Region:Global

Author(s):Shubham

Product Code:KRAD0699

Pages:83

Published On:August 2025

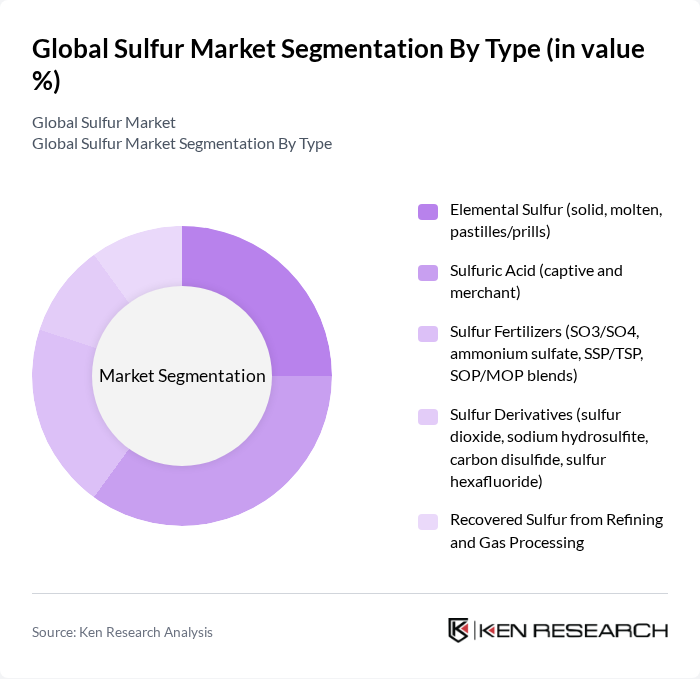

By Type:The sulfur market can be segmented into various types, including elemental sulfur, sulfuric acid, sulfur fertilizers, sulfur derivatives, and recovered sulfur from refining and gas processing. Each type serves distinct applications across industries, with sulfuric acid and fertilizers being the most prominent due to their extensive use in agriculture and chemical manufacturing. Elemental sulfur supply is largely recovered as a by-product from petroleum refining and natural gas processing, supporting stable availability for downstream sulfuric acid production and fertilizer applications .

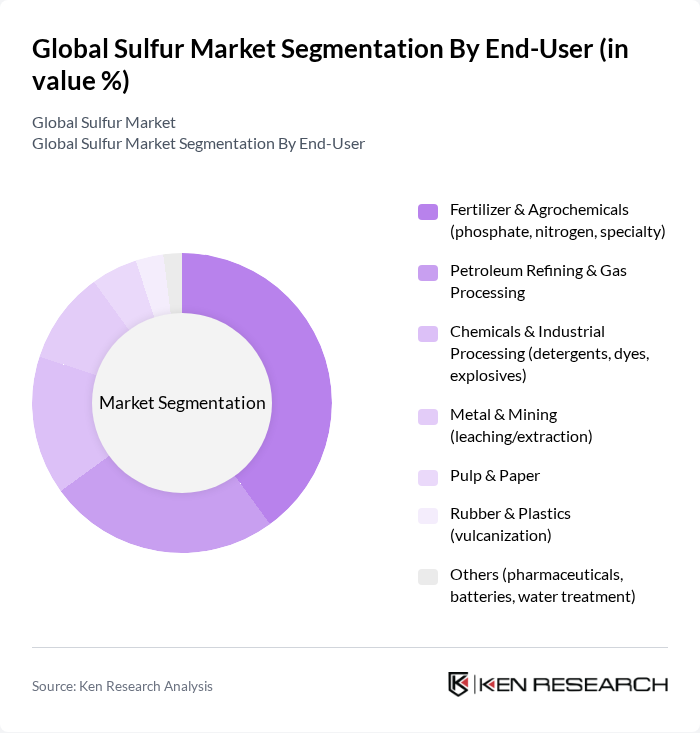

By End-User:The end-user segmentation of the sulfur market includes various industries such as fertilizers and agrochemicals, petroleum refining and gas processing, chemicals and industrial processing, metal and mining, pulp and paper, rubber and plastics, and others. The fertilizer and agrochemicals sector is the largest consumer, driven by the need for enhanced agricultural productivity and the pivotal role of sulfuric acid in phosphate fertilizers; additional demand stems from chemical manufacturing, rubber processing (vulcanization), and pulp and paper applications .

