Region:Global

Author(s):Dev

Product Code:KRAA1516

Pages:98

Published On:August 2025

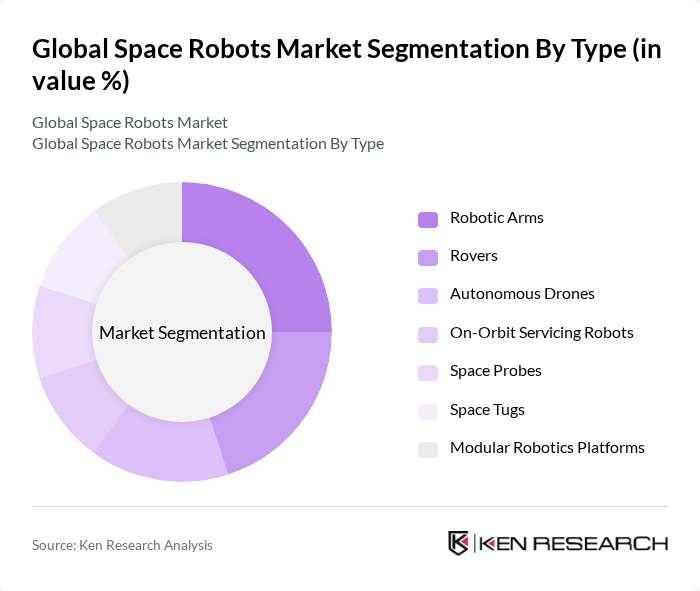

By Type:The market is segmented into various types of space robots, including robotic arms, rovers, autonomous drones, on-orbit servicing robots, space probes, space tugs, and modular robotics platforms. Each type serves distinct functions in space missions, contributing to the overall efficiency and effectiveness of operations.

The robotic arms segment is currently leading the market due to their critical role in various space missions, including assembly, maintenance, and repair tasks. Their versatility and precision make them essential for both crewed and uncrewed missions. The increasing complexity of space operations and the need for high-precision tasks have driven the demand for robotic arms, making them a focal point in the development of space robotics.

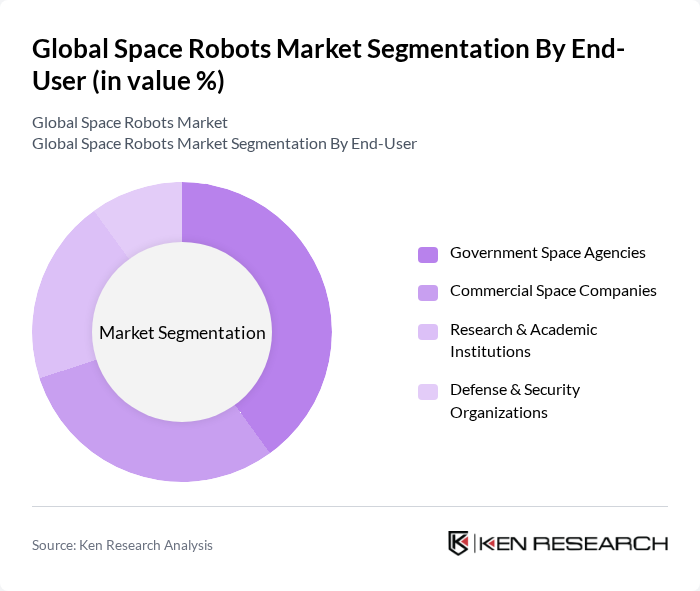

By End-User:The market is segmented by end-users, including government space agencies, commercial space companies, research and academic institutions, and defense and security organizations. Each end-user category has unique requirements and applications for space robots, influencing the overall market dynamics.

Government space agencies dominate the market due to their substantial funding and long-term projects focused on exploration and scientific research. These agencies, such as NASA and ESA, invest heavily in robotic technologies to enhance their capabilities in space missions. The increasing collaboration with commercial entities further strengthens their position, as they leverage advanced technologies developed by private companies.

The Global Space Robots Market is characterized by a dynamic mix of regional and international players. Leading participants such as NASA, SpaceX, Boeing, Lockheed Martin, Northrop Grumman, ESA (European Space Agency), Blue Origin, Airbus Defence and Space, Thales Alenia Space, Maxar Technologies, Honeybee Robotics, Astrobotic Technology, Motiv Space Systems, Altius Space Machines, Made In Space, Effective Space Solutions Limited, Planet Labs, Rocket Lab, Axiom Space contribute to innovation, geographic expansion, and service delivery in this space.

The future of the space robots market appears promising, driven by increasing automation and a focus on sustainability. As space agencies and private companies invest in autonomous spacecraft, the demand for advanced robotics will rise. Innovations in AI and machine learning will enhance operational efficiency, enabling robots to perform complex tasks with minimal human intervention. Furthermore, the expansion of lunar and Martian missions will create new opportunities for robotic applications, fostering collaboration between public and private sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Robotic Arms Rovers Autonomous Drones On-Orbit Servicing Robots Space Probes Space Tugs Modular Robotics Platforms |

| By End-User | Government Space Agencies Commercial Space Companies Research & Academic Institutions Defense & Security Organizations |

| By Application | Planetary Exploration Satellite Servicing & Maintenance Scientific Experiments Space Debris Removal Cargo & Logistics Operations |

| By Component | Sensors & Vision Systems Actuators & Mobility Systems Control & Navigation Systems Power & Energy Systems Communication Modules |

| By Distribution Channel | Direct Contracts Online Procurement Platforms Specialized Distributors |

| By Payload Capacity | Light Payload (<50 kg) Medium Payload (50–500 kg) Heavy Payload (>500 kg) |

| By Policy Support | Government Grants Tax Incentives Research Funding |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Satellite Robotics Development | 100 | Project Managers, Aerospace Engineers |

| Planetary Exploration Robotics | 80 | Research Scientists, Robotics Specialists |

| Space Debris Management Solutions | 60 | Environmental Engineers, Policy Makers |

| Robotic Systems for Space Stations | 90 | Operations Managers, Technical Directors |

| Commercial Space Robotics Applications | 70 | Business Development Managers, Product Strategists |

The Global Space Robots Market is valued at approximately USD 5.2 billion, driven by advancements in robotics technology, increased investments in space exploration, and a growing demand for automation in space missions.