Region:Global

Author(s):Shubham

Product Code:KRAA1861

Pages:96

Published On:August 2025

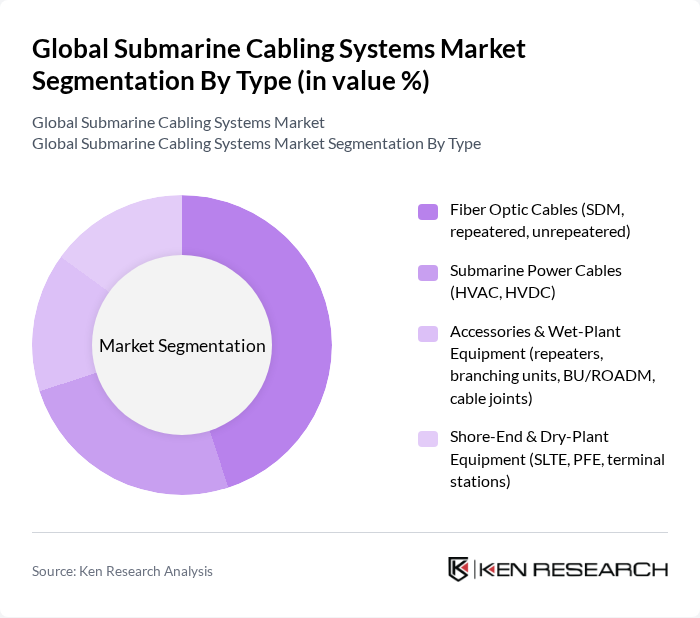

By Type:The market is segmented into various types, including Fiber Optic Cables, Submarine Power Cables, Accessories & Wet-Plant Equipment, and Shore-End & Dry-Plant Equipment. Among these, Fiber Optic Cables are the most dominant due to their high data transmission capacity and efficiency. The increasing demand for high-speed internet and data services has led to a surge in the deployment of fiber optic cables, making them a critical component of submarine cabling systems. Continued hyperscaler-led investment in high-fiber-count SDM systems and upgrades of repeatered routes further reinforce the dominance of fiber optic submarine telecom cables .

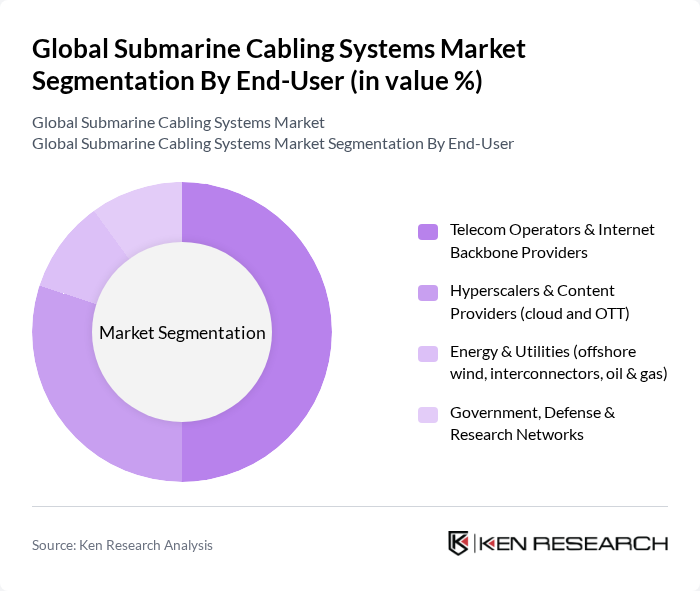

By End-User:The end-user segmentation includes Telecom Operators & Internet Backbone Providers, Hyperscalers & Content Providers, Energy & Utilities, and Government, Defense & Research Networks. Telecom Operators & Internet Backbone Providers dominate this segment due to the increasing demand for bandwidth and the need for reliable communication networks. The rapid growth of internet traffic and the expansion of digital services have made this segment crucial for the submarine cabling systems market. At the same time, hyperscalers have significantly increased direct participation and consortia leadership in transoceanic builds, accelerating capacity additions .

The Global Submarine Cabling Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as SubCom LLC, NEC Corporation, Alcatel Submarine Networks (ASN), a Nokia company, HMN Tech (formerly Huawei Marine Networks), NTT Ltd. (Submarine Cable and Global Networks), Orange Marine, Global Marine Group, Prysmian Group, Nexans S.A., ZTT Group (Jiangsu Zhongtian Technology), Hengtong Optic-Electric Co., Ltd., Telxius (Telefónica Group), Tata Communications (TGN), Google (Subsea Cable Investments), Meta (Facebook) Subsea Investments contribute to innovation, geographic expansion, and service delivery in this space. Ongoing demand drivers include record international bandwidth growth, European offshore wind interconnections stimulating power cable demand, and hyperscaler-led SDM deployments that increase fiber-pair counts and spectral efficiency across new builds .

The future of submarine cabling systems is poised for significant transformation, driven by technological advancements and increasing global connectivity needs. As countries invest in digital infrastructure, the integration of AI and IoT technologies will enhance operational efficiency and security. Furthermore, the growing emphasis on sustainability will lead to the development of eco-friendly cabling solutions. These trends indicate a robust demand for innovative submarine cabling systems that can support the evolving landscape of global communication and energy distribution.

| Segment | Sub-Segments |

|---|---|

| By Type | Fiber Optic Cables (SDM, repeatered, unrepeatered) Submarine Power Cables (HVAC, HVDC) Accessories & Wet-Plant Equipment (repeaters, branching units, BU/ROADM, cable joints) Shore-End & Dry-Plant Equipment (SLTE, PFE, terminal stations) |

| By End-User | Telecom Operators & Internet Backbone Providers Hyperscalers & Content Providers (cloud and OTT) Energy & Utilities (offshore wind, interconnectors, oil & gas) Government, Defense & Research Networks |

| By Application | Data Communications (international and domestic subsea connectivity) Power Transmission (offshore wind export, grid interconnectors) Offshore Field Infrastructure (oil & gas, platform power/comm links) Environmental and SMART Sensing (seafloor monitoring, tsunami, seismic) |

| By Component | Wet Plant (cables, repeaters/amplifiers, branching units, cable protection) Dry Plant (SLTE, power feeding equipment, network management) Marine Services (survey, installation, ploughing, burial, repairs) Project & System Integration (route engineering, permitting, testing) |

| By Sales Channel | Direct EPC/System Turnkey Contracts Consortia & Club Deals Vendor Frameworks & Strategic Sourcing Integrators and Marine Service Providers |

| By Distribution Mode | Subsea (deepwater, shallow water) Shore-End & Terrestrial Backhaul Island and Interconnector Routes |

| By Investment Source | Private & Hyperscaler-Led Investments Public Funding & PPPs Carrier Consortia Multilateral & Development Finance |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Infrastructure | 120 | Network Engineers, Infrastructure Managers |

| Marine Surveying Services | 90 | Marine Engineers, Survey Technicians |

| Cable Installation Projects | 80 | Project Managers, Operations Directors |

| Maintenance and Repair Services | 70 | Maintenance Supervisors, Technical Leads |

| Regulatory Compliance and Policy | 60 | Regulatory Affairs Specialists, Compliance Officers |

The Global Submarine Cabling Systems Market is valued at approximately USD 15.3 billion, reflecting a significant demand driven by international bandwidth needs, hyperscale data center expansion, and cloud migration, according to multiple industry trackers.