The Global Sulfur Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Arabian Oil Company (Saudi Aramco), QatarEnergy, Abu Dhabi National Oil Company (ADNOC), Kuwait Petroleum Corporation (KPC), Royal Dutch Shell plc, ExxonMobil Corporation, Chevron Corporation, Sinopec (China Petroleum & Chemical Corporation), PetroChina Company Limited, Gazprom PJSC, OAO Tatneft, PJSC Rosneft Oil Company, OCP Group, The Mosaic Company, Nutrien Ltd., Yara International ASA, Chemtrade Logistics Income Fund, BASF SE, Elementis plc, Ineos Group Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sulfur market appears promising, driven by increasing agricultural demands and technological advancements in sulfur recovery. As global populations rise, the need for efficient fertilizers will continue to grow, particularly in developing regions. Additionally, innovations in sulfur production processes are expected to enhance efficiency and reduce environmental impacts. The market is likely to see a shift towards sustainable practices, with investments in recovery technologies and alternative applications, such as battery production, gaining traction.

| Segment | Sub-Segments |

|---|---|

| By Type | Elemental Sulfur (solid, molten, pastilles/prills) Sulfuric Acid (captive and merchant) Sulfur Fertilizers (SO3/SO4, ammonium sulfate, SSP/TSP, SOP/MOP blends) Sulfur Derivatives (sulfur dioxide, sodium hydrosulfite, carbon disulfide, sulfur hexafluoride) Recovered Sulfur from Refining and Gas Processing |

| By End-User | Fertilizer & Agrochemicals (phosphate, nitrogen, specialty) Petroleum Refining & Gas Processing Chemicals & Industrial Processing (detergents, dyes, explosives) Metal & Mining (leaching/extraction) Pulp & Paper Rubber & Plastics (vulcanization) Others (pharmaceuticals, batteries, water treatment) |

| By Application | Sulfuric Acid Production Fertilizers (phosphate acidulation, ammonium sulfate) Industrial Chemicals (surfactants/sulphonation, sulfites, sulfates) Metallurgy & Mining (ore leaching, pickling) Pulping & Bleaching Rubber Vulcanization & Additives Emerging Uses (Li–S batteries, cathode materials) |

| By Distribution Channel | Direct Offtake/Term Contracts (refiners, gas plants, smelters) Traders & Distributors (merchant sulfur and sulfuric acid) Spot/Index-Linked Sales Digital/Platform-Based Bidding Retail/Blenders (fertilizer retail networks) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High |

| By Policy Support | Emissions & Sulfur Recovery Mandates (EPA, EU IED, China standards) Subsidies/Support for Fertilizers Trade Tariffs/Export Controls Environmental & Safety Compliance |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Fertilizer Producers | 120 | Procurement Managers, Agronomists |

| Petrochemical Industry Stakeholders | 90 | Production Managers, Chemical Engineers |

| Mining and Metallurgy Companies | 70 | Operations Directors, Environmental Compliance Officers |

| Environmental Regulatory Bodies | 50 | Policy Analysts, Environmental Scientists |

| Research Institutions and Academia | 60 | Research Scientists, Professors in Chemical Engineering |

The Global Sulfur Market is valued at approximately USD 10.7 billion, reflecting demand in sectors such as fertilizers, industrial chemicals, and petroleum refining by-product recovery. This valuation is consistent with recent industry analyses that estimate the market size between USD 10.7 and 10.8 billion.