Region:Global

Author(s):Shubham

Product Code:KRAA1712

Pages:89

Published On:August 2025

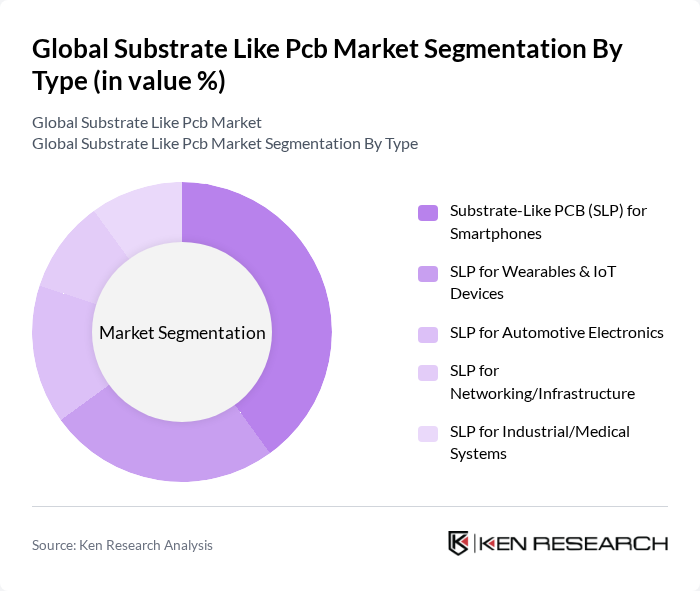

By Type:The market is segmented into various types of substrate-like PCBs, including SLP for smartphones, wearables & IoT devices, automotive electronics, networking/infrastructure, and industrial/medical systems. Each of these segments caters to specific applications and consumer needs, with varying levels of technological complexity and performance requirements.

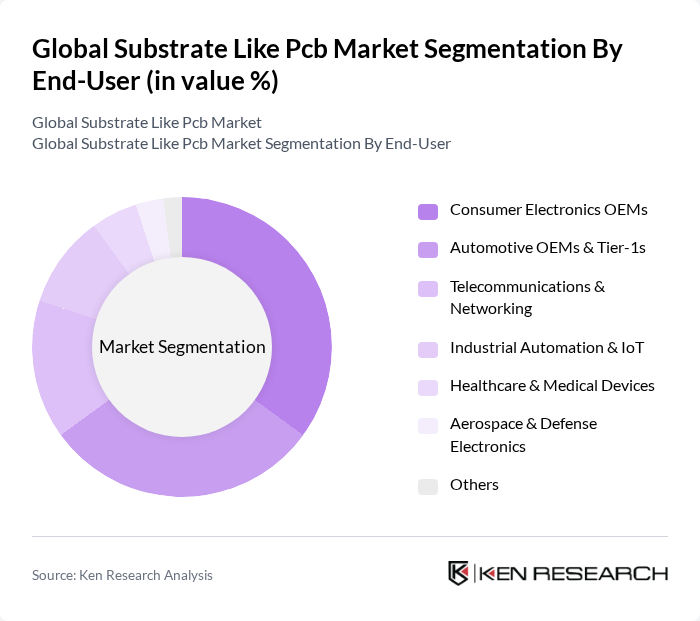

By End-User:The end-user segmentation includes consumer electronics OEMs, automotive OEMs & Tier-1s, telecommunications & networking, industrial automation & IoT, healthcare & medical devices, aerospace & defense electronics, and others. Each end-user category has distinct requirements and influences the demand for substrate-like PCBs based on technological advancements and market trends. Consumer electronics remains the dominant end market for SLP due to flagship smartphones and premium wearables; automotive, telecom/networking, and industrial IoT are rising as fine-pitch interconnects and reliability standards mature.

The Global Substrate Like PCB market is characterized by a dynamic mix of regional and international players. Leading participants such as Zhen Ding Technology Holding Limited, Unimicron Technology Corporation, Compeq Manufacturing Co., Ltd., Ibiden Co., Ltd., Shennan Circuits Co., Ltd., Tripod Technology Corporation, AT&S (Austria Technologie & Systemtechnik AG), Meiko Electronics Co., Ltd., HannStar Board Corporation, WUS Printed Circuit Co., Ltd., Kinwong Electronic (Shenzhen) Co., Ltd., Victory Giant Technology Co., Ltd., DSBJ (Dongshan Precision Manufacturing Co., Ltd.), Flexium Interconnect, Inc., NAN YA Printed Circuit Board Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the substrate-like PCB market appears promising, driven by technological advancements and increasing demand across various sectors. As industries continue to prioritize miniaturization and efficiency, the integration of innovative materials and designs will be crucial. Furthermore, the ongoing shift towards sustainable manufacturing practices will likely influence production methods. Companies that invest in R&D and adapt to emerging technologies will be well-positioned to capitalize on growth opportunities, particularly in the electric vehicle and consumer electronics markets.

| Segment | Sub-Segments |

|---|---|

| By Type | Substrate-Like PCB (SLP) for Smartphones SLP for Wearables & IoT Devices SLP for Automotive Electronics SLP for Networking/Infrastructure SLP for Industrial/Medical Systems |

| By End-User | Consumer Electronics OEMs Automotive OEMs & Tier-1s Telecommunications & Networking Industrial Automation & IoT Healthcare & Medical Devices Aerospace & Defense Electronics Others |

| By Application | Smartphones & Tablets Wearables (Smartwatches, AR/VR) Computing (Laptops, Edge/AI Modules) Automotive ADAS, Infotainment & Domain Controllers Networking (5G Radios, Routers, Gateways) Industrial Control & Power Management Others |

| By Material/Build | Build-Up Layer Count (8–10, 10–12, >12 Layers) Line/Space Technology (25/25 µm, 30/30 µm, ?20/20 µm) Dielectric/Resin System (Low-Loss, High-Tg, Halogen-Free) Copper Foil Type (RA, ED, Ultra-Thin) Others |

| By Sales Channel | Direct to OEM EMS/ODM Partnerships Distributors Online/Tender-Based Others |

| By Distribution Mode | Contract Manufacturing Supply Framework Agreements Spot Orders Direct Shipping Others |

| By Price/Performance Tier | Entry (Cost-Optimized SLP) Mainstream (Balanced Cost/Performance) Premium (?25 µm, Low-Loss, High Layer Count) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Electronics Manufacturers | 100 | Product Development Engineers, Quality Assurance Managers |

| Telecommunications Equipment Suppliers | 80 | Supply Chain Managers, Technical Directors |

| Consumer Electronics Producers | 120 | Procurement Specialists, R&D Managers |

| Medical Device Manufacturers | 70 | Regulatory Affairs Managers, Design Engineers |

| PCB Material Suppliers | 90 | Sales Managers, Product Line Managers |

The Global Substrate Like PCB market is valued at approximately USD 1.9 billion, driven by the increasing demand for high-density, miniaturized electronics in various sectors, including smartphones, automotive, and telecommunications.