Region:Global

Author(s):Geetanshi

Product Code:KRAA2811

Pages:97

Published On:August 2025

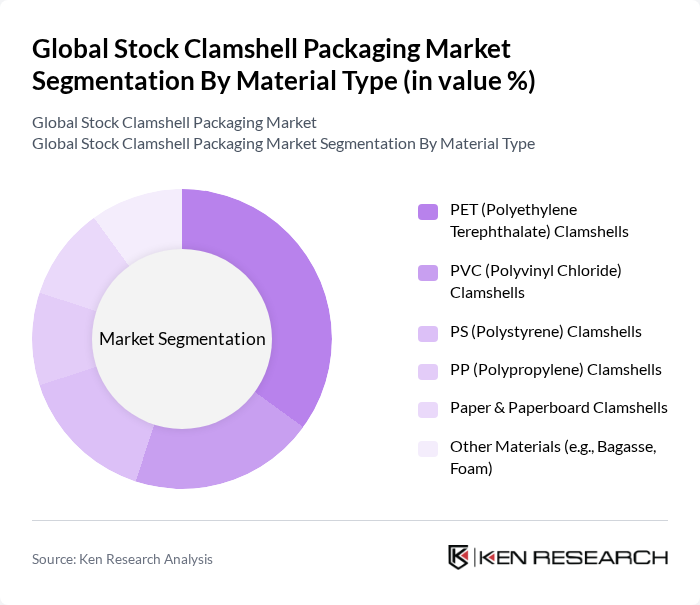

By Material Type:The material type segmentation includes various materials used in the production of clamshell packaging. The primary materials are PET (Polyethylene Terephthalate), PVC (Polyvinyl Chloride), PS (Polystyrene), PP (Polypropylene), Paper & Paperboard, and Other Materials such as Bagasse and Foam. Each material offers unique properties that cater to different packaging needs, with PET and molded fiber gaining traction for their recyclability and compliance with evolving regulations.

The PET (Polyethylene Terephthalate) clamshells segment is currently dominating the market due to its lightweight, durability, and recyclability. PET is especially favored in food packaging applications for its safety, hygiene, and clear product visibility. The rising consumer preference for sustainable packaging solutions and the adoption of post-consumer recycled PET (rPET) have further boosted demand, as manufacturers seek to align with regulatory requirements and environmental goals. Advancements in recycling technologies and compostability certifications are making PET and molded fiber increasingly attractive options for both manufacturers and retailers.

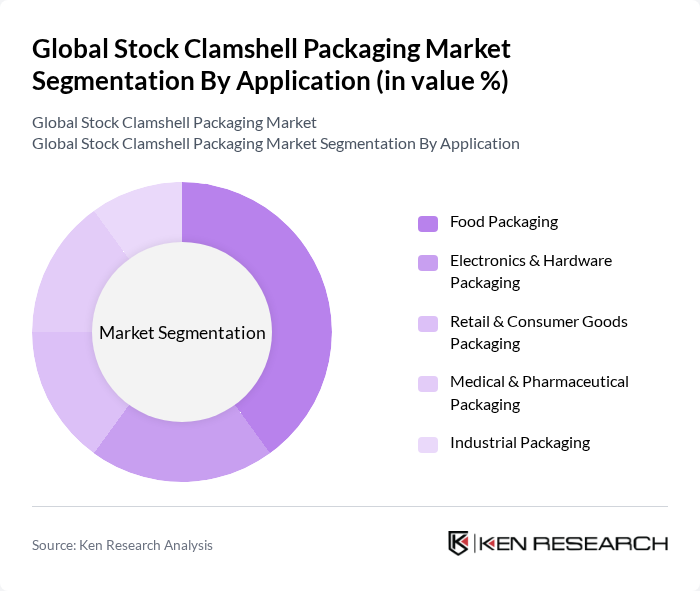

By Application:The application segmentation encompasses various sectors where clamshell packaging is utilized. Key applications include Food Packaging, Electronics & Hardware Packaging, Retail & Consumer Goods Packaging, Medical & Pharmaceutical Packaging, and Industrial Packaging. Each application has specific requirements that influence the choice of packaging materials and designs, with food and electronics leading due to their high demand for secure, tamper-evident, and visually appealing packaging.

The Food Packaging application segment is leading the market, driven by the growing demand for ready-to-eat meals, convenience foods, and packaged fresh produce. Clamshell packaging is preferred in this sector for its excellent visibility, product protection, and ability to meet food safety standards. The rise in health-conscious consumers and the expansion of organized retail have further enhanced demand. Electronics and hardware packaging also represent a significant share, fueled by e-commerce growth and the need for tamper-resistant, secure packaging formats. Sustainability trends and regulatory mandates continue to push manufacturers to innovate across all applications.

The Global Stock Clamshell Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Sealed Air Corporation, Berry Global, Inc., Sonoco Products Company, WestRock Company, Smurfit Kappa Group, Mondi Group, DS Smith Plc, Huhtamaki Oyj, International Paper Company, Graphic Packaging Holding Company, ProAmpac LLC, Placon Corporation, Lacerta Group, Inc., Rohrer Corporation, EasyPak LLC, Dordan Manufacturing Company, VisiPak (Sinclair & Rush, Inc.), Brentwood Industries, Inc., Novolex Holdings, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of clamshell packaging in None appears promising, driven by a strong shift towards sustainable practices and technological advancements. As consumers increasingly demand eco-friendly options, manufacturers are likely to invest in biodegradable materials and smart packaging technologies. Additionally, the growth of e-commerce will continue to fuel innovation in packaging design, enhancing product visibility and convenience. Companies that adapt to these trends will likely capture significant market share and drive industry growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Material Type | PET (Polyethylene Terephthalate) Clamshells PVC (Polyvinyl Chloride) Clamshells PS (Polystyrene) Clamshells PP (Polypropylene) Clamshells Paper & Paperboard Clamshells Other Materials (e.g., Bagasse, Foam) |

| By Application | Food Packaging Electronics & Hardware Packaging Retail & Consumer Goods Packaging Medical & Pharmaceutical Packaging Industrial Packaging |

| By End-User Industry | Food & Beverage Consumer Electronics Healthcare & Pharmaceuticals Household & Personal Care Others |

| By Sales Channel | Direct Sales Online Sales Retail Sales Distributors |

| By Distribution Mode | Bulk Distribution Retail Distribution E-commerce Distribution Others |

| By Price Range | Economy Mid-range Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Packaging Manufacturers | 100 | Production Managers, Quality Assurance Leads |

| Retail Sector Clamshell Usage | 80 | Store Managers, Supply Chain Coordinators |

| Consumer Electronics Packaging | 70 | Product Development Managers, Packaging Engineers |

| Sustainability Initiatives in Packaging | 50 | Sustainability Managers, Corporate Social Responsibility Officers |

| Market Trends in Clamshell Packaging | 90 | Market Analysts, Business Development Executives |

The Global Stock Clamshell Packaging Market is valued at approximately USD 5.3 billion, reflecting a significant growth trend driven by the demand for sustainable packaging solutions and the expansion of e-commerce and retail sectors.