Global Stainless Steel Market Overview

- The Global Stainless Steel Market is valued at USD 134 billion, based on a five-year historical analysis. This growth is primarily driven by increasing demand from construction, automotive, and consumer goods industries, as well as the rising trend of urbanization and infrastructure development worldwide. Additional growth drivers include the expanding use of stainless steel in renewable energy, heightened focus on sustainability, and stricter environmental regulations favoring recyclable and low-emission materials .

- Countries such as China, India, and the United States dominate the stainless steel market due to robust industrial sectors and significant investments in infrastructure projects. China leads the market, driven by its extensive manufacturing capabilities and high consumption rates in construction and automotive industries .

- The European Union adopted the “Regulation (EU) 2023/956 establishing a carbon border adjustment mechanism,” issued by the European Parliament and the Council in 2023. This regulation requires steel producers, including stainless steel manufacturers, to report embedded carbon emissions and purchase certificates to cover emissions above a set threshold, thereby incentivizing cleaner production technologies and sustainable practices .

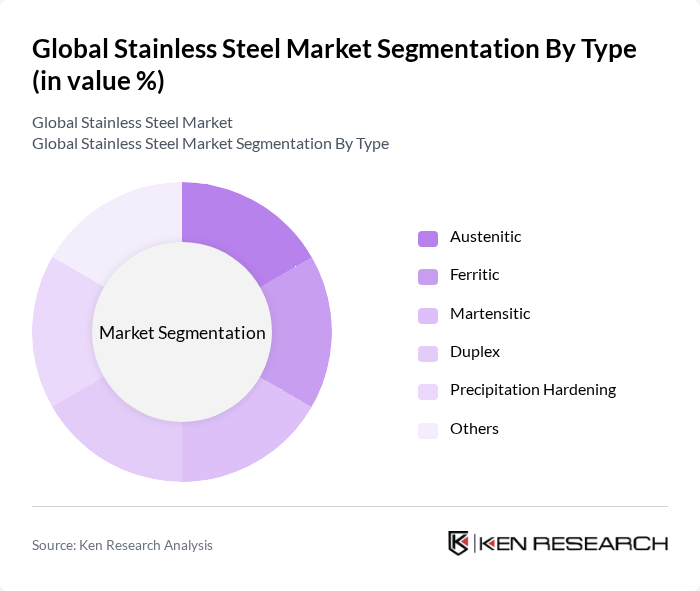

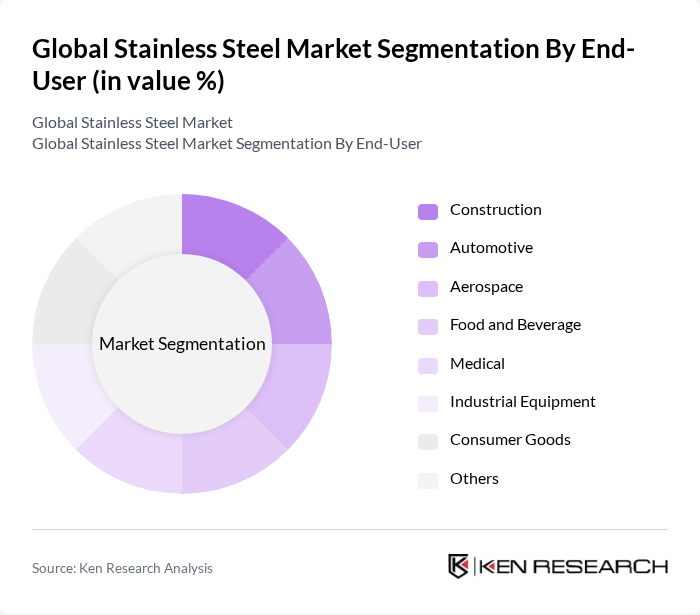

Global Stainless Steel Market Segmentation

By Type:The stainless steel market is segmented into Austenitic, Ferritic, Martensitic, Duplex, Precipitation Hardening, and Others. Austenitic stainless steel remains the most widely used type due to its superior corrosion resistance, formability, and versatility, making it suitable for applications ranging from kitchenware to industrial equipment .

