Region:Global

Author(s):Dev

Product Code:KRAA1664

Pages:96

Published On:August 2025

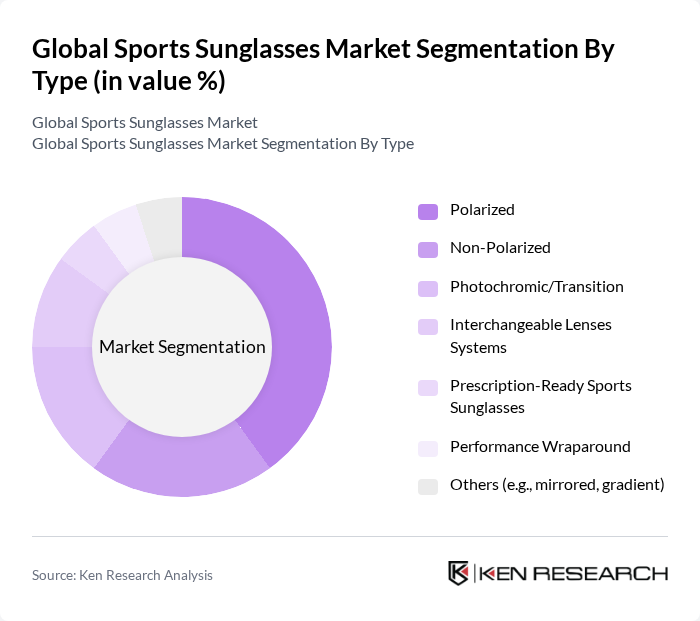

By Type:The market is segmented into various types of sports sunglasses, including polarized, non-polarized, photochromic/transition, interchangeable lenses systems, prescription-ready sports sunglasses, performance wraparound, and others such as mirrored and gradient lenses. Among these, polarized sunglasses are leading the market due to their superior glare reduction and visual clarity, making them a preferred choice for outdoor sports enthusiasts. The demand for photochromic lenses is also rising as they offer versatility for both indoor and outdoor use.

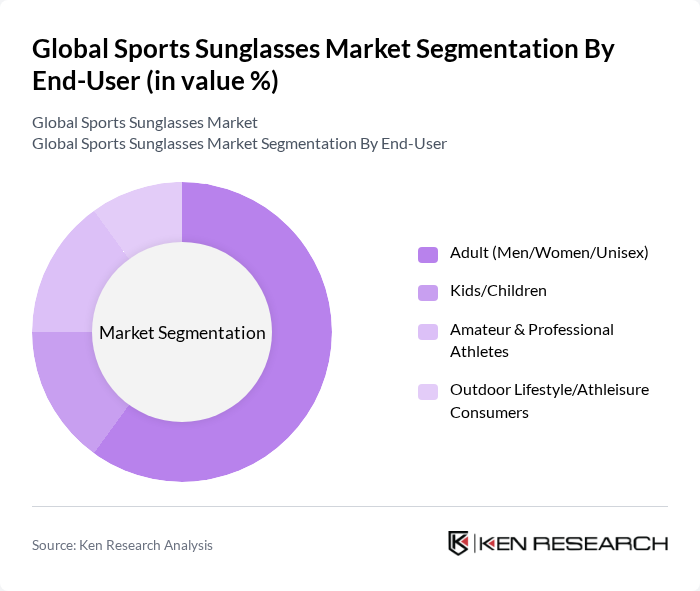

By End-User:The end-user segmentation includes adults (men, women, unisex), kids/children, amateur and professional athletes, and outdoor lifestyle/athleisure consumers. The adult segment dominates the market, driven by the increasing trend of outdoor activities and sports participation among adults. Additionally, the rise of athleisure fashion has led to a growing demand for stylish yet functional eyewear among casual consumers.

The Global Sports Sunglasses Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oakley (EssilorLuxottica), Ray-Ban (EssilorLuxottica), Nike Vision (Marchon/EssilorLuxottica licensed), Adidas Sport Eyewear (Marcolin licensed), Under Armour Eyewear (Safilo licensed), Smith Optics (Safilo Group), Bollé, Tifosi Optics, Maui Jim, Serengeti, Wiley X, Costa Del Mar (EssilorLuxottica), Spy Optic (Bollé Brands), Revo, Julbo contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sports sunglasses market appears promising, driven by increasing consumer awareness of eye health and the growing trend of outdoor activities. As technological advancements continue to enhance product offerings, brands are likely to focus on integrating smart technology into eyewear, catering to tech-savvy consumers. Additionally, sustainability will play a crucial role, with manufacturers prioritizing eco-friendly materials and practices to meet the demands of environmentally conscious buyers, ensuring long-term growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Polarized Non-Polarized Photochromic/Transition Interchangeable Lenses Systems Prescription-Ready Sports Sunglasses Performance Wraparound Others (e.g., mirrored, gradient) |

| By End-User | Adult (Men/Women/Unisex) Kids/Children Amateur & Professional Athletes Outdoor Lifestyle/Athleisure Consumers |

| By Sales Channel | Online Stores Specialty Sports Stores Supermarkets/Hypermarkets Brand-Owned Retail & Direct-to-Consumer |

| By Distribution Mode | Offline Stores E-commerce Marketplaces Wholesale/Distributors |

| By Price Range | Mass/Budget Mid-Range Premium/Performance |

| By Material | Polycarbonate Trivex/nylon (e.g., NXT) Glass (mineral) Bio-based/eco materials (frames/lenses) |

| By Sport/Application | Cycling Running/Trail Golf Water Sports & Fishing Snow Sports (ski/snowboard) Baseball/Field Sports Motorsports Multi-sport/Outdoor Recreation |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Sports Sunglasses | 140 | Store Managers, Sales Associates |

| Consumer Preferences in Sports Eyewear | 150 | Athletes, Outdoor Enthusiasts |

| Market Trends in Sports Eyewear | 100 | Industry Analysts, Market Researchers |

| Product Development Insights | 80 | Product Designers, Brand Managers |

| Impact of Technology on Sports Sunglasses | 70 | Optometrists, Tech Innovators |

The Global Sports Sunglasses Market is valued at approximately USD 4.6 billion, based on a five-year historical analysis. This figure aligns with industry estimates that place the market within the USD 45.5 billion range, indicating steady demand for performance eyewear.