Region:Global

Author(s):Geetanshi

Product Code:KRAD7925

Pages:81

Published On:December 2025

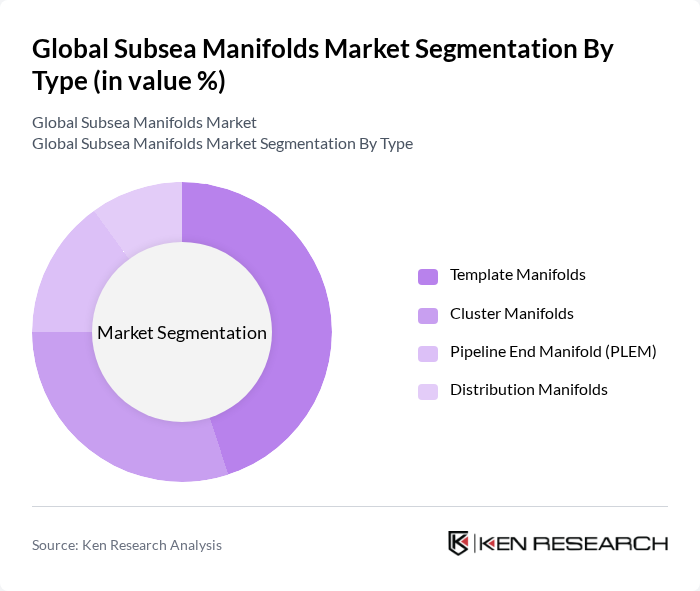

By Type:The subsea manifolds market is segmented into four main types: Template Manifolds, Cluster Manifolds, Pipeline End Manifold (PLEM), and Others. Among these, Template Manifolds are gaining traction due to their versatility and efficiency in managing multiple wells from a single location. Cluster Manifolds are also popular as they facilitate the integration of various subsea systems, enhancing operational efficiency. The Pipeline End Manifold (PLEM) is crucial for connecting subsea pipelines to surface facilities, making it a vital component in deepwater projects.

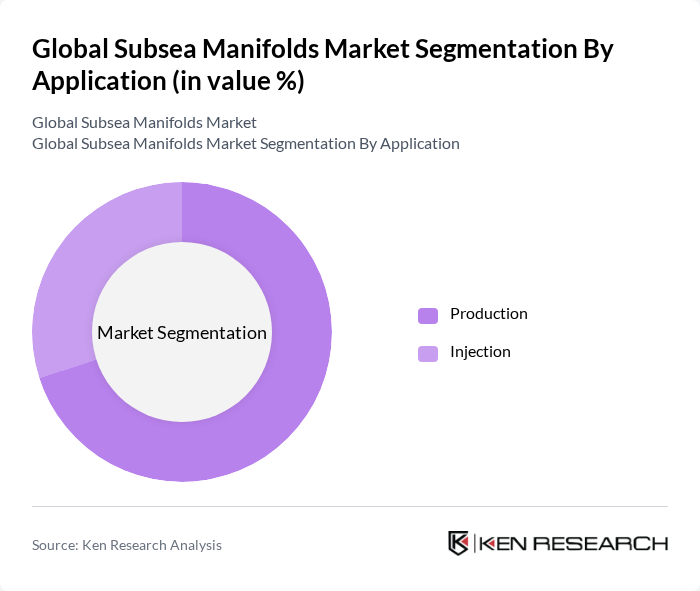

By Application:The subsea manifolds market is categorized into Production, Injection, and Others. The Production segment is the most significant, driven by the need for efficient extraction of hydrocarbons from subsea reservoirs. Injection applications, including water and gas injection, are also critical for maintaining reservoir pressure and enhancing oil recovery. The Others segment includes various specialized applications that cater to specific project requirements.

The Global Subsea Manifolds Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schlumberger Limited, TechnipFMC plc, Subsea 7 S.A., Aker Solutions ASA, Baker Hughes Company, Halliburton Company, Oceaneering International Inc., Saipem S.p.A., Wood Group PLC, McDermott International Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the subsea manifolds market appears promising, driven by ongoing technological advancements and a shift towards integrated subsea systems. As companies increasingly adopt digital technologies, operational efficiencies are expected to improve significantly. Additionally, the rising emphasis on safety and risk management will likely lead to enhanced regulatory compliance, fostering a more stable market environment. The focus on sustainable energy solutions will further shape the landscape, encouraging innovation and investment in the None region.

| Segment | Sub-Segments |

|---|---|

| By Type | Template Manifolds Cluster Manifolds Pipeline End Manifold (PLEM) Others |

| By Application | Production Injection Others |

| By Water Depth | Shallow Water Deep Water Ultra-Deep Water Others |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Subsea Projects | 120 | Project Managers, Operations Directors |

| Renewable Energy Subsea Applications | 100 | Technical Leads, Environmental Engineers |

| Subsea Equipment Manufacturing | 80 | Product Managers, R&D Engineers |

| Subsea Installation Services | 70 | Service Managers, Field Engineers |

| Regulatory Compliance in Subsea Operations | 60 | Compliance Officers, Safety Managers |

The Global Subsea Manifolds Market is valued at approximately USD 6 billion, driven by increasing offshore oil and gas exploration and advancements in subsea technologies. This market is expected to grow significantly due to rising investments in deepwater and ultra-deepwater projects.