Region:Global

Author(s):Shubham

Product Code:KRAC0677

Pages:91

Published On:August 2025

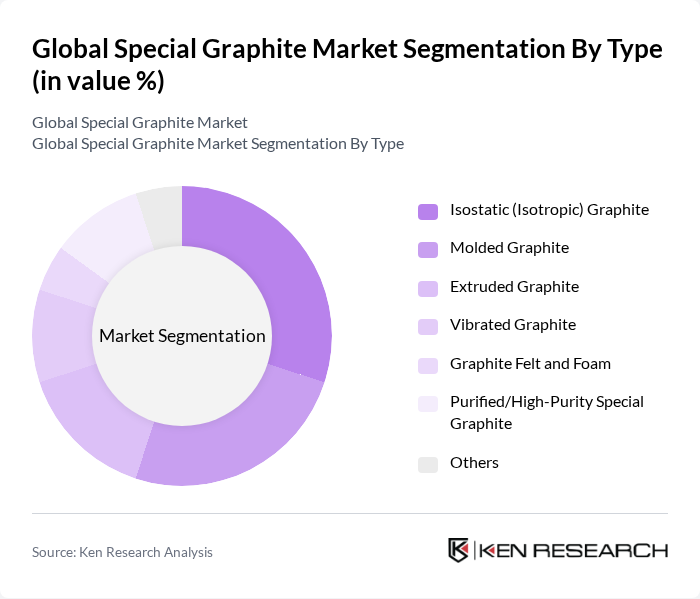

By Type:The special graphite market can be segmented into various types, including Isostatic (Isotropic) Graphite, Molded Graphite, Extruded Graphite, Vibrated Graphite, Graphite Felt and Foam, Purified/High-Purity Special Graphite, and Others. Among these,Isostatic Graphiteis gaining traction due to its high strength, fine grain, and thermal shock resistance, supporting demanding uses such as semiconductor wafer boats, susceptors, EDM, and aerospace fixtures .

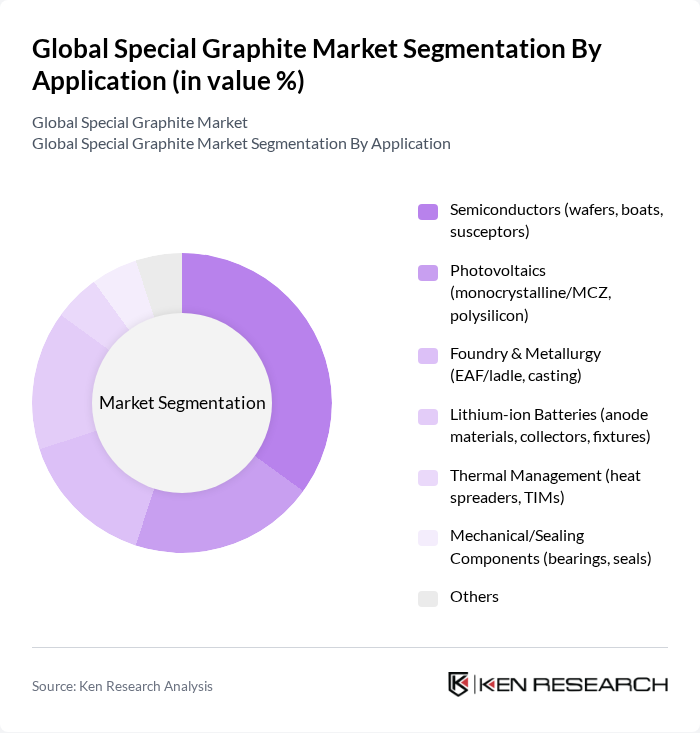

By Application:The applications of special graphite include Semiconductors (wafers, boats, susceptors), Photovoltaics (monocrystalline/MCZ, polysilicon), Foundry & Metallurgy (EAF/ladle, casting), Lithium-ion Batteries (anode materials, collectors, fixtures), Thermal Management (heat spreaders, TIMs), Mechanical/Sealing Components (bearings, seals), and Others. Thesemiconductorapplication is a major demand center due to the material’s purity, machinability, and high-temperature performance in crystal growth and epitaxy tools; PV ingot/wafer processes and Li-ion battery-related components are additional growth engines .

The Global Special Graphite Market is characterized by a dynamic mix of regional and international players. Leading participants such as SGL Carbon SE, Tokai Carbon Co., Ltd., Toyo Tanso Co., Ltd., Mersen SA, IBIDEN Co., Ltd., GrafTech International Ltd., SEC Carbon, Ltd., HEG Limited, CGT Carbon GmbH, Schunk Carbon Technology (Schunk Group), Imerys Graphite & Carbon, Asbury Carbons, Superior Graphite Co., Graphite India Limited, Resonac Holdings Corporation (formerly Showa Denko K.K.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the special graphite market appears promising, driven by technological advancements and increasing demand across various sectors. As industries prioritize sustainability, the shift towards eco-friendly sourcing and production methods will gain momentum. Additionally, the integration of digital technologies in supply chain management is expected to enhance efficiency and transparency. These trends will likely foster innovation, enabling companies to adapt to evolving market needs while capitalizing on growth opportunities in emerging markets and renewable energy applications.

| Segment | Sub-Segments |

|---|---|

| By Type | Isostatic (Isotropic) Graphite Molded Graphite Extruded Graphite Vibrated Graphite Graphite Felt and Foam Purified/High-Purity Special Graphite Others |

| By Application | Semiconductors (wafers, boats, susceptors) Photovoltaics (monocrystalline/MCZ, polysilicon) Foundry & Metallurgy (EAF/ladle, casting) Lithium?ion Batteries (anode materials, collectors, fixtures) Thermal Management (heat spreaders, TIMs) Mechanical/Sealing Components (bearings, seals) Others |

| By End-User | Electronics & Semiconductor Photovoltaic/Solar Automotive & EV Foundry & Metallurgy Energy & Power (fuel cells, nuclear, storage) Aerospace & Defense Others |

| By Distribution Channel | Direct Sales (OEM/key accounts) Authorized Distributors Project/Engineering Procurement (EPC) E-commerce/Online Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Standard Grade High Grade Ultra High Grade Others |

| By Quality Grade | High Purity Graphite Medium Purity Graphite Low Purity Graphite Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Battery Manufacturing Sector | 120 | Production Managers, R&D Engineers |

| Automotive Components Industry | 90 | Procurement Managers, Quality Assurance Specialists |

| Electronics and Semiconductor Applications | 100 | Product Development Engineers, Supply Chain Analysts |

| Thermal Management Solutions | 70 | Technical Sales Representatives, Application Engineers |

| Graphite Mining and Processing | 60 | Mining Engineers, Operations Managers |

The Global Special Graphite Market is valued at approximately USD 1.05 billion, driven by increasing demand for high-performance materials in sectors such as electronics, automotive, and renewable energy, particularly in semiconductor and lithium-ion battery applications.