Region:Global

Author(s):Rebecca

Product Code:KRAA2174

Pages:96

Published On:August 2025

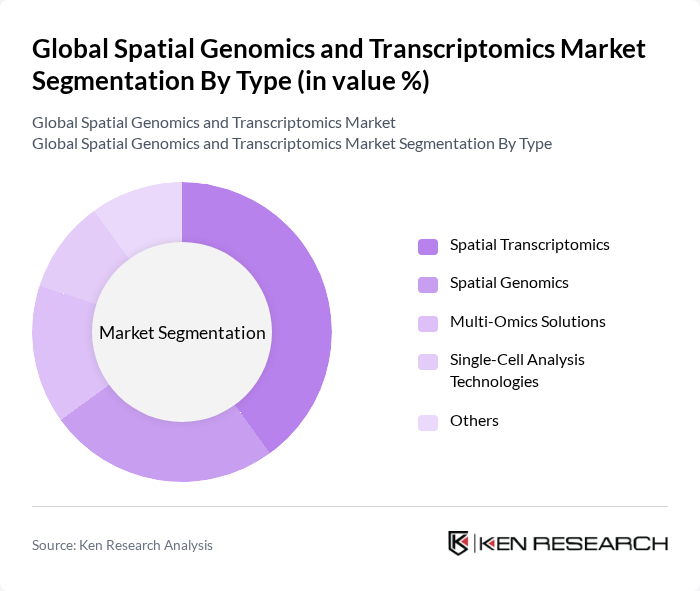

By Type:The market is segmented into various types, including Spatial Transcriptomics, Spatial Genomics, Multi-Omics Solutions, Single-Cell Analysis Technologies, and Others. Among these, Spatial Transcriptomics is currently the leading sub-segment, driven by its ability to provide high-resolution spatial information about gene expression in tissues. This technology is increasingly utilized in cancer research and developmental biology, making it a preferred choice for researchers and clinicians. The adoption of AI-powered spatial transcriptomics platforms is further enhancing the resolution and throughput of gene expression mapping in complex tissues .

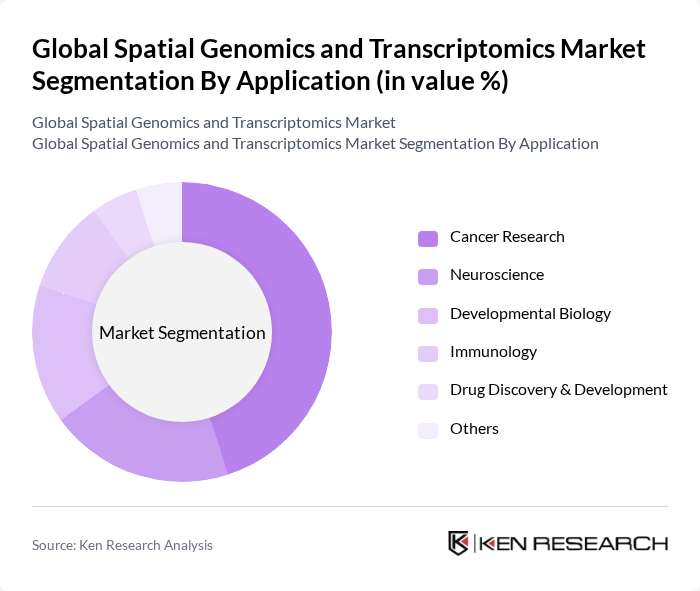

By Application:The applications of spatial genomics and transcriptomics include Cancer Research, Neuroscience, Developmental Biology, Immunology, Drug Discovery & Development, and Others. Cancer Research is the dominant application area, as the need for precise tumor characterization and understanding tumor microenvironments drives the adoption of these technologies. Researchers are increasingly leveraging spatial genomics to identify biomarkers and develop targeted therapies, making it a critical focus area in the market. The integration of spatial omics with AI is further advancing biomarker discovery and stratification in oncology .

The Global Spatial Genomics and Transcriptomics Market is characterized by a dynamic mix of regional and international players. Leading participants such as 10x Genomics, Inc., Illumina, Inc., NanoString Technologies, Inc., Akoya Biosciences, Inc., BGI Genomics Co., Ltd., F. Hoffmann-La Roche AG, Thermo Fisher Scientific Inc., PerkinElmer, Inc., Agilent Technologies, Inc., Bio-Techne Corporation, QIAGEN N.V., Genomatix Software GmbH, Spatial Genomics, Inc., Vizgen, Inc., CARTANA AB (a 10x Genomics company), Bruker Corporation, Dovetail Genomics (now part of Cantata Bio), Rebus Biosystems, Inc., Resolve Biosciences GmbH, Fluidigm Corporation (now Standard BioTools Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of spatial genomics and transcriptomics is poised for transformative growth, driven by technological advancements and increasing integration with artificial intelligence. As researchers continue to explore multi-omics approaches, the ability to analyze complex biological systems will enhance. Furthermore, collaborations between industry and academia are expected to foster innovation, leading to the development of cost-effective solutions that democratize access to spatial genomics technologies, ultimately improving patient care and research outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Spatial Transcriptomics Spatial Genomics Multi-Omics Solutions Single-Cell Analysis Technologies Others |

| By Application | Cancer Research Neuroscience Developmental Biology Immunology Drug Discovery & Development Others |

| By End-User | Academic & Research Institutes Pharmaceutical & Biotechnology Companies Clinical & Diagnostic Laboratories Contract Research Organizations (CROs) Others |

| By Component | Instruments Consumables Software & Analytics Services |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Research Type | Basic Research Applied Research Clinical Research Translational Research Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Genomic Sequencing Services | 100 | Laboratory Directors, Genomics Researchers |

| Transcriptomics Applications | 60 | Biotech Product Managers, Research Scientists |

| Clinical Genomics Market | 50 | Healthcare Professionals, Clinical Researchers |

| Pharmaceutical R&D in Genomics | 40 | Pharmaceutical Executives, R&D Managers |

| Academic Research Institutions | 50 | University Professors, Research Fellows |

The Global Spatial Genomics and Transcriptomics Market is valued at approximately USD 555 million, driven by advancements in spatial omics technologies and increasing investments in pharmaceutical and biotechnology research and development.