Region:Global

Author(s):Rebecca

Product Code:KRAB0226

Pages:97

Published On:August 2025

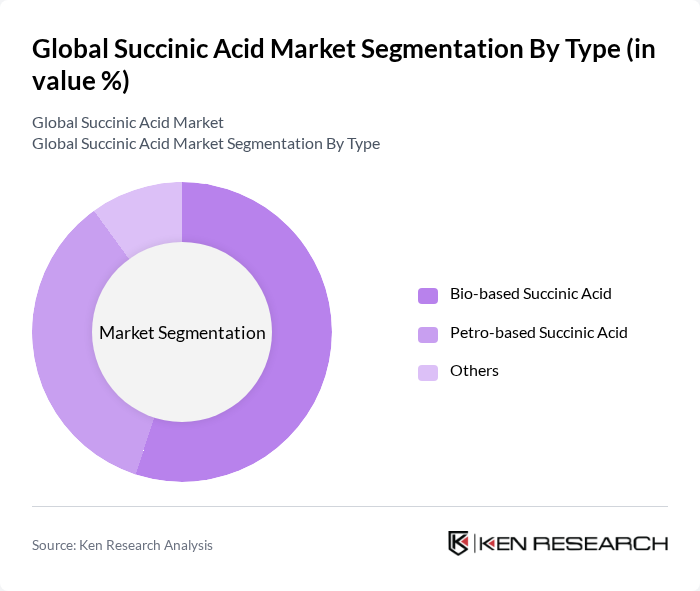

By Type:The market is segmented into bio-based succinic acid, petro-based succinic acid, and others. Bio-based succinic acid is gaining traction due to its renewable nature and lower environmental impact, making it the leading sub-segment. The growing consumer preference for sustainable and green products is driving demand for bio-based alternatives, while petro-based succinic acid remains relevant due to established production processes and cost advantages in certain regions .

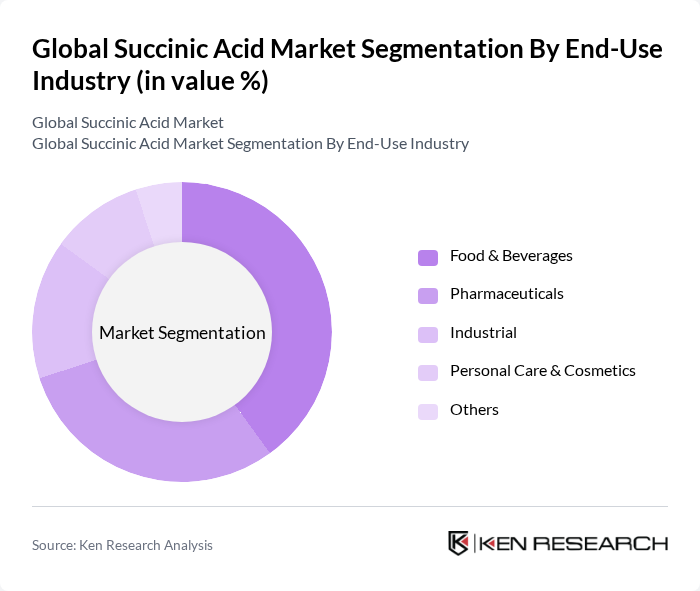

By End-Use Industry:The end-use industries for succinic acid include food & beverages, pharmaceuticals, industrial applications, personal care & cosmetics, and others. The food & beverages sector is the dominant segment, driven by the increasing use of succinic acid as a food additive, acidulant, and preservative. The pharmaceutical industry is also experiencing notable growth due to the compound's role in drug formulation and development, while industrial and personal care applications continue to expand with the adoption of bio-based chemicals .

The Global Succinic Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Myriant Corporation, BioAmber Inc., Reverdia (DSM & Roquette joint venture), TCI Chemicals (Tokyo Chemical Industry Co., Ltd.), Mitsubishi Chemical Corporation, Koninklijke DSM N.V., Genomatica, Inc., Succinity GmbH (BASF & Corbion joint venture), Roquette Frères S.A., Cargill, Incorporated, DuPont de Nemours, Inc., Eastman Chemical Company, Green Biologics Ltd., and Novozymes A/S contribute to innovation, geographic expansion, and service delivery in this space .

The future of the succinic acid market appears promising, driven by increasing consumer demand for sustainable products and innovations in production technologies. As industries shift towards greener alternatives, the adoption of succinic acid in various applications is expected to rise. Additionally, strategic partnerships among manufacturers and research institutions are likely to enhance product development, ensuring that succinic acid remains a vital component in the renewable chemicals landscape, particularly in emerging markets.

| Segment | Sub-Segments |

|---|---|

| By Type | Bio-based Succinic Acid Petro-based Succinic Acid Others |

| By End-Use Industry | Food & Beverages Pharmaceuticals Industrial Personal Care & Cosmetics Others |

| By Application | Solvents Plasticizers Coatings Resins & Polymers Food Additives Pharmaceuticals Intermediates Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (Saudi Arabia, South Africa, Rest of MEA) |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-based Pricing |

| By Product Form | Liquid Succinic Acid Solid Succinic Acid Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 60 | Product Managers, Regulatory Affairs Specialists |

| Food & Beverage Sector | 50 | Quality Control Managers, R&D Managers |

| Biodegradable Plastics Industry | 40 | Material Scientists, Sustainability Managers |

| Cosmetics and Personal Care | 40 | Formulation Chemists, Brand Managers |

| Industrial Chemicals Market | 50 | Procurement Managers, Supply Chain Analysts |

The Global Succinic Acid Market is valued at approximately USD 300 million, driven by the increasing demand for bio-based chemicals and diverse applications in industries such as food, pharmaceuticals, and plastics.