Region:Global

Author(s):Dev

Product Code:KRAB0509

Pages:88

Published On:August 2025

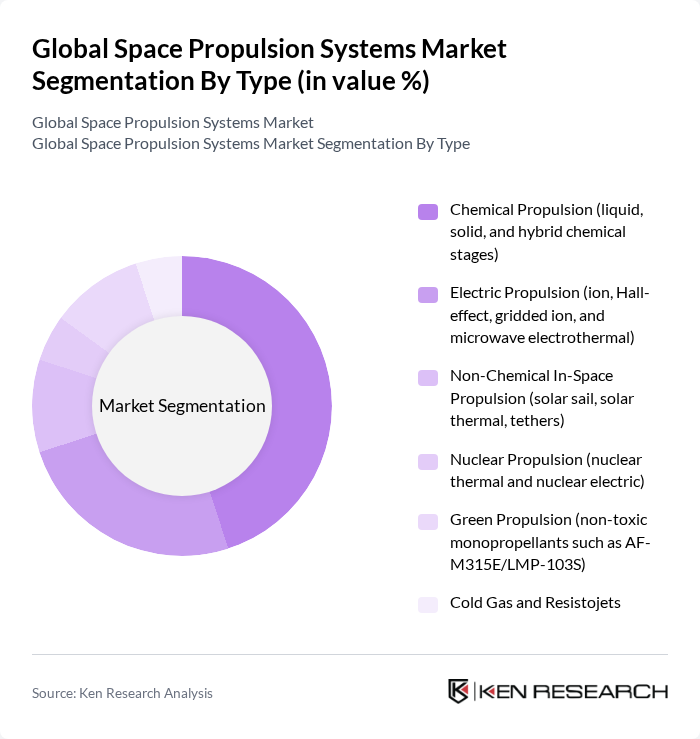

By Type:The market is segmented into various propulsion types, including Chemical Propulsion, Electric Propulsion, Non-Chemical In-Space Propulsion, Nuclear Propulsion, Green Propulsion, and Cold Gas and Resistojets. Among these, Chemical Propulsion remains the most widely used due to its high-thrust capability and established flight heritage, particularly in launch vehicles and many spacecraft maneuvers. Electric Propulsion is gaining traction for its propellant efficiency and suitability for long-duration and constellation missions. Green Propulsion (e.g., hydroxylammonium nitrate and ammonium dinitramide monopropellants) is emerging to reduce toxicity and ground-handling costs while meeting performance needs .

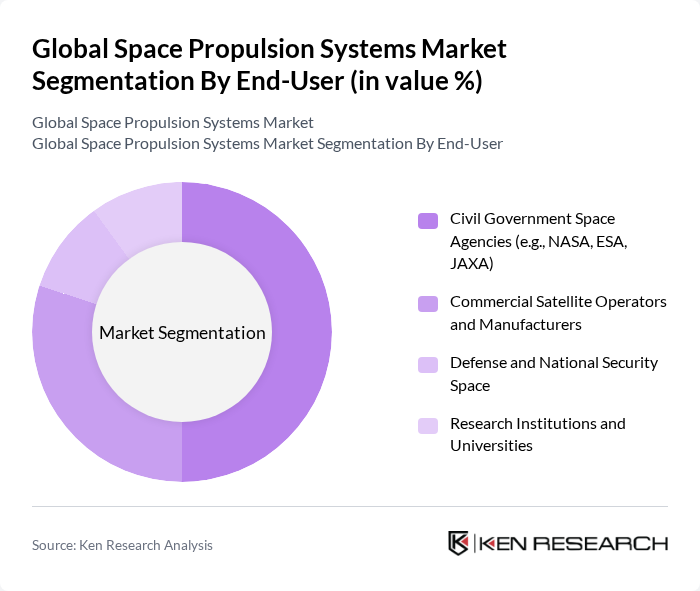

By End-User:The end-user segmentation includes Civil Government Space Agencies, Commercial Satellite Operators and Manufacturers, Defense and National Security Space, and Research Institutions and Universities. Civil Government Space Agencies are the largest consumers of propulsion systems due to mission diversity (science, exploration, Earth observation) and program budgets. Commercial operators increasingly invest in propulsion to optimize satellite lifetime, station-keeping, and constellation deployment, while defense programs emphasize responsive space and maneuverability .

The Global Space Propulsion Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Safran Aircraft Engines (ArianeGroup), Airbus Defence and Space, Northrop Grumman Corporation, Lockheed Martin Corporation, Aerojet Rocketdyne (an L3Harris Technologies company), Rocket Lab USA, Inc., Thales Alenia Space, Moog Inc., IHI Corporation, and Blue Origin contribute to innovation, geographic expansion, and service delivery in this space .

Notes on updates and validations:

The future of the space propulsion systems market appears promising, driven by technological advancements and increasing global interest in space exploration. As nations and private companies invest heavily in space missions, the demand for innovative propulsion solutions will continue to rise. Furthermore, the integration of artificial intelligence in propulsion systems is expected to enhance operational efficiency and safety, paving the way for more ambitious space endeavors. The market is poised for significant transformation as it adapts to these emerging trends and challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemical Propulsion (liquid, solid, and hybrid chemical stages) Electric Propulsion (ion, Hall-effect, gridded ion, and microwave electrothermal) Non-Chemical In-Space Propulsion (solar sail, solar thermal, tethers) Nuclear Propulsion (nuclear thermal and nuclear electric) Green Propulsion (non-toxic monopropellants such as AF-M315E/LMP-103S) Cold Gas and Resistojets |

| By End-User | Civil Government Space Agencies (e.g., NASA, ESA, JAXA) Commercial Satellite Operators and Manufacturers Defense and National Security Space Research Institutions and Universities |

| By Application | Launch Vehicle Main Propulsion and Upper Stages Satellite Orbit Raising and Station-Keeping In-Space Transportation and Interplanetary Missions Rendezvous, Proximity Operations, and Debris Removal |

| By Component | Thrusters and Engines Propellant Tanks and Feed Systems Power Processing Units (PPUs) and Controllers Valves, Regulators, and Plumbing |

| By Distribution Mode | Direct Contracting (OEM to prime/integrator) System Integrators and Primes Distributors and Specialized Suppliers |

| By Investment Source | Venture Capital and Private Equity Government Funding and Grants Public-Private Partnerships and ESA/NASA Programs |

| By Policy Support | R&D Subsidies and Technology Demonstration Programs Tax Incentives and Export Credit Support Sovereign Constellation and Security Programs Standards, Safety, and Environmental Regulations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chemical Propulsion Systems | 120 | Propulsion Engineers, Aerospace Project Managers |

| Electric Propulsion Technologies | 95 | R&D Directors, Space Technology Analysts |

| Hybrid Propulsion Systems | 65 | Systems Engineers, Aerospace Consultants |

| Satellite Propulsion Applications | 110 | Satellite Operations Managers, Aerospace Program Directors |

| Launch Vehicle Propulsion | 85 | Launch Directors, Aerospace Engineers |

The Global Space Propulsion Systems Market is valued at approximately USD 11 billion, reflecting a five-year historical analysis. This valuation aligns with various industry assessments indicating market sizes in the low-teens billions, driven by satellite deployment and advancements in propulsion technologies.