Region:Global

Author(s):Dev

Product Code:KRAB0383

Pages:83

Published On:August 2025

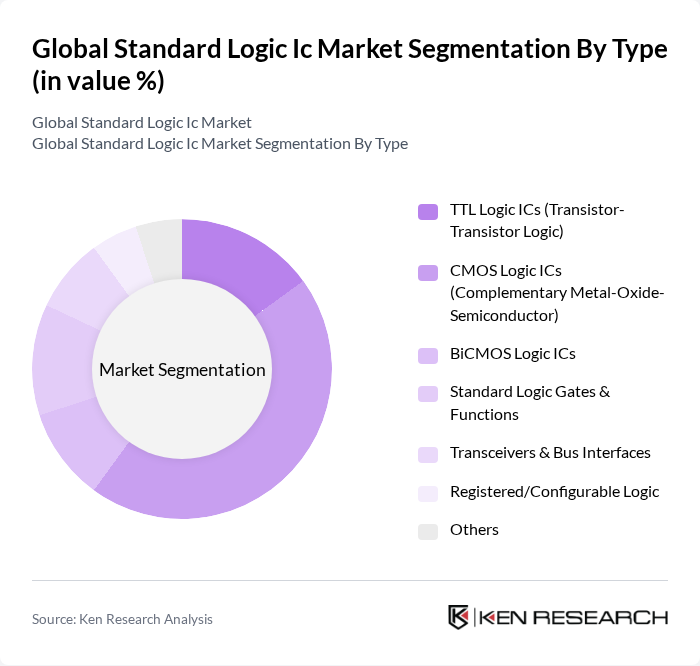

By Type:The market is segmented into various types of logic ICs, including TTL Logic ICs, CMOS Logic ICs, BiCMOS Logic ICs, Standard Logic Gates & Functions, Transceivers & Bus Interfaces, Registered/Configurable Logic, and Others. Among these, CMOS Logic ICs are leading the market due to their low power consumption and high integration capabilities, and their ubiquity across smartphones, automotive ECUs, and networking equipment; industry sources highlight CMOS and BiCMOS advances as key enablers of higher performance and energy efficiency in logic families .

By End-User:The end-user segmentation includes Consumer Electronics, Automotive, Telecommunications & Networking, Industrial & Factory Automation, Data Center & Enterprise Equipment, Healthcare & Medical Devices, Aerospace & Defense, and Others. The Consumer Electronics segment is the most significant contributor, driven by the increasing adoption of smart devices, pervasive connectivity, and interface logic needs across mobile and home devices; automotive and telecom/networking remain important demand centers as ADAS/EV electronics and communications infrastructure expand .

The Global Standard Logic IC Market is characterized by a dynamic mix of regional and international players. Leading participants such as Texas Instruments Incorporated, Nexperia B.V., ON Semiconductor Corporation (onsemi), STMicroelectronics N.V., Renesas Electronics Corporation, Toshiba Electronic Devices & Storage Corporation, Diodes Incorporated, Analog Devices, Inc., Microchip Technology Incorporated, Infineon Technologies AG, Rohm Co., Ltd., NXP Semiconductors N.V., Skyworks Solutions, Inc., Maxim Integrated Products, Inc. (now part of Analog Devices), and Cypress Semiconductor Corporation (now Infineon Technologies) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the standard logic IC market appears promising, driven by technological advancements and increasing integration of AI in electronic devices. As industries continue to embrace automation and smart technologies, the demand for customized logic ICs is expected to rise. Furthermore, sustainability initiatives will push manufacturers to develop energy-efficient ICs, aligning with global environmental goals. These trends indicate a dynamic market landscape, where innovation and adaptability will be key to success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | TTL Logic ICs (Transistor-Transistor Logic) CMOS Logic ICs (Complementary Metal-Oxide-Semiconductor) BiCMOS Logic ICs Standard Logic Gates & Functions (AND/OR/NAND/NOR/XOR/NOT, Buffers, Latches, Flip-Flops) Transceivers & Bus Interfaces (Level Shifters, Line Drivers/Receivers) Registered/Configurable Logic (Shift Registers, Multiplexers/Demultiplexers, Counters) Others |

| By End-User | Consumer Electronics Automotive Telecommunications & Networking Industrial & Factory Automation Data Center & Enterprise Equipment Healthcare & Medical Devices Aerospace & Defense Others |

| By Application | Servers, Storage Networks, and Data Center Switches/Routers Wireless Base Stations and Backhaul Equipment PCs, Laptops, and Embedded Computing Smartphones, Tablets, and Consumer Appliances Automotive Electronics (ADAS, Infotainment, Body Control) Industrial Controls, PLCs, and Robotics IoT Nodes and Edge Devices Others |

| By Distribution Channel | Direct Sales (OEM/ODM) Authorized Distributors Online Catalog Distributors Value-Added Resellers Others |

| By Component | Standard Logic ICs Supporting Discretes (Level Translators, Protection ICs) Passive Components Connectors Others |

| By Price Range | Low Price Mid Price High Price Premium Price |

| By Technology | CMOS Technology BiCMOS Technology Bipolar (TTL) Technology SOI Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 150 | Product Managers, R&D Engineers |

| Automotive Semiconductor Suppliers | 120 | Supply Chain Managers, Technical Directors |

| Industrial Automation Firms | 90 | Operations Managers, Design Engineers |

| Telecommunications Equipment Providers | 80 | Network Engineers, Product Development Leads |

| Research Institutions and Academia | 60 | Research Scientists, Professors in Electronics |

The Global Standard Logic IC Market is valued at approximately USD 40 billion, based on a five-year historical analysis. This figure is supported by various industry trackers that report standard logic-specific revenues at this level, distinguishing it from the broader logic IC category.