Region:Global

Author(s):Dev

Product Code:KRAD0515

Pages:84

Published On:August 2025

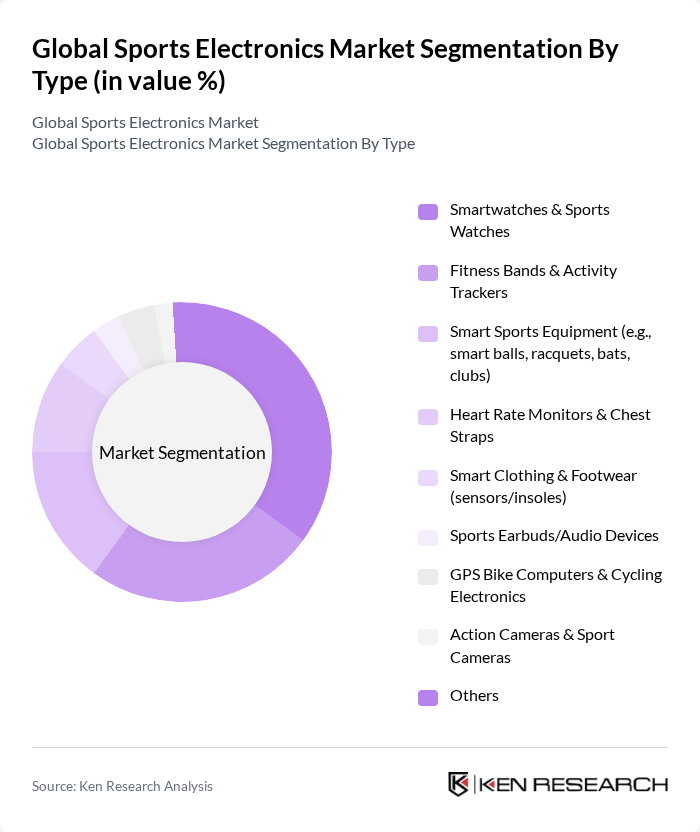

By Type:The market is segmented into various types of sports electronics, including smartwatches, fitness bands, smart sports equipment, heart rate monitors, smart clothing, sports earbuds, GPS bike computers, action cameras, and others. Among these, smartwatches and sports watches dominate the market due to their multifunctionality, combining fitness tracking with smartphone capabilities. Fitness bands and activity trackers also hold a significant share, appealing to consumers seeking affordable and user-friendly options for health monitoring.

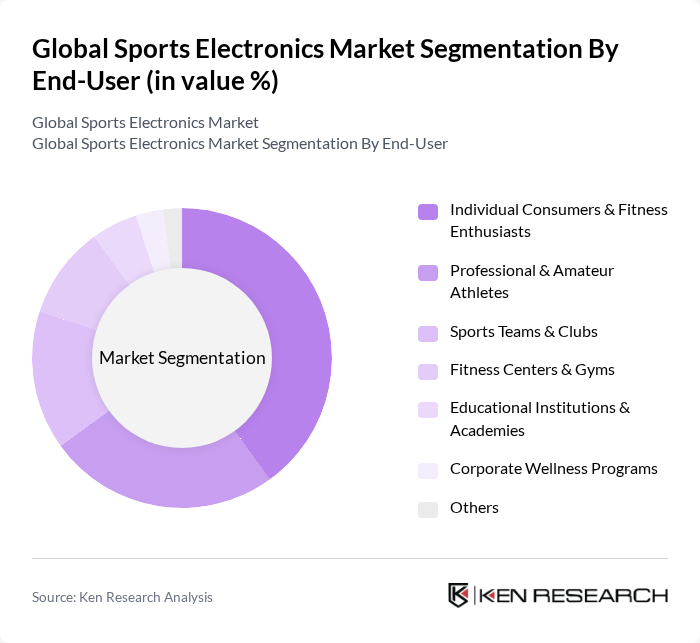

By End-User:The end-user segmentation includes individual consumers, professional and amateur athletes, sports teams, fitness centers, educational institutions, and corporate wellness programs. Individual consumers and fitness enthusiasts represent the largest segment, driven by the growing trend of personal fitness and health monitoring. Professional athletes also contribute significantly, as they require advanced technology for performance analysis and training optimization.

The Global Sports Electronics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Garmin Ltd., Fitbit (Google LLC), Under Armour, Inc., Polar Electro Oy, Suunto Oy, Apple Inc., Samsung Electronics Co., Ltd., Sony Group Corporation, adidas AG, Nike, Inc., Huawei Technologies Co., Ltd., Xiaomi Corporation, Bose Corporation, Jabra (GN Audio A/S), Beats Electronics (Apple Inc.), Catapult Group International Ltd, WHOOP, Inc., COROS Wearables Inc., Wahoo Fitness, Zwift, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sports electronics market appears promising, driven by ongoing technological advancements and a growing consumer base focused on health and fitness. The integration of AI and machine learning into sports devices is expected to enhance user experiences significantly. Additionally, the rise of connected fitness ecosystems will likely foster greater engagement among users, leading to increased sales. As sustainability becomes a priority, manufacturers will need to adapt their practices to meet consumer expectations and regulatory requirements, ensuring long-term viability in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Smartwatches & Sports Watches Fitness Bands & Activity Trackers Smart Sports Equipment (e.g., smart balls, racquets, bats, clubs) Heart Rate Monitors & Chest Straps Smart Clothing & Footwear (sensors/insoles) Sports Earbuds/Audio Devices GPS Bike Computers & Cycling Electronics Action Cameras & Sport Cameras Others |

| By End-User | Individual Consumers & Fitness Enthusiasts Professional & Amateur Athletes Sports Teams & Clubs Fitness Centers & Gyms Educational Institutions & Academies Corporate Wellness Programs Others |

| By Distribution Channel | Online Direct-to-Consumer (Brand eCommerce) Online Marketplaces (e.g., Amazon, Tmall) Specialty Sports Retailers Consumer Electronics Stores Fitness Equipment Dealers & Distributors Others |

| By Price Range | Budget Mid-Range Premium Luxury/Pro-Grade |

| By Application | Fitness & Activity Tracking Performance Monitoring & Analytics Health & Wellness Monitoring (sleep, SpO2, ECG) Training & Coaching Assistance Injury Prevention & Recovery Others |

| By Technology | Bluetooth Wi?Fi NFC GPS/GNSS Bio-sensors (PPG, ECG, EMG) Others |

| By Brand Loyalty | Brand Advocates Brand Switchers Brand Indifferent Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wearable Fitness Technology | 140 | Fitness Enthusiasts, Health Coaches |

| Smart Sports Equipment | 100 | Product Managers, Sports Equipment Retailers |

| Consumer Electronics in Sports | 80 | Electronics Retail Managers, Sports Event Organizers |

| Mobile Apps for Sports Training | 70 | App Developers, Sports Trainers |

| Market Trends in Sports Electronics | 90 | Market Analysts, Sports Technology Experts |

The Global Sports Electronics Market is valued at approximately USD 22 billion, reflecting a significant growth trend driven by the increasing adoption of wearable technology and rising health consciousness among consumers.