Region:Global

Author(s):Dev

Product Code:KRAA1643

Pages:100

Published On:August 2025

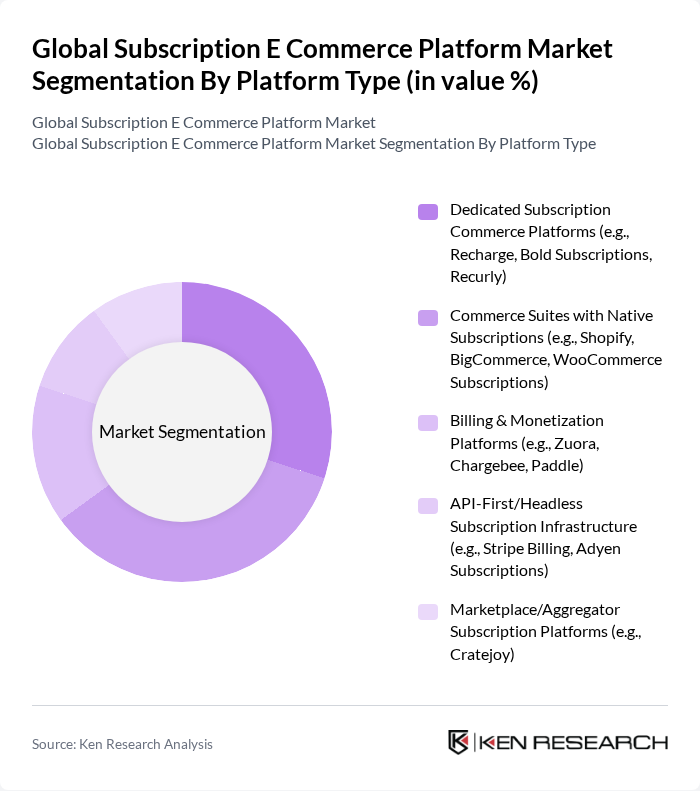

By Platform Type:The segmentation of the market by platform type includes various categories that cater to different business needs and consumer preferences. The subsegments are as follows:

The dominant subsegment in the platform type category is the Commerce Suites with Native Subscriptions. This is primarily due to the increasing number of businesses opting for integrated solutions that offer seamless subscription management alongside other e-commerce functionalities. The convenience of having a single platform for multiple services appeals to both small and large enterprises, driving their adoption. Additionally, the flexibility and scalability of these platforms cater to diverse business models, further solidifying their market leadership .

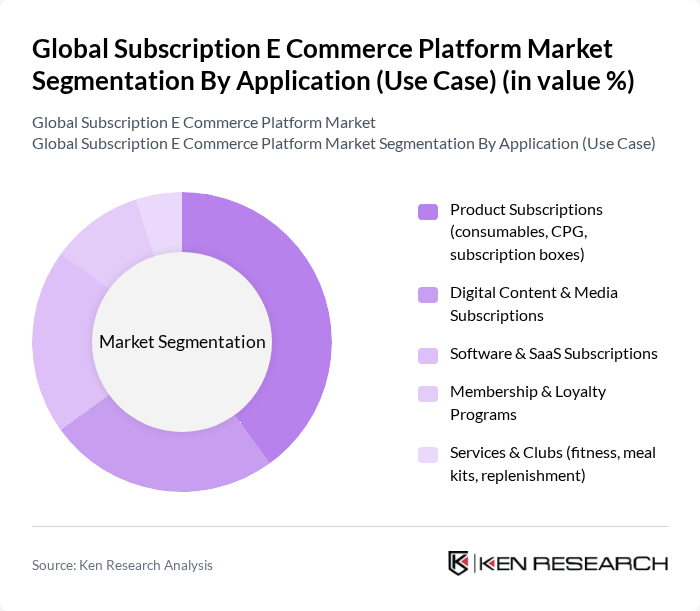

By Application (Use Case):The market can also be segmented based on various applications that cater to different consumer needs. The subsegments are as follows:

Among the application segments, Product Subscriptions lead the market due to the growing trend of consumers preferring convenience and regular delivery of essential goods. Subscription boxes and replenishment models have strong adoption in categories such as food, personal care, and household items, reflecting consumer demand for curated and recurring delivery experiences within e-commerce .

The Global Subscription E Commerce Platform Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shopify Inc. (Shopify Subscriptions ecosystem), BigCommerce Holdings, Inc., WooCommerce (Automattic Inc.), Recharge Payments, Bold Commerce (Bold Subscriptions), Zuora, Inc., Chargebee Inc., Stripe, Inc. (Stripe Billing), Paddle.com Market Limited, Recurly, Inc., Adyen N.V. (Recurring & Subscriptions), Amazon.com, Inc. (Subscribe & Save, Prime benefits for merchants), Cratejoy, Inc., SAP SE (SAP Commerce Cloud Subscriptions), Salesforce, Inc. (Commerce Cloud & Subscription Management) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the subscription e-commerce platform market appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt AI and machine learning, personalized offerings will enhance customer experiences, fostering loyalty. Additionally, the growing emphasis on sustainability will likely lead to innovative subscription models that cater to eco-conscious consumers. Companies that adapt to these trends will be well-positioned to capture market share and drive growth in future.

| Segment | Sub-Segments |

|---|---|

| By Platform Type | Dedicated Subscription Commerce Platforms (e.g., Recharge, Bold Subscriptions, Recurly) Commerce Suites with Native Subscriptions (e.g., Shopify, BigCommerce, WooCommerce Subscriptions) Billing & Monetization Platforms (e.g., Zuora, Chargebee, Paddle) API-First/Headless Subscription Infrastructure (e.g., Stripe Billing, Adyen Subscriptions) Marketplace/Aggregator Subscription Platforms (e.g., Cratejoy) |

| By Application (Use Case) | Product Subscriptions (consumables, CPG, subscription boxes) Digital Content & Media Subscriptions Software & SaaS Subscriptions Membership & Loyalty Programs Services & Clubs (fitness, meal kits, replenishment) |

| By Business Size | Micro & Small Businesses (SMBs) Mid-Market Large Enterprises |

| By Deployment | Cloud/SaaS On-Premises Hybrid |

| By Billing Model | Fixed-Rate (Flat) Billing Tiered & Volume-Based Pricing Usage- & Consumption-Based Billing Freemium and Trials with Conversion |

| By Payment Method | Cards (Credit/Debit) Digital Wallets (Apple Pay, Google Pay, PayPal) Bank Debits & Transfers (ACH/SEPA/Direct Debit) Alternative Payments (BNPL, local APMs) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Media Subscription Services | 120 | Content Managers, Marketing Directors |

| Food Delivery Subscriptions | 100 | Operations Managers, Customer Experience Leads |

| Fashion Subscription Boxes | 80 | Product Managers, Brand Strategists |

| Health & Wellness Subscriptions | 70 | Health Coaches, Subscription Service Owners |

| Software as a Service (SaaS) Subscriptions | 110 | IT Managers, Business Development Executives |

The Global Subscription E Commerce Platform Market is valued at approximately USD 20 billion, reflecting a strong trend towards subscription models across various sectors, including retail and digital services, driven by consumer preferences for convenience and personalization.