Region:Global

Author(s):Shubham

Product Code:KRAB0827

Pages:87

Published On:August 2025

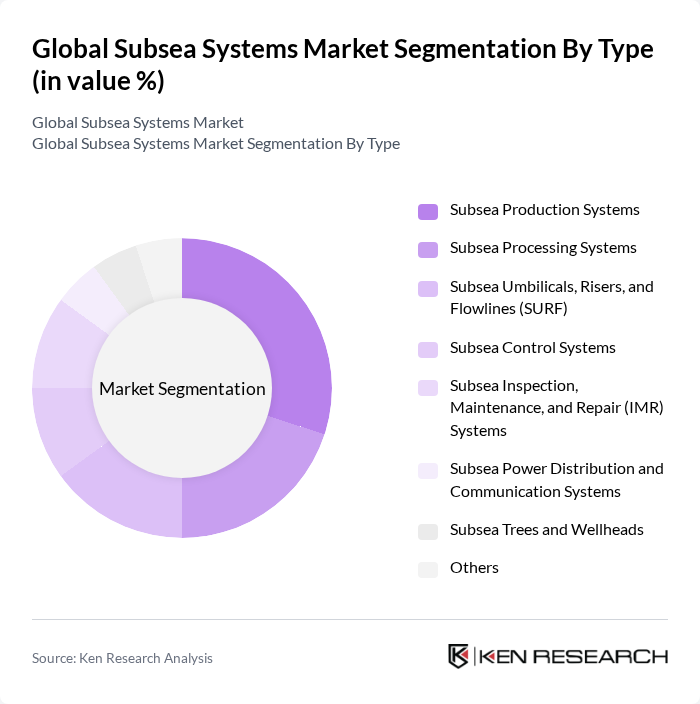

By Type:The subsea systems market is segmented into Subsea Production Systems, Subsea Processing Systems, Subsea Umbilicals, Risers, and Flowlines (SURF), Subsea Control Systems, Subsea Inspection, Maintenance, and Repair (IMR) Systems, Subsea Power Distribution and Communication Systems, Subsea Trees and Wellheads, and Others. Subsea Production Systems remain the leading segment due to their critical role in enhancing oil and gas extraction efficiency, supporting both brownfield redevelopment and new deepwater projects.

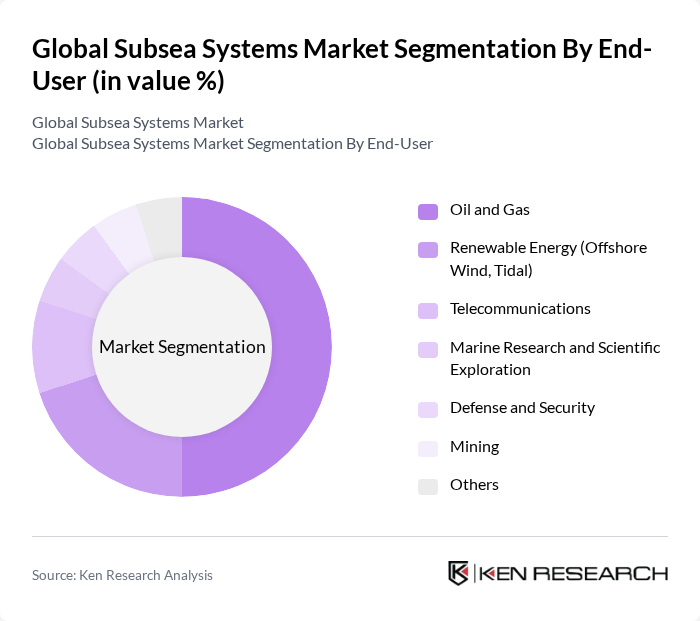

By End-User:The subsea systems market is categorized by end-users, including Oil and Gas, Renewable Energy (Offshore Wind, Tidal), Telecommunications, Marine Research and Scientific Exploration, Defense and Security, Mining, and Others. The Oil and Gas sector is the dominant end-user, driven by the ongoing need for efficient extraction methods, expansion of offshore drilling activities, and the integration of advanced subsea technologies to meet stringent safety and environmental standards.

The Global Subsea Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as TechnipFMC, Subsea 7, Aker Solutions, SLB (Schlumberger), Halliburton, Baker Hughes, Oceaneering International, Saipem, John Wood Group plc, Kongsberg Gruppen, Fugro, C-Kore Systems, Eni S.p.A., BP plc, TotalEnergies SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the subsea systems market appears promising, driven by technological advancements and a growing emphasis on sustainability. As companies increasingly adopt digital twins and AI-driven analytics, operational efficiencies are expected to improve significantly. Furthermore, the integration of eco-friendly solutions will likely become a standard practice, aligning with global environmental goals. This evolving landscape presents a unique opportunity for innovation and collaboration among industry players, fostering a more resilient market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Subsea Production Systems Subsea Processing Systems Subsea Umbilicals, Risers, and Flowlines (SURF) Subsea Control Systems Subsea Inspection, Maintenance, and Repair (IMR) Systems Subsea Power Distribution and Communication Systems Subsea Trees and Wellheads Others |

| By End-User | Oil and Gas Renewable Energy (Offshore Wind, Tidal) Telecommunications Marine Research and Scientific Exploration Defense and Security Mining Others |

| By Application | Exploration Production Drilling Decommissioning Inspection and Maintenance Others |

| By Component | Hardware (e.g., Trees, Manifolds, Wellheads, Sensors) Software (Control & Monitoring, Data Analytics) Services (Installation, IMR, Engineering) |

| By Water Depth | Shallow Water (0–500 meters) Deep Water (500–1,500 meters) Ultra-Deep Water (1,500 meters and below) |

| By Region | North America Latin America Europe Middle East & Africa Asia Pacific |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Subsea Operations | 120 | Project Managers, Operations Directors |

| Subsea Equipment Manufacturing | 90 | Product Development Engineers, Sales Managers |

| Marine Survey and Inspection Services | 60 | Survey Managers, Quality Assurance Officers |

| Subsea Technology Research & Development | 50 | R&D Managers, Innovation Leads |

| Environmental Impact Assessments | 40 | Environmental Consultants, Compliance Officers |

The Global Subsea Systems Market is valued at approximately USD 20 billion, driven by increasing demand for oil and gas exploration, advancements in subsea technology, and investments in offshore renewable energy projects.