By End-User:End-user segmentation includes Construction, Automotive, Aerospace, Food and Beverage, Medical, Industrial Equipment, Consumer Goods, and Others. The construction sector is the largest end-user, driven by the demand for durable, corrosion-resistant materials in infrastructure and building projects. Automotive and industrial equipment sectors are also significant consumers, reflecting the material’s versatility and performance in demanding environments .

Global Stainless Steel Market Competitive Landscape

The Global Stainless Steel Market is characterized by a dynamic mix of regional and international players. Leading participants such as ArcelorMittal, Outokumpu Oyj, Nippon Steel Corporation, POSCO, thyssenkrupp AG, Cleveland-Cliffs Inc. (formerly AK Steel Holding Corporation), Jindal Stainless Limited, Baosteel Group Corporation, Tata Steel Limited, Allegheny Technologies Incorporated (ATI), Stainless Structurals LLC, Swiss Steel Group (formerly Schmolz + Bickenbach AG), Outokumpu Nirosta GmbH, Sandvik AB, Carpenter Technology Corporation, Acerinox S.A., Aperam S.A. contribute to innovation, geographic expansion, and service delivery in this space.

Global Stainless Steel Market Industry Analysis

Growth Drivers

- Increasing Demand from Construction Sector:The construction sector is projected to contribute significantly to the stainless steel market, with global construction spending expected to reach $14 trillion in future. This growth is driven by urbanization and infrastructure development, particularly in emerging economies. For instance, China alone accounted for over $3 trillion in construction investments in future, highlighting the robust demand for durable materials like stainless steel in building projects, which are essential for structural integrity and longevity.

- Rising Automotive Production:The automotive industry is a major consumer of stainless steel, with global vehicle production anticipated to exceed 90 million units in future. This increase is fueled by a shift towards electric vehicles (EVs), which require high-strength, lightweight materials for efficiency. In future, the production of EVs surged by 50%, leading to a heightened demand for stainless steel components, particularly in battery casings and structural parts, thereby driving market growth.

- Expansion of Food Processing Industry:The food processing industry is experiencing rapid growth, with the global market expected to reach $4.5 trillion in future. Stainless steel is favored for its corrosion resistance and hygiene properties, making it ideal for food processing equipment. In future, the North American food processing sector alone invested over $20 billion in new facilities, further driving the demand for stainless steel in manufacturing food-safe machinery and storage solutions.

Market Challenges

- Fluctuating Raw Material Prices:The stainless steel market faces challenges due to volatile raw material prices, particularly nickel and chromium, which constitute a significant portion of production costs. In future, nickel prices fluctuated between $18,000 and $25,000 per ton, impacting profit margins for manufacturers. This instability can lead to increased production costs, making it difficult for companies to maintain competitive pricing in a price-sensitive market.

- Environmental Regulations:Stricter environmental regulations are posing challenges for stainless steel manufacturers. In future, the European Union implemented new emission standards that require a 30% reduction in greenhouse gas emissions by 2030. Compliance with these regulations necessitates significant investment in cleaner technologies and processes, which can strain financial resources and affect overall market competitiveness, particularly for smaller players in the industry.

Global Stainless Steel Market Future Outlook

The future of the stainless steel market appears promising, driven by increasing investments in sustainable manufacturing practices and technological advancements. As industries prioritize eco-friendly solutions, the demand for recycled stainless steel is expected to rise, aligning with global sustainability goals. Additionally, innovations in stainless steel alloys will enhance product performance, catering to diverse applications across sectors. The expansion into emerging markets will further bolster growth, as these regions invest in infrastructure and industrial development, creating new opportunities for stainless steel applications.

Market Opportunities

- Innovations in Stainless Steel Alloys:The development of advanced stainless steel alloys presents significant market opportunities. These innovations can enhance properties such as strength, corrosion resistance, and heat tolerance, making them suitable for high-performance applications in aerospace and energy sectors. The global investment in research and development for these alloys is projected to exceed $1 billion in future, indicating a strong potential for market growth.

- Growth in Renewable Energy Sector:The renewable energy sector is rapidly expanding, with global investments expected to surpass $1.5 trillion in future. Stainless steel is increasingly used in wind turbines and solar panels due to its durability and resistance to environmental factors. This trend presents a lucrative opportunity for manufacturers to supply materials for renewable energy infrastructure, aligning with global efforts to transition to sustainable energy sources.