Region:Global

Author(s):Shubham

Product Code:KRAD0691

Pages:97

Published On:August 2025

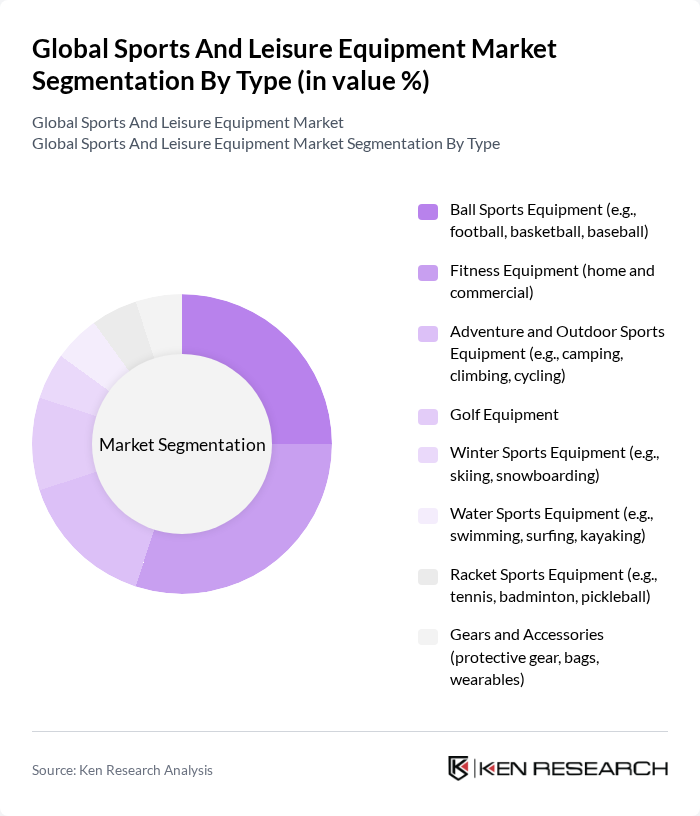

By Type:The market is segmented into various types of sports and leisure equipment, including ball sports equipment, fitness equipment, adventure and outdoor sports equipment, golf equipment, winter sports equipment, water sports equipment, racket sports equipment, and gears and accessories. Among these, fitness equipment has gained significant traction due to the increasing focus on health and wellness, and ongoing adoption of home and commercial connected fitness, while ball sports equipment remains popular due to the global appeal of sports like football and basketball and continued community-level participation and school sports , .

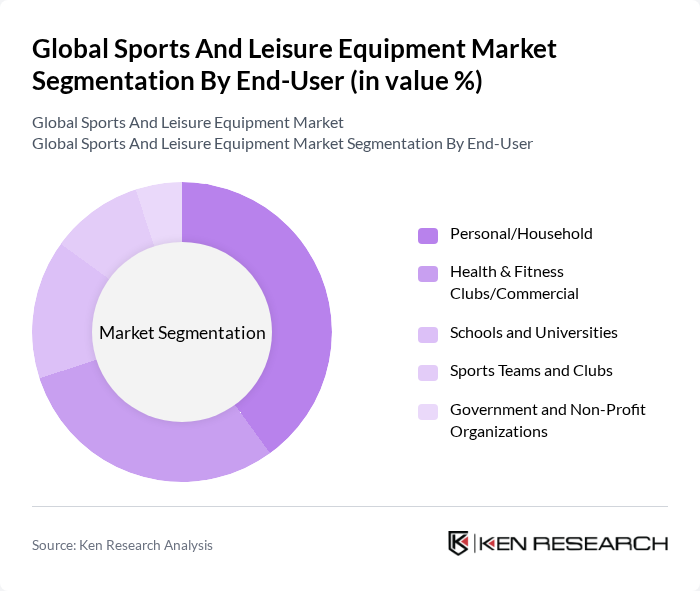

By End-User:The market is segmented by end-users, including personal/household, health & fitness clubs/commercial, schools and universities, sports teams and clubs, and government and non-profit organizations. The personal/household segment is the largest, driven by the increasing trend of home fitness, e-commerce adoption, and recreational activities, while health and fitness clubs are also significant due to the rise in gym memberships, reopening of facilities, and investment in connected cardio and strength equipment , .

The Global Sports And Leisure Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Under Armour, Inc., PUMA SE, Decathlon S.A., Amer Sports Corporation, Wilson Sporting Goods Co., Callaway Golf Company, Newell Brands Inc. (Rawlings, Coleman), Brunswick Corporation (Fitness, Bowling, Marine Recreation), HEAD N.V. (Head Sport GmbH), Mizuno Corporation, ASICS Corporation, The North Face (VF Corporation), Skechers U.S.A., Inc., Columbia Sportswear Company, Anta Sports Products Limited, Li-Ning Company Limited, YONEX Co., Ltd., Peloton Interactive, Inc. contribute to innovation, geographic expansion, and service delivery in this space , .

The future of the sports and leisure equipment market appears promising, driven by ongoing trends in health consciousness and technological innovation. As consumers increasingly seek personalized and eco-friendly products, companies are likely to invest in sustainable manufacturing practices and smart technologies. Additionally, the rise of home fitness solutions and virtual training platforms will continue to shape consumer preferences, creating new avenues for growth. The market is expected to adapt to these evolving demands, fostering innovation and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Ball Sports Equipment (e.g., football, basketball, baseball) Fitness Equipment (home and commercial) Adventure and Outdoor Sports Equipment (e.g., camping, climbing, cycling) Golf Equipment Winter Sports Equipment (e.g., skiing, snowboarding) Water Sports Equipment (e.g., swimming, surfing, kayaking) Racket Sports Equipment (e.g., tennis, badminton, pickleball) Gears and Accessories (protective gear, bags, wearables) |

| By End-User | Personal/Household Health & Fitness Clubs/Commercial Schools and Universities Sports Teams and Clubs Government and Non-Profit Organizations |

| By Distribution Channel | Specialty Sporting Goods Stores Supermarkets/Hypermarkets Online Retail Stores/Marketplaces Brand-owned Stores and Direct-to-Consumer Others (department stores, distributors) |

| By Price Range | Economy Mid-Range Premium |

| By Material | Metals and Alloys (e.g., steel, aluminum, titanium) Plastics and Polymers Wood Composite Materials (e.g., carbon fiber, fiberglass) Textiles and Foams |

| By Product Category | Equipment Apparel Footwear Accessories |

| By Region | North America Europe Asia-Pacific South America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fitness Equipment Retailers | 120 | Store Managers, Sales Representatives |

| Outdoor Sports Equipment Manufacturers | 100 | Product Development Managers, Marketing Directors |

| Team Sports Equipment Distributors | 80 | Supply Chain Managers, Procurement Officers |

| Consumer Insights from Sports Enthusiasts | 120 | Active Participants, Coaches, Trainers |

| Leisure Equipment Retail Analysis | 90 | Retail Analysts, Category Managers |

The Global Sports and Leisure Equipment Market is valued at approximately USD 115 billion, reflecting a significant growth trend driven by increasing health consciousness and rising disposable incomes among consumers.