Region:Global

Author(s):Shubham

Product Code:KRAC0832

Pages:93

Published On:August 2025

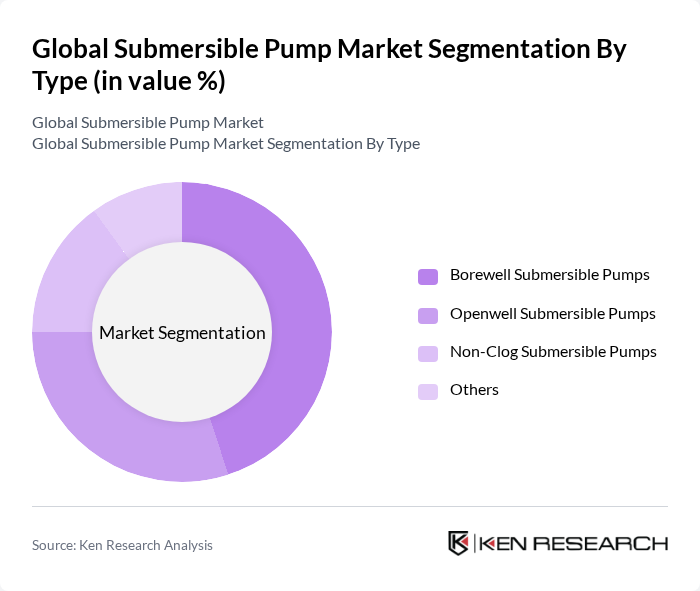

By Type:The submersible pump market is segmented into Borewell Submersible Pumps, Openwell Submersible Pumps, Non-Clog Submersible Pumps, and Others. Among these, Borewell Submersible Pumps remain the most dominant segment due to their widespread use in agricultural irrigation and groundwater extraction. Increasing demand for reliable water supply in both rural and urban areas, coupled with advancements in pump technology and efficiency, drives the preference for borewell submersible pumps among consumers.

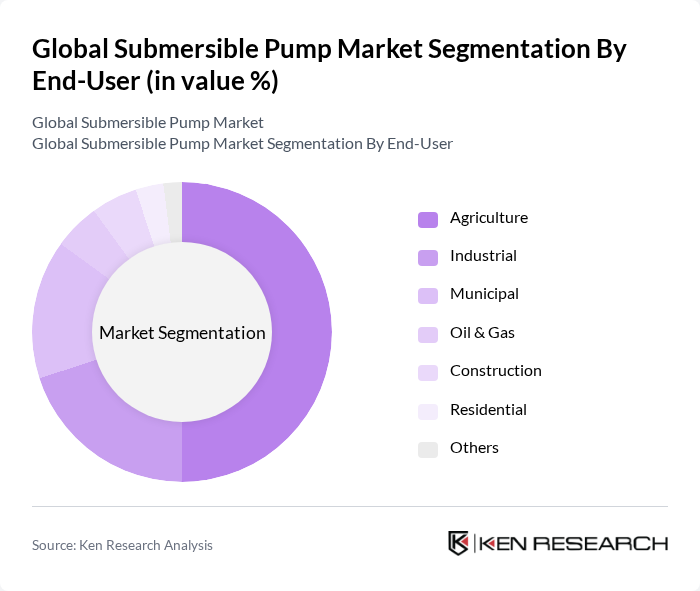

By End-User:The market is categorized into Agriculture, Industrial, Municipal, Oil & Gas, Construction, Residential, and Others. The Agriculture segment leads the market, driven by the increasing need for efficient irrigation solutions and water management in farming practices. Rising global population and the need for food security continue to boost demand for submersible pumps in agriculture. Industrial and municipal sectors also contribute significantly, with applications in wastewater management, water supply, and infrastructure development.

The Global Submersible Pump Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grundfos Holding A/S, Xylem Inc., KSB SE & Co. KGaA, Sulzer Ltd., Franklin Electric Co., Inc., Pentair plc, Ebara Corporation, Wilo SE, Zoeller Company, Tsurumi Manufacturing Co., Ltd., The Gorman-Rupp Company, ITT Inc., Flowserve Corporation, Borets International Ltd., National Pump Company, BBA Pumps B.V., ARO Fluid Management contribute to innovation, geographic expansion, and service delivery in this space.

The future of the submersible pump market in None appears promising, driven by increasing investments in sustainable water management and technological innovations. As urbanization continues to rise, the demand for efficient water supply systems will likely grow. Additionally, the integration of IoT technologies in pump monitoring is expected to enhance operational efficiency and reduce maintenance costs, making submersible pumps more appealing to a broader range of industries and applications.

| Segment | Sub-Segments |

|---|---|

| By Type | Borewell Submersible Pumps Openwell Submersible Pumps Non-Clog Submersible Pumps Others |

| By End-User | Agriculture Industrial Municipal Oil & Gas Construction Residential Others |

| By Application | Water Supply Wastewater Management Irrigation Dewatering Slurry Handling Others |

| By Material | Stainless Steel Cast Iron Thermoplastics Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Power Rating | Low (Up to 1.5 HP) Medium (1.5 HP to 5 HP) High (Above 5 HP) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Irrigation Systems | 60 | Agronomists, Farm Managers |

| Municipal Water Supply | 50 | Water Utility Managers, City Planners |

| Industrial Applications | 40 | Plant Managers, Operations Directors |

| Oil and Gas Extraction | 40 | Field Engineers, Procurement Specialists |

| Wastewater Treatment Facilities | 50 | Environmental Engineers, Facility Managers |

The Global Submersible Pump Market is valued at approximately USD 13.85 billion, driven by factors such as water scarcity, urbanization, and agricultural expansion. This valuation is based on a comprehensive five-year historical analysis of market trends and growth drivers.