-Situ Prospecting (ISR/ISRU) Drilling, Excavation & Material Processing Units Spacecraft, Landers & Transfer Vehicles |

| By Market Maturity | Concept/Demonstration Early Commercialization Growth Mature |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Asteroid Mining Initiatives | 120 | Space Engineers, Project Managers |

| Space Resource Utilization Technologies | 90 | Research Scientists, Technology Developers |

| Investment in Space Mining Startups | 60 | Venture Capitalists, Financial Analysts |

| Regulatory Frameworks for Space Mining | 50 | Policy Makers, Legal Experts in Space Law |

| International Collaboration in Space Exploration | 70 | Government Officials, Space Agency Representatives |

The Global Space Mining Market is valued at approximately USD 2 billion, based on recent assessments and a five-year historical analysis. This valuation reflects the growing interest and investment in space exploration technologies and resource extraction.