Region:Global

Author(s):Geetanshi

Product Code:KRAB0090

Pages:99

Published On:August 2025

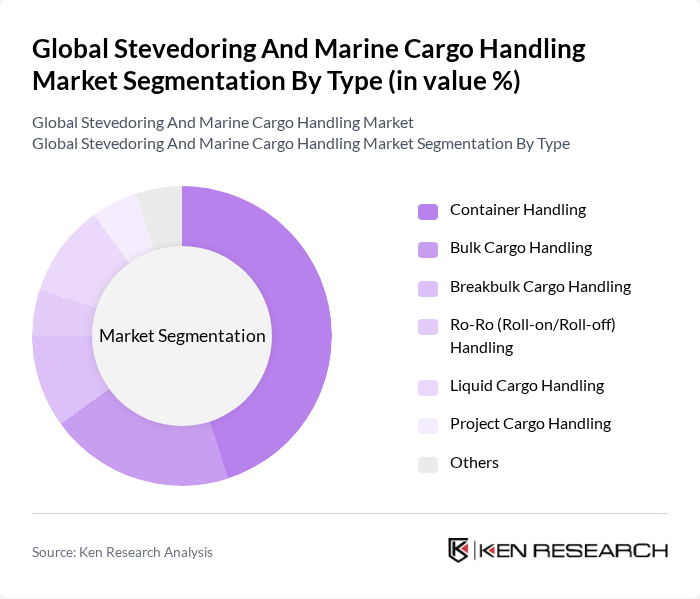

By Type:The market is segmented into various types of cargo handling services, including Container Handling, Bulk Cargo Handling, Breakbulk Cargo Handling, Ro-Ro (Roll-on/Roll-off) Handling, Liquid Cargo Handling, Project Cargo Handling, and Others. Among these, Container Handling remains a dominant segment due to the increasing reliance on containerized shipping for global trade. However, recent trends indicate that Bulk Cargo Handling is also gaining prominence, particularly in Asia-Pacific, driven by rising commodity exports. The efficiency and speed of container handling operations, supported by automation and digitalization, continue to make it the preferred choice for shipping lines and logistics companies, driving significant investments in port infrastructure and technology .

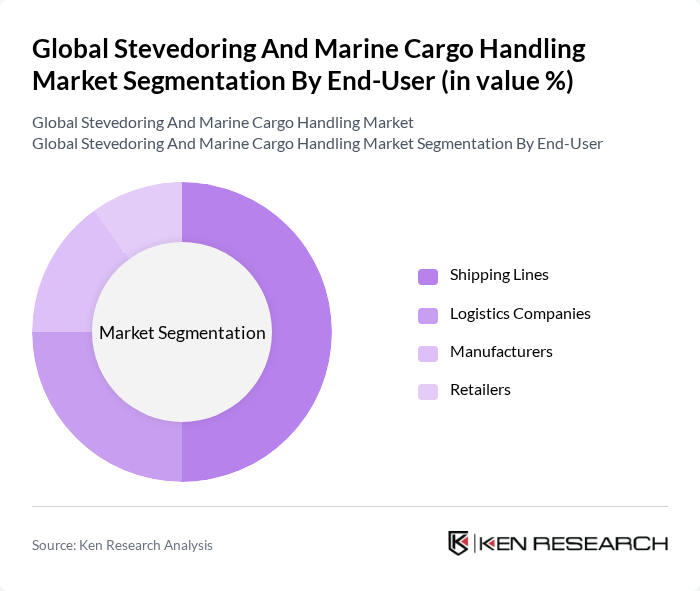

By End-User:The end-user segmentation includes Shipping Lines, Logistics Companies, Manufacturers, and Retailers. Shipping Lines represent the largest share of the market, driven by the increasing volume of global trade and the need for efficient cargo handling services. The growth of e-commerce and the demand for quick delivery have further propelled the need for reliable logistics solutions, making shipping lines a critical component of the supply chain .

The Global Stevedoring And Marine Cargo Handling Market is characterized by a dynamic mix of regional and international players. Leading participants such as APM Terminals, DP World, Hutchison Ports, PSA International, Ceres Terminals, Port of Rotterdam Authority, International Container Terminal Services, Inc. (ICTSI), Hamburger Hafen und Logistik AG (HHLA), SAAM S.A., Ports America, CMA CGM Group, COSCO Shipping Ports Limited, Mediterranean Shipping Company (MSC), Irish Continental Group, ZIM Integrated Shipping Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the stevedoring and marine cargo handling market appears promising, driven by technological innovations and the expansion of global trade networks. As ports modernize and adopt automation, operational efficiencies are expected to improve significantly. Additionally, the increasing focus on sustainability will likely shape industry practices, pushing companies to adopt greener technologies. These trends will create a dynamic environment, fostering growth and adaptation in response to evolving market demands and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Container Handling Bulk Cargo Handling Breakbulk Cargo Handling Ro-Ro (Roll-on/Roll-off) Handling Liquid Cargo Handling Project Cargo Handling Others |

| By End-User | Shipping Lines Logistics Companies Manufacturers Retailers |

| By Service Type | Loading Services Unloading Services Storage Services Transshipment Services |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Cargo Type | Containerized Cargo Bulk Cargo Breakbulk Cargo Liquid Bulk Cargo |

| By Operational Model | Manual Handling Automated Handling Semi-Automated Handling |

| By Pricing Model | Fixed Pricing Variable Pricing Performance-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Container Handling Operations | 100 | Terminal Managers, Operations Supervisors |

| Bulk Cargo Management | 80 | Logistics Coordinators, Cargo Planners |

| Port Authority Regulations | 60 | Regulatory Affairs Managers, Compliance Officers |

| Stevedoring Service Providers | 50 | Business Development Managers, Sales Directors |

| Marine Cargo Insurance | 40 | Insurance Underwriters, Risk Management Specialists |

The Global Stevedoring and Marine Cargo Handling Market is valued at approximately USD 11 billion, driven by increasing global trade activities, expansion of shipping routes, and the rise in containerized cargo transport.