Region:Global

Author(s):Dev

Product Code:KRAA1489

Pages:100

Published On:August 2025

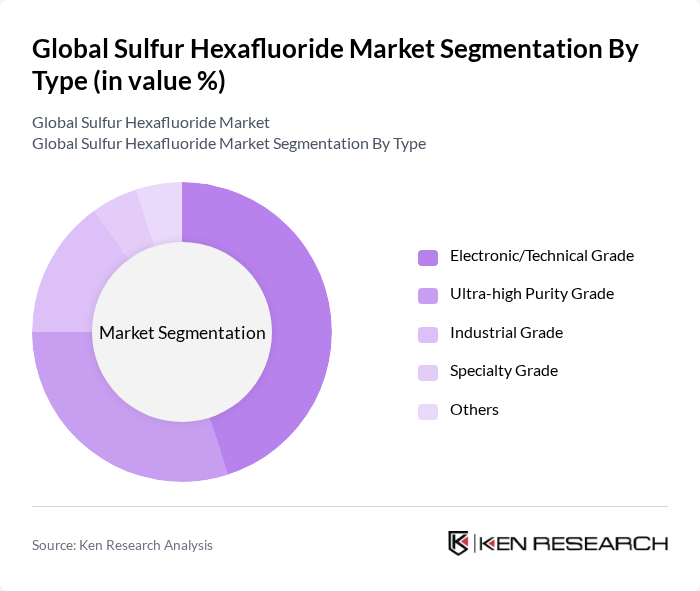

By Type:The sulfur hexafluoride market is segmented into various types, including Electronic/Technical Grade, Ultra-high Purity Grade, Industrial Grade, Specialty Grade, and Others. Among these, the Electronic/Technical Grade segment holds the largest share due to its critical applications in the electronics and semiconductor industries, where high purity and reliability are essential. The demand for ultra-high purity grade sulfur hexafluoride is also increasing, driven by the need for precision in manufacturing processes and the growing adoption of advanced semiconductor technologies.

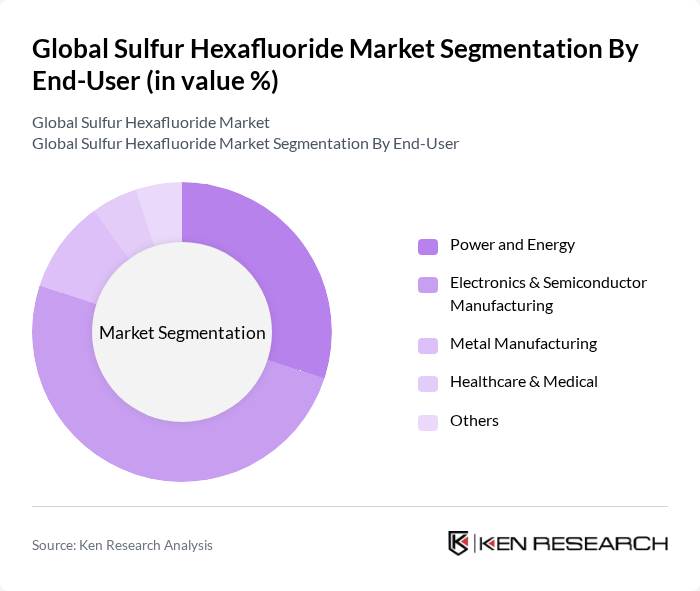

By End-User:The end-user segmentation of the sulfur hexafluoride market includes Power and Energy, Electronics & Semiconductor Manufacturing, Metal Manufacturing, Healthcare & Medical, and Others. The Electronics & Semiconductor Manufacturing segment leads the market, driven by the increasing demand for advanced electronic devices and components, as well as the expansion of semiconductor fabrication facilities globally. The power and energy sector also significantly contributes to the market, as sulfur hexafluoride is widely used in high-voltage equipment for its excellent insulating properties.

The Global Sulfur Hexafluoride Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air Products and Chemicals, Inc., Linde plc, Matheson Tri-Gas, Inc., Praxair Technology, Inc., Solvay S.A., Showa Denko K.K., Merck KGaA, Kanto Chemical Co., Inc., Air Liquide S.A., Fujifilm Corporation, DAIKIN INDUSTRIES, Ltd., 3M Company, A-Gas International, Chemtron Science Laboratories Pvt. Ltd., and Messer Group GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sulfur hexafluoride market appears promising, driven by technological advancements and a growing emphasis on sustainability. Innovations in gas recycling technologies are expected to enhance the lifecycle management of SF6, reducing environmental impact. Additionally, the expansion into emerging markets, particularly in Asia-Pacific, is anticipated to create new opportunities for growth. As industries adapt to regulatory changes, the market is likely to witness a shift towards eco-friendly alternatives while maintaining the essential applications of SF6.

| Segment | Sub-Segments |

|---|---|

| By Type | Electronic/Technical Grade Ultra-high Purity Grade Industrial Grade Specialty Grade Others |

| By End-User | Power and Energy Electronics & Semiconductor Manufacturing Metal Manufacturing Healthcare & Medical Others |

| By Application | Electrical Insulation (Switchgear, Circuit Breakers, Transformers) Plasma Etching Tracer Gas Magnesium Die Casting Medical Imaging (Echocardiography, Ophthalmology) Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (United States, Canada, Mexico) Europe (Germany, France, UK, Russia, Italy) Asia-Pacific (China, Japan, Korea, India, Southeast Asia) South America (Brazil, Argentina, Colombia) Middle East & Africa (Saudi Arabia, UAE, Egypt, Nigeria, South Africa) |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| By Regulatory Compliance | ISO Standards Environmental Regulations (GHG Protocol, EU F-Gas Regulation) Safety Regulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Semiconductor Manufacturing | 90 | Process Engineers, Production Managers |

| Electrical Equipment Production | 70 | Product Development Engineers, Quality Assurance Managers |

| Environmental Compliance | 50 | Regulatory Affairs Specialists, Environmental Managers |

| Research Institutions | 40 | Research Scientists, Laboratory Managers |

| Gas Supply and Distribution | 60 | Supply Chain Managers, Operations Directors |

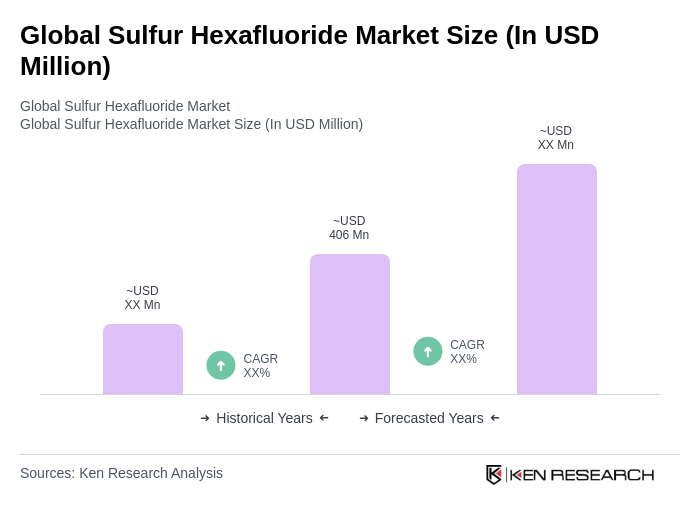

The Global Sulfur Hexafluoride Market is valued at approximately USD 406 million, reflecting a robust growth trajectory driven by increasing demand in electrical insulation and semiconductor manufacturing sectors.