Region:Global

Author(s):Geetanshi

Product Code:KRAA2809

Pages:82

Published On:August 2025

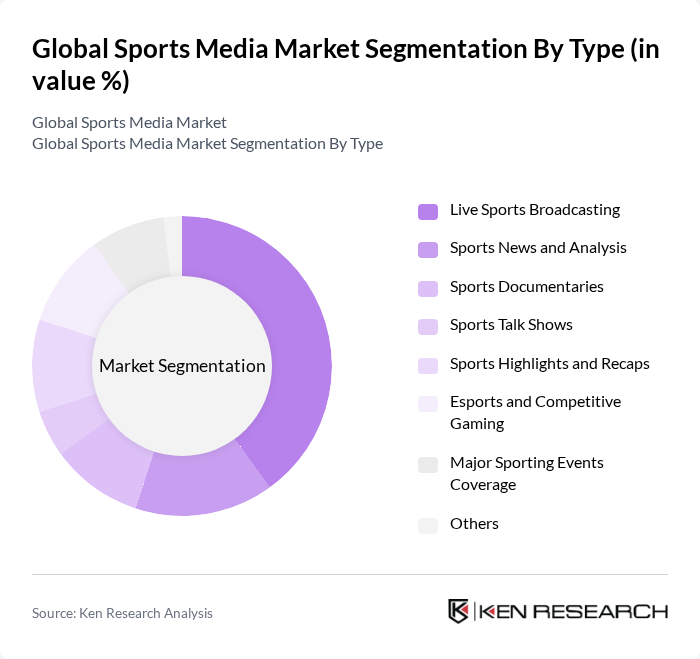

By Type:The market is segmented into Live Sports Broadcasting, Sports News and Analysis, Sports Documentaries, Sports Talk Shows, Sports Highlights and Recaps, Esports and Competitive Gaming, Major Sporting Events Coverage, and Others. Among these,Live Sports Broadcastingremains the dominant segment, propelled by the demand for real-time sports content and the global popularity of major sporting events. The rapid adoption of digital platforms and streaming services has further expanded this segment, as consumers increasingly seek immediate and flexible access to live sports .

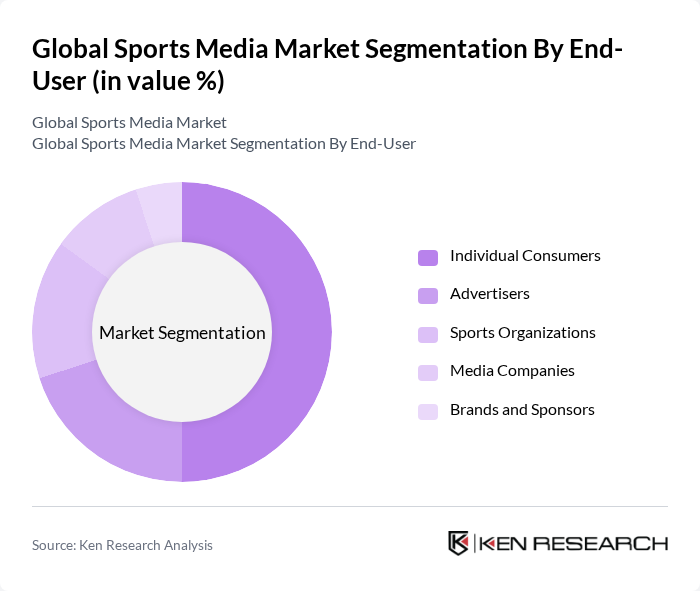

By End-User:This segmentation includes Individual Consumers, Advertisers, Sports Organizations, Media Companies, and Brands and Sponsors.Individual Consumersrepresent the leading category, driven by the expanding global base of sports fans and the surge in subscription-based streaming services. The shift toward personalized and on-demand content consumption has further increased demand from individual viewers, making this segment a central driver of market expansion .

The Global Sports Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as ESPN Inc., NBC Sports Group, Fox Sports, DAZN Group, Warner Bros. Discovery Sports (formerly Turner Sports), CBS Sports, Sky Group, Amazon Prime Video Sports, YouTube TV, FuboTV, Hulu + Live TV, Sling TV, Paramount Global, beIN Media Group, Rakuten Sports, Tencent Sports, Eleven Sports, and Sony Sports Network contribute to innovation, geographic expansion, and service delivery in this space .

The future of the sports media market is poised for transformation, driven by technological advancements and evolving consumer preferences. As the demand for personalized content grows, platforms will increasingly leverage data analytics to enhance audience engagement. Additionally, the integration of augmented reality in sports viewing experiences is expected to redefine how fans interact with content. These trends will likely lead to innovative monetization strategies, ensuring sustained growth and adaptation in a rapidly changing environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Live Sports Broadcasting Sports News and Analysis Sports Documentaries Sports Talk Shows Sports Highlights and Recaps Esports and Competitive Gaming Major Sporting Events Coverage Others |

| By End-User | Individual Consumers Advertisers Sports Organizations Media Companies Brands and Sponsors |

| By Distribution Channel | Cable Television Satellite Television Online Streaming Platforms Mobile Applications Social Media Platforms |

| By Content Format | HD Broadcasting K Broadcasting Virtual Reality Content Audio/Podcast Content |

| By Audience Demographics | Age Groups Gender Geographic Location Fandom Type (e.g., Women's Sports Fans, Esports Fans) |

| By Advertising Model | Pay-Per-View Subscription-Based Ad-Supported Sponsorship-Driven |

| By Engagement Level | Passive Viewers Active Participants Social Media Engagers Interactive/Immersive Experience Users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Television Sports Broadcasting | 120 | Network Executives, Programming Directors |

| Digital Streaming Services | 90 | Product Managers, Marketing Directors |

| Sports Sponsorship and Advertising | 70 | Brand Managers, Advertising Executives |

| Fan Engagement Platforms | 60 | Community Managers, User Experience Designers |

| International Sports Rights Management | 50 | Legal Advisors, Rights Acquisition Managers |

The Global Sports Media Market is valued at approximately USD 150 billion, driven by the increasing consumption of sports content through traditional television and digital streaming services, along with significant broadcasting rights deals.