Region:Global

Author(s):Dev

Product Code:KRAD0401

Pages:93

Published On:August 2025

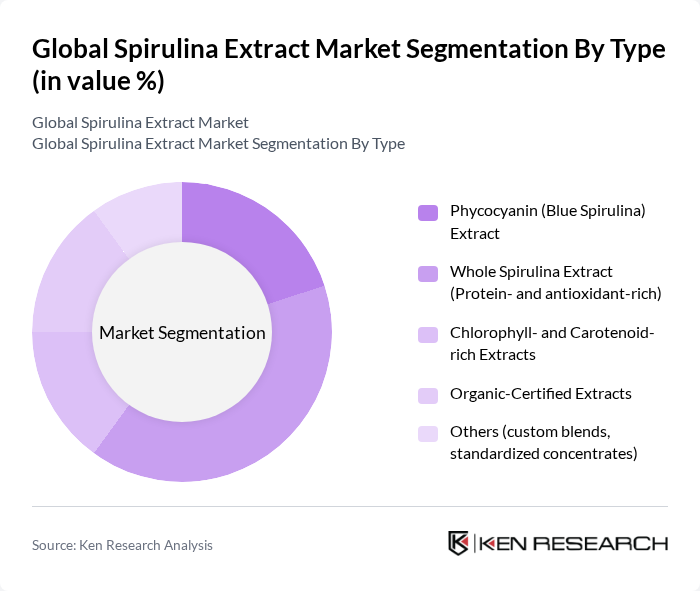

By Type:The market is segmented into various types of spirulina extracts, including Phycocyanin (Blue Spirulina) Extract, Whole Spirulina Extract (Protein- and antioxidant-rich), Chlorophyll- and Carotenoid-rich Extracts, Organic-Certified Extracts, and Others (custom blends, standardized concentrates). Phycocyanin-based ingredients have seen rapid adoption as natural blue colorants in foods and beverages, while whole spirulina and organic-certified formats continue to be widely used in supplements for their protein and antioxidant content .

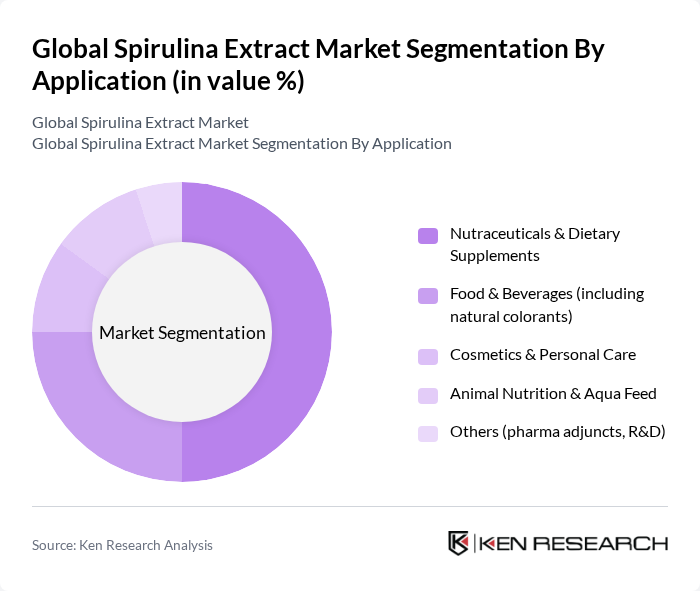

By Application:The applications of spirulina extracts are diverse, including Nutraceuticals & Dietary Supplements, Food & Beverages (including natural colorants), Cosmetics & Personal Care, Animal Nutrition & Aqua Feed, and Others (pharma adjuncts, R&D). Nutraceuticals & Dietary Supplements and Food & Beverages represent the largest demand pools, supported by consumer interest in plant-based protein and antioxidants, and the clean-label colorant shift favoring phycocyanin in confectionery, dairy, and beverages .

The Global Spirulina Extract Market is characterized by a dynamic mix of regional and international players. Leading participants such as DIC Corporation (including Earthrise Nutritionals, LLC), Cyanotech Corporation (Nutrex Hawaii), Chr. Hansen Holding A/S, Döhler GmbH, Givaudan SA (including Naturex), Sensient Technologies Corporation, Parry Nutraceuticals (Valensa International), AlgaTechnologies Ltd. (Solabia-Algatech Nutrition), Fuqing King Dnarmsa Spirulina Co., Ltd., Zhejiang Binmei Biotechnology Co., Ltd., Tianjin Norland Biotech Co., Ltd., DDW, The Color House (Givaudan), BASF SE, Naturex SA (Givaudan), Qingdao Haizhijiao Biotechnology Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the spirulina extract market appears promising, driven by increasing consumer awareness of health benefits and a shift towards sustainable food sources. Innovations in product formulations and applications are expected to enhance market penetration, particularly in the food and beverage sector. Additionally, the rise of e-commerce platforms is likely to facilitate broader distribution, making spirulina more accessible to consumers. As health trends evolve, the market is poised for significant growth, particularly in regions with emerging health-conscious populations.

| Segment | Sub-Segments |

|---|---|

| By Type | Phycocyanin (Blue Spirulina) Extract Whole Spirulina Extract (Protein- and antioxidant-rich) Chlorophyll- and Carotenoid-rich Extracts Organic-Certified Extracts Others (custom blends, standardized concentrates) |

| By Application | Nutraceuticals & Dietary Supplements Food & Beverages (including natural colorants) Cosmetics & Personal Care Animal Nutrition & Aqua Feed Others (pharma adjuncts, R&D) |

| By End-User | Nutraceutical & Supplement Brands Food & Beverage Manufacturers Cosmetics & Personal Care Companies Animal Feed & Aquaculture Companies Contract Manufacturers & Formulators |

| By Distribution Channel | B2B (Direct to Manufacturer/Brand) Distributors/Wholesalers Online (DTC brands, marketplaces) Specialty Health Stores & Pharmacies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Conventional Grade Organic Grade High-Purity Phycocyanin (Premium) |

| By Packaging Type | Bulk Drums & Foil Bags (B2B) Retail Jars/Sachets (B2C) Eco-friendly Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Supplement Manufacturers | 120 | Product Development Managers, Quality Assurance Officers |

| Food and Beverage Companies | 100 | R&D Managers, Marketing Directors |

| Cosmetic Product Developers | 80 | Formulation Chemists, Brand Managers |

| Agricultural Producers of Spirulina | 60 | Farm Owners, Operations Managers |

| Retailers of Health Products | 90 | Category Managers, Purchasing Agents |

The Global Spirulina Extract Market is valued at approximately USD 560 million, reflecting strong demand for natural colorants and nutraceuticals, driven by increasing health consciousness and the application of spirulina in food and beverage products.