Region:Global

Author(s):Dev

Product Code:KRAA8191

Pages:94

Published On:November 2025

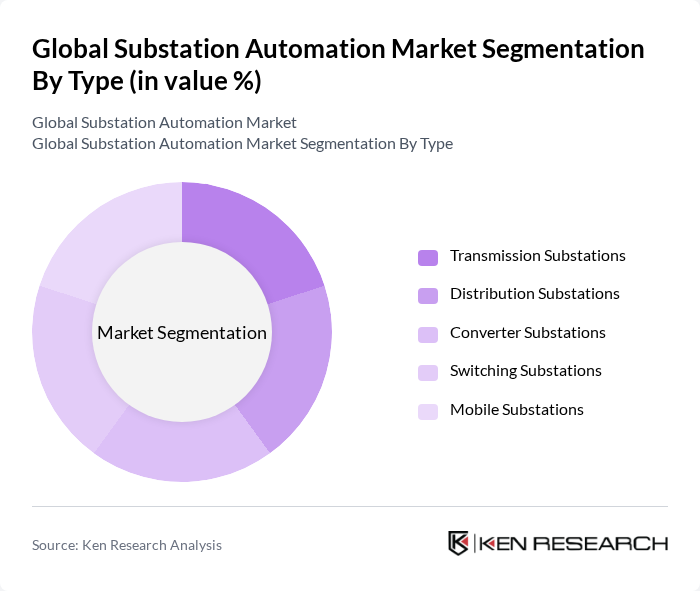

By Type:The market is segmented into various types, including Transmission Substations, Distribution Substations, Converter Substations, Switching Substations, and Mobile Substations. Each type serves distinct functions within the power distribution network, catering to different operational needs and technological advancements. Transmission substations account for the largest share due to the increasing complexity of high-voltage networks and the need for real-time operational control and fault management .

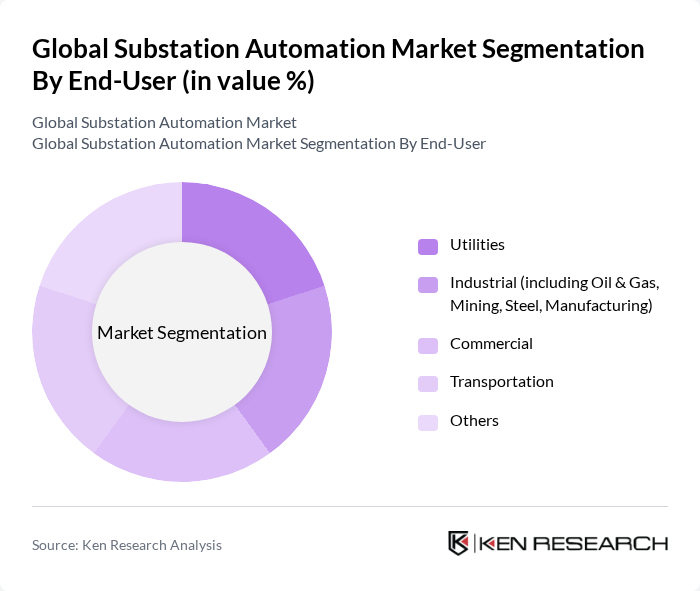

By End-User:The end-user segmentation includes Utilities, Industrial (including Oil & Gas, Mining, Steel, Manufacturing), Commercial, Transportation, and Others. Utilities remain the dominant end-user, driven by large-scale investments in grid modernization and the need for reliable power delivery. Industrial users are also significant, leveraging automation for operational efficiency and safety in critical infrastructure .

The Global Substation Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Schneider Electric SE, ABB Ltd., General Electric Company, Eaton Corporation plc, Mitsubishi Electric Corporation, Honeywell International Inc., Rockwell Automation, Inc., Cisco Systems, Inc., Emerson Electric Co., Toshiba Corporation, Alstom SA, Hitachi, Ltd., National Instruments Corporation, Enel X S.r.l. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the substation automation market is poised for significant transformation, driven by technological advancements and increasing energy demands. As utilities prioritize digitalization, the integration of IoT and AI technologies will enhance operational efficiency and predictive maintenance capabilities. Furthermore, the rise of decentralized energy systems will necessitate more sophisticated automation solutions, enabling better management of distributed energy resources and improving grid resilience in the face of evolving energy landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Transmission Substations Distribution Substations Converter Substations Switching Substations Mobile Substations |

| By End-User | Utilities Industrial (including Oil & Gas, Mining, Steel, Manufacturing) Commercial Transportation Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | SCADA Systems Intelligent Electronic Devices (IEDs) Communication Networks (Ethernet, Optical Fiber, Power Line, Copper Wire) Protection & Control Systems Others |

| By Application | Monitoring and Control Protection Systems Automation Systems Data Management Asset Management |

| By Installation Type | New Installations Retrofit/Upgrades |

| By Voltage Level | Low Voltage Medium Voltage High Voltage |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Company Automation Projects | 120 | Project Managers, Automation Engineers |

| Smart Grid Implementation | 90 | Energy Analysts, IT Managers |

| Renewable Energy Integration | 60 | Renewable Energy Managers, System Integrators |

| Substation Upgrade Initiatives | 50 | Operations Managers, Electrical Engineers |

| Market Trends in Automation Technologies | 70 | Industry Experts, Technology Developers |

The Global Substation Automation Market is valued at approximately USD 44 billion, driven by the increasing demand for efficient power distribution systems, integration of renewable energy sources, and investments in smart grid technologies.