Region:Global

Author(s):Shubham

Product Code:KRAC0673

Pages:99

Published On:August 2025

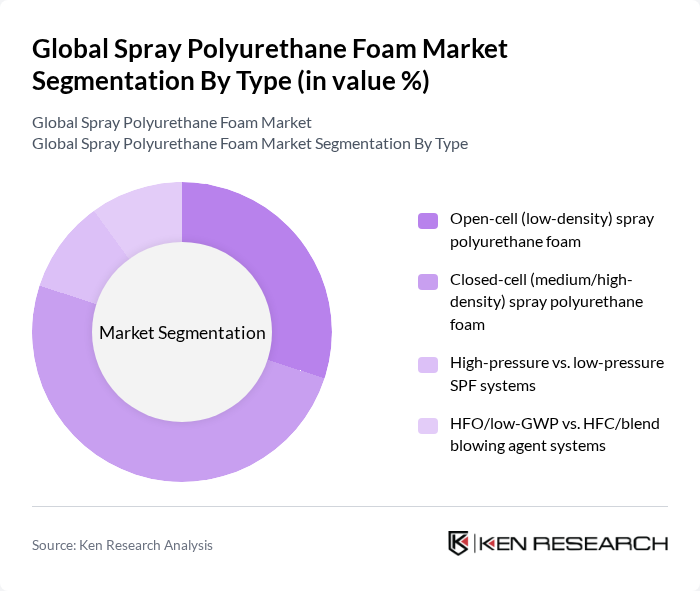

By Type:The market is segmented into various types, including open-cell (low-density) spray polyurethane foam, closed-cell (medium/high-density) spray polyurethane foam, high-pressure vs. low-pressure SPF systems, and HFO/low-GWP vs. HFC/blend blowing agent systems. Among these, closed-cell spray polyurethane foam is dominating the market due to its higher R-value per inch, structural rigidity, and moisture resistance, supporting both wall and roofing applications and aligning with energy code requirements; adoption of low?GWP/HFO-blown closed-cell systems has accelerated with regulatory shifts.

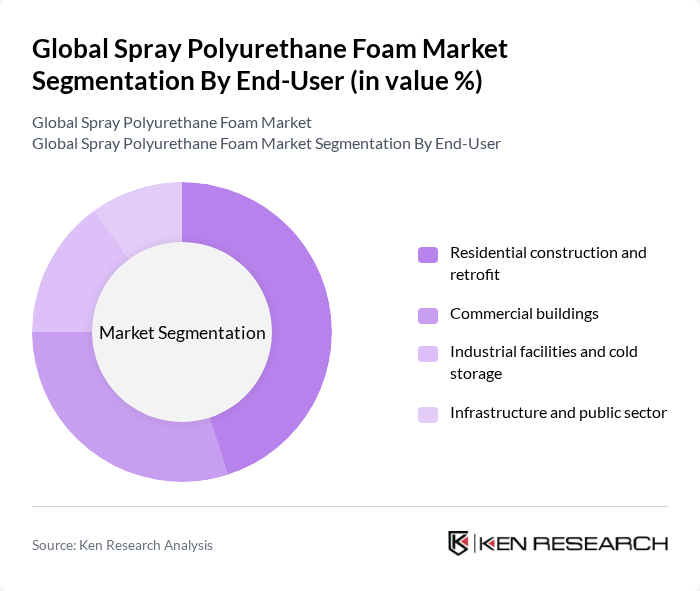

By End-User:The end-user segmentation includes residential construction and retrofit, commercial buildings, industrial facilities and cold storage, and infrastructure and public sector. The residential construction and retrofit segment is leading the market, supported by weatherization and energy-efficiency upgrades that favor SPF for air sealing and insulation to lower heating and cooling loads; commercial reroofing and envelope retrofits are also notable demand drivers.

The Global Spray Polyurethane Foam Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Huntsman Corporation, Dow Inc., Covestro AG, Carlisle Spray Foam Insulation (part of Carlisle Companies), Holcim Building Envelope (Gaco, GenFlex, Duro-Last), NCFI Polyurethanes, Sika AG, SOPREMA Group, Huntsman Building Solutions (Icynene-Lapolla), Henry Company (a Carlisle Companies brand), Fomo Products, LLC (Touch ‘n Foam / Handi-Foam), Johns Manville (a Berkshire Hathaway company), Lapolla Industries (legacy brand under Huntsman Building Solutions), and Rhino Linings Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the spray polyurethane foam market appears promising, driven by increasing demand for energy-efficient solutions and sustainable building practices. As governments worldwide implement stricter energy efficiency regulations, the adoption of SPF is likely to rise. Additionally, advancements in technology will enhance product performance and application methods. The market is expected to witness a shift towards bio-based formulations, aligning with consumer preferences for environmentally friendly materials, thus creating a dynamic landscape for growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Open-cell (low-density) spray polyurethane foam Closed-cell (medium/high-density) spray polyurethane foam High-pressure vs. low-pressure SPF systems HFO/low-GWP vs. HFC/blend blowing agent systems |

| By End-User | Residential construction and retrofit Commercial buildings Industrial facilities and cold storage Infrastructure and public sector |

| By Application | Building envelope insulation (walls, attics, crawl spaces) Roofing and roof coatings (SPF roofing systems) Air sealing and moisture/vapor control Acoustic insulation and sound attenuation Marine, tanks, and specialty protection |

| By Distribution Channel | Direct sales to contractors and OEMs Authorized distributors and spray foam suppliers Online procurement and marketplaces |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Entry-grade (contractor packs) Mid-grade (low-GWP standard) Premium (high-performance, specialty and roofing-grade) |

| By Others | Bio-based SPF share DIY kits vs. professional SPF |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Insulation Applications | 120 | Homeowners, Contractors, Insulation Specialists |

| Commercial Roofing Solutions | 90 | Facility Managers, Architects, Roofing Contractors |

| Industrial Applications | 80 | Plant Managers, Safety Officers, Maintenance Supervisors |

| Energy Efficiency Projects | 70 | Energy Auditors, Sustainability Consultants, Project Managers |

| Regulatory Compliance Insights | 60 | Compliance Officers, Environmental Managers, Policy Makers |

The Global Spray Polyurethane Foam Market is valued at approximately USD 3.3 billion, based on a comprehensive five-year analysis. This valuation reflects the growing demand for energy-efficient insulation in both residential and commercial construction sectors.