Region:Global

Author(s):Geetanshi

Product Code:KRAA0148

Pages:87

Published On:August 2025

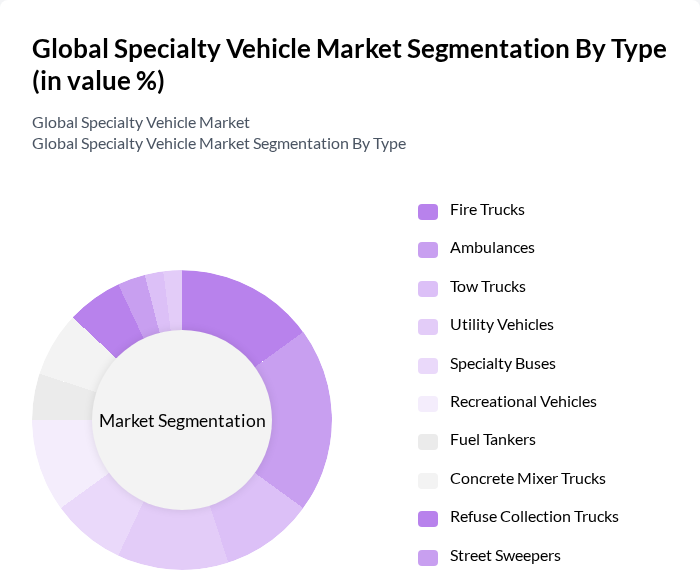

By Type:The market is segmented into various types of specialty vehicles, including Fire Trucks, Ambulances, Tow Trucks, Utility Vehicles, Specialty Buses, Recreational Vehicles, Fuel Tankers, Concrete Mixer Trucks, Refuse Collection Trucks, Street Sweepers, Winter Maintenance Vehicles, and Others. Each type serves specific functions and industries, contributing to the overall market dynamics. Fire Trucks and Ambulances are essential for emergency response, while Utility Vehicles and Specialty Buses support infrastructure and public transport. Recreational Vehicles address leisure and tourism needs, and vehicles like Fuel Tankers and Concrete Mixer Trucks are critical for industrial and construction operations .

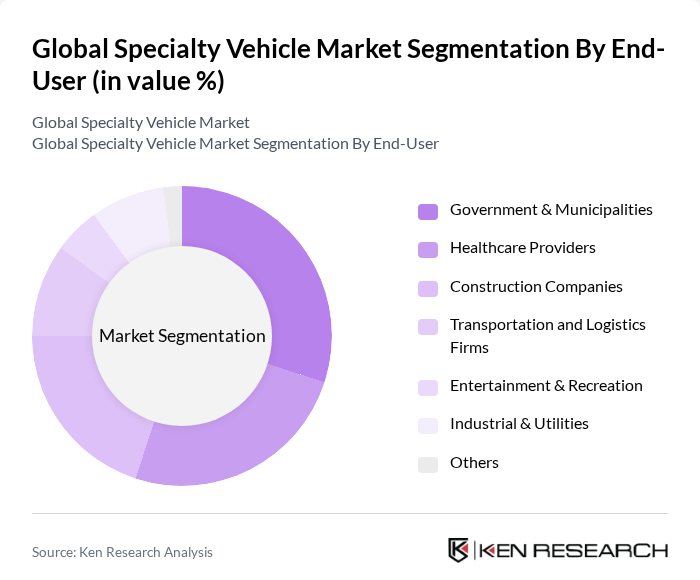

By End-User:The market is segmented by end-users, including Government & Municipalities, Healthcare Providers, Construction Companies, Transportation and Logistics Firms, Entertainment & Recreation, Industrial & Utilities, and Others. Each end-user category has distinct requirements and influences the demand for specialty vehicles. Government & Municipalities are primary buyers for emergency and utility vehicles, Healthcare Providers drive demand for ambulances and mobile clinics, while Construction Companies require a range of specialized vehicles for project execution. Transportation and Logistics Firms increasingly seek customized vehicles for last-mile delivery and freight, and Industrial & Utilities focus on vehicles for maintenance and operational support .

The Global Specialty Vehicle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daimler Truck AG, Volvo Group, Oshkosh Corporation, PACCAR Inc., Navistar International Corporation, Isuzu Motors Ltd., Hino Motors, Ltd., MAN Truck & Bus SE, Mitsubishi Fuso Truck and Bus Corporation, BYD Company Limited, Workhorse Group Inc., Altec Industries, Inc., Terex Corporation, Rosenbauer International AG, and REV Group, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the specialty vehicle market appears promising, driven by technological advancements and a growing emphasis on sustainability. As manufacturers increasingly adopt electric and hybrid technologies, the market is expected to see a significant transformation. Additionally, the integration of smart technologies will enhance vehicle functionality and safety. With a projected increase in consumer demand for customized and eco-friendly vehicles, the market is poised for substantial growth, particularly in emerging economies where infrastructure development is accelerating.

| Segment | Sub-Segments |

|---|---|

| By Type | Fire Trucks Ambulances Tow Trucks Utility Vehicles Specialty Buses Recreational Vehicles Fuel Tankers Concrete Mixer Trucks Refuse Collection Trucks Street Sweepers Winter Maintenance Vehicles Others |

| By End-User | Government & Municipalities Healthcare Providers Construction Companies Transportation and Logistics Firms Entertainment & Recreation Industrial & Utilities Others |

| By Application | Emergency Services (Fire, Ambulance, Police) Construction and Maintenance Public Transport Waste Management Law Enforcement Fuel & Chemical Transport Others |

| By Fuel Type | Diesel Gasoline Electric Hybrid Hydrogen Fuel Cell Others |

| By Size | Light-Duty Vehicles Medium-Duty Vehicles Heavy-Duty Vehicles Others |

| By Customization Level | Fully Customized Semi-Customized Standard Models Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Specialty Vehicles | 100 | Fleet Managers, Project Supervisors |

| Agricultural Specialty Vehicles | 60 | Farm Equipment Operators, Agricultural Engineers |

| Emergency Response Vehicles | 50 | Fire Chiefs, Emergency Services Coordinators |

| Recreational Specialty Vehicles | 70 | Dealership Managers, Product Development Teams |

| Utility Specialty Vehicles | 40 | Utility Managers, Maintenance Supervisors |

The Global Specialty Vehicle Market is valued at approximately USD 103 billion, driven by increasing demand for specialized vehicles across sectors such as emergency services, healthcare, construction, and logistics, along with advancements in technology and urbanization.