Region:Global

Author(s):Rebecca

Product Code:KRAB0282

Pages:82

Published On:August 2025

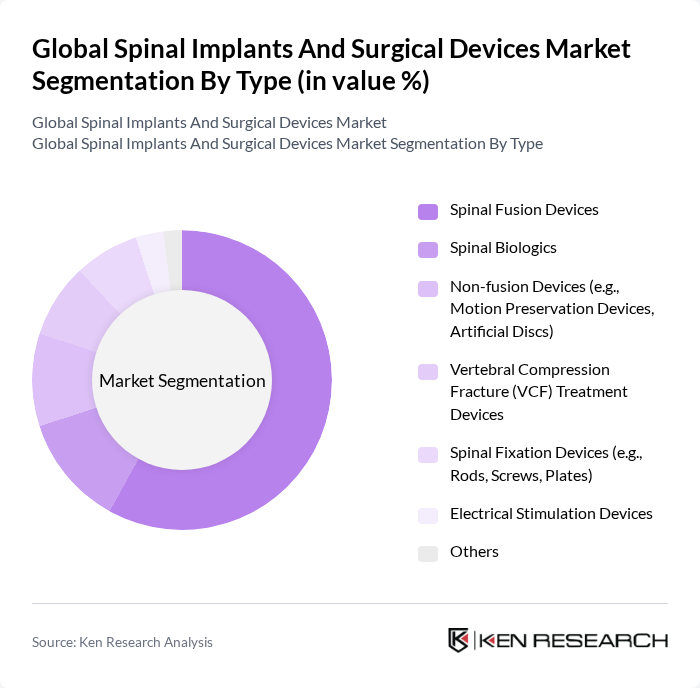

By Type:The market is segmented into various types of spinal implants and surgical devices, including Spinal Fusion Devices, Spinal Biologics, Non-fusion Devices (such as Motion Preservation Devices and Artificial Discs), Vertebral Compression Fracture (VCF) Treatment Devices, Spinal Fixation Devices (including Rods, Screws, Plates), Electrical Stimulation Devices, and Others. Among these, Spinal Fusion Devices are the most dominant, accounting for the largest share due to their widespread use in stabilizing the spine and alleviating pain. The increasing incidence of degenerative disc diseases and the growing preference for minimally invasive surgeries are significant drivers for this segment.

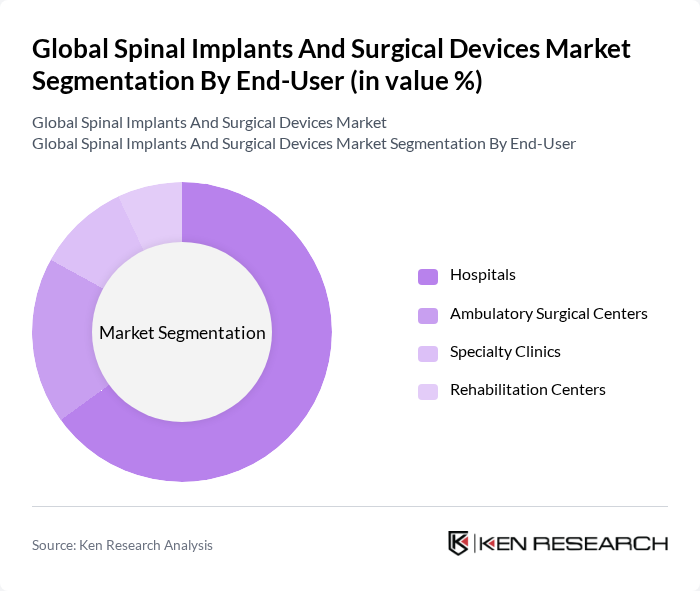

By End-User:The end-user segmentation includes Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Rehabilitation Centers. Hospitals are the leading end-users, accounting for the majority share of the market. This dominance is attributed to the high volume of spinal surgeries performed in hospital settings, where advanced surgical facilities and specialized medical staff are available. The increasing number of surgical procedures and the growing preference for hospital-based care further bolster this segment. Ambulatory Surgical Centers are experiencing growth due to the rising demand for outpatient procedures and cost-effective care.

The Global Spinal Implants And Surgical Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Johnson & Johnson (DePuy Synthes), Stryker Corporation, NuVasive, Inc., Zimmer Biomet Holdings, Inc., Globus Medical, Inc., B. Braun Melsungen AG (Aesculap), Orthofix Medical Inc., Alphatec Holdings, Inc. (Alphatec Spine), SeaSpine Holdings Corporation, RTI Surgical Holdings, Inc., Xtant Medical Holdings, Inc., MicroPort Scientific Corporation, ulrich GmbH & Co. KG, icotec ag contribute to innovation, geographic expansion, and service delivery in this space.

The future of the spinal implants and surgical devices market appears promising, driven by technological advancements and demographic shifts. The integration of artificial intelligence and machine learning in surgical planning is expected to enhance precision and outcomes. Additionally, as healthcare systems increasingly prioritize minimally invasive procedures, the demand for innovative spinal solutions will likely rise. This trend, coupled with the growing focus on personalized medicine, will shape the market landscape in the coming years, fostering further growth and development.

| Segment | Sub-Segments |

|---|---|

| By Type | Spinal Fusion Devices Spinal Biologics Non-fusion Devices (e.g., Motion Preservation Devices, Artificial Discs) Vertebral Compression Fracture (VCF) Treatment Devices Spinal Fixation Devices (e.g., Rods, Screws, Plates) Electrical Stimulation Devices Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Rehabilitation Centers |

| By Application | Degenerative Disc Disease Spinal Stenosis Scoliosis & Deformity Correction Trauma & Fractures Tumor Others |

| By Material | Titanium Stainless Steel Polyetheretherketone (PEEK) Biodegradable Materials |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Range Mid Range High Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Surgeons | 60 | Spine Surgeons, Trauma Surgeons |

| Hospital Procurement Managers | 50 | Supply Chain Managers, Purchasing Directors |

| Medical Device Sales Representatives | 40 | Sales Managers, Territory Managers |

| Healthcare Policy Makers | 40 | Health Economists, Regulatory Affairs Specialists |

| Clinical Researchers | 45 | Research Scientists, Clinical Trial Coordinators |

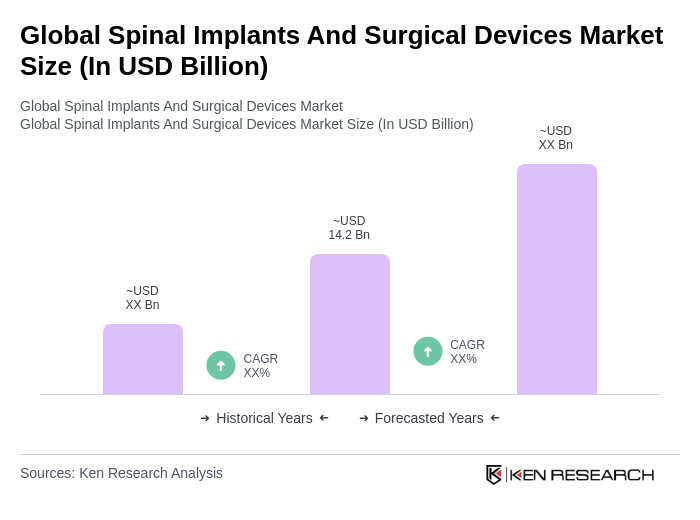

The Global Spinal Implants and Surgical Devices Market is valued at approximately USD 14.2 billion, driven by the increasing prevalence of spinal disorders and advancements in surgical techniques, particularly minimally invasive procedures.