Region:Global

Author(s):Rebecca

Product Code:KRAB0173

Pages:82

Published On:August 2025

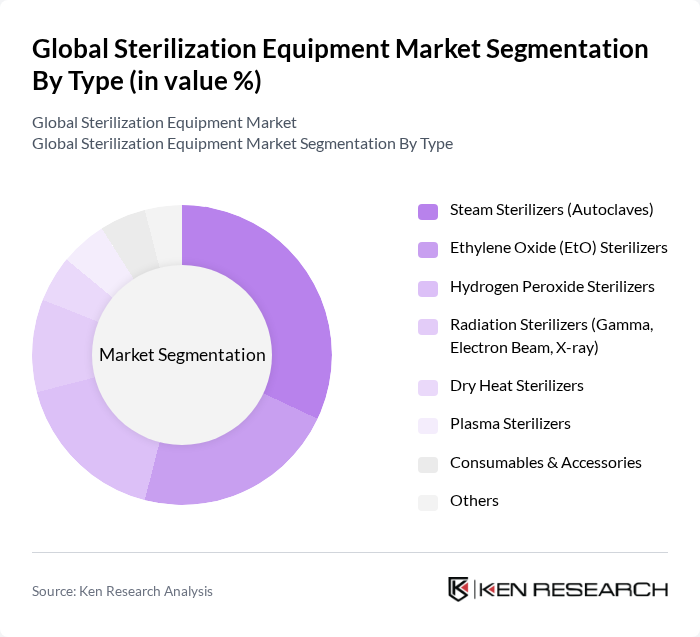

By Type:The sterilization equipment market is segmented into various types, including Steam Sterilizers (Autoclaves), Ethylene Oxide (EtO) Sterilizers, Hydrogen Peroxide Sterilizers, Radiation Sterilizers (Gamma, Electron Beam, X-ray), Dry Heat Sterilizers, Plasma Sterilizers, Consumables & Accessories, and Others. Among these, low-temperature sterilizers (including hydrogen peroxide and EtO) have gained significant market share due to their effectiveness in sterilizing heat-sensitive medical devices and their alignment with environmental and regulatory requirements. Steam sterilizers (autoclaves) remain widely used for their cost-efficiency and reliability in sterilizing surgical instruments and medical devices. The growing number of surgical procedures and the need for stringent infection control measures in healthcare facilities are driving the demand for both steam and low-temperature sterilizers.

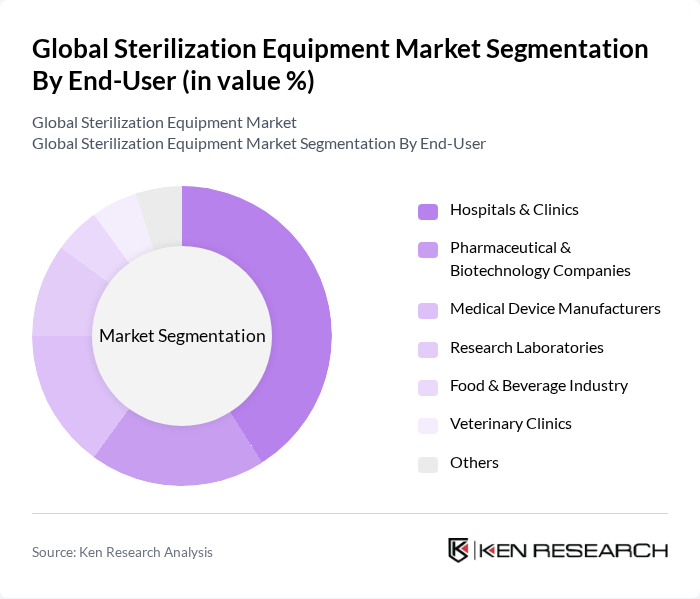

By End-User:The end-user segment of the sterilization equipment market includes Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, Medical Device Manufacturers, Research Laboratories, Food & Beverage Industry, Veterinary Clinics, and Others. Hospitals & Clinics are the leading end-users, driven by the increasing number of surgical procedures, the rising incidence of healthcare-associated infections, and the need for compliance with health regulations. Pharmaceutical and biotechnology companies are also significant users, as they require strict sterilization protocols to ensure product safety and regulatory compliance.

The Global Sterilization Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as STERIS plc, Getinge AB, 3M Company, Ecolab Inc., Belimed AG, Advanced Sterilization Products (ASP, a Fortive Company), Cantel Medical (a STERIS company), Matachana Group, Tuttnauer, Halyard Health, Inc. (now part of Owens & Minor), Sterigenics International, LLC, Steelco S.p.A., CISA Group, Miele Professional, Shinva Medical Instrument Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sterilization equipment market appears promising, driven by ongoing technological advancements and increasing regulatory pressures for infection control. As healthcare facilities prioritize patient safety, the adoption of automated and IoT-integrated sterilization systems is expected to rise. Furthermore, the shift towards eco-friendly sterilization solutions will likely gain momentum, aligning with global sustainability goals. These trends indicate a dynamic market landscape, fostering innovation and investment in sterilization technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Steam Sterilizers (Autoclaves) Ethylene Oxide (EtO) Sterilizers Hydrogen Peroxide Sterilizers Radiation Sterilizers (Gamma, Electron Beam, X-ray) Dry Heat Sterilizers Plasma Sterilizers Consumables & Accessories Others |

| By End-User | Hospitals & Clinics Pharmaceutical & Biotechnology Companies Medical Device Manufacturers Research Laboratories Food & Beverage Industry Veterinary Clinics Others |

| By Application | Surgical Instruments Laboratory Equipment Medical Devices Pharmaceuticals Food Products Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Region | North America (U.S., Canada) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Mexico, Rest of Latin America) Middle East & Africa (South Africa, Saudi Arabia, UAE, Rest of MEA) Others |

| By Price Range | Low Price Mid Price High Price |

| By Technology | Conventional Sterilization Advanced Sterilization Technologies Automated Sterilization Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Sterilization Departments | 100 | Procurement Managers, Infection Control Officers |

| Manufacturers of Sterilization Equipment | 60 | Product Managers, Sales Directors |

| Healthcare Facilities (Clinics and Ambulatory Surgery Centers) | 50 | Facility Managers, Clinical Directors |

| Regulatory Bodies and Health Organizations | 40 | Policy Makers, Compliance Officers |

| Research Institutions Focused on Sterilization Technologies | 40 | Research Scientists, Academic Professors |

The Global Sterilization Equipment Market is valued at approximately USD 15 billion, driven by increasing demand for sterilization in healthcare settings, rising surgical procedures, and advancements in sterilization technologies.