Region:Global

Author(s):Dev

Product Code:KRAA1533

Pages:85

Published On:August 2025

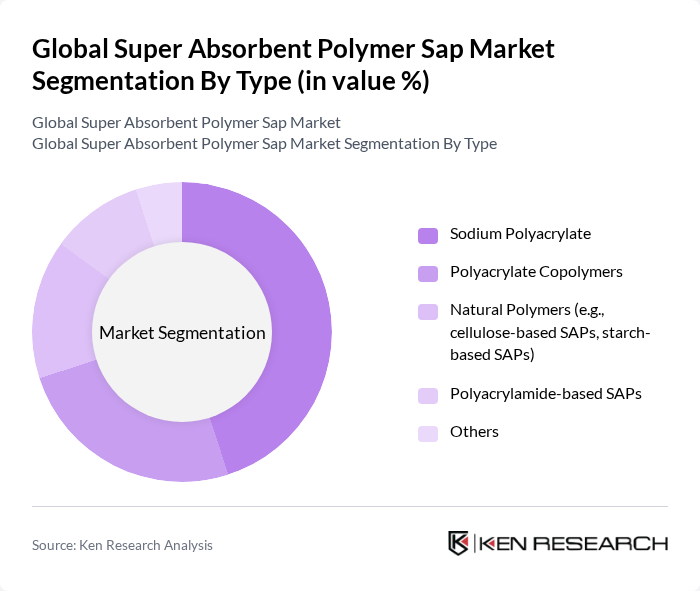

By Type:The market is segmented into various types of super absorbent polymers, including Sodium Polyacrylate, Polyacrylate Copolymers, Natural Polymers (e.g., cellulose-based SAPs, starch-based SAPs), Polyacrylamide-based SAPs, and Others. Sodium Polyacrylate is the most widely used type due to its high absorbency and cost-effectiveness, making it a preferred choice in personal care products and agriculture .

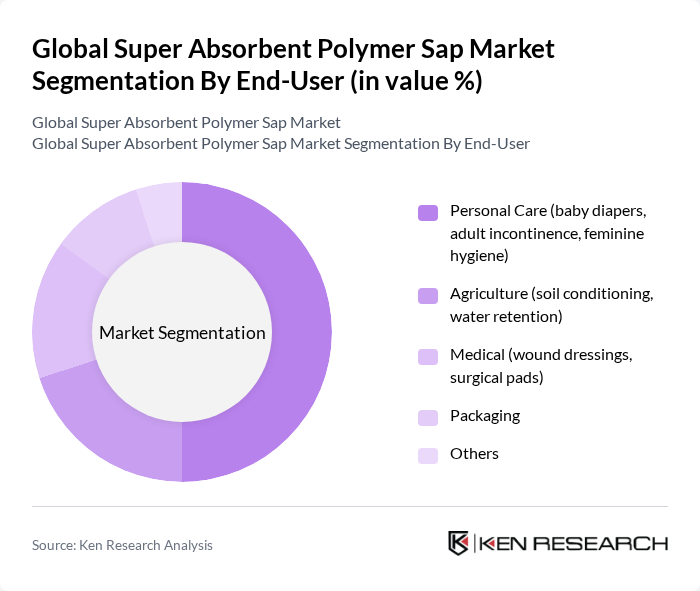

By End-User:The super absorbent polymer market is segmented by end-user into Personal Care (baby diapers, adult incontinence, feminine hygiene), Agriculture (soil conditioning, water retention), Medical (wound dressings, surgical pads), Packaging, and Others. The personal care segment leads the market due to the rising birth rates, increasing awareness of hygiene products, and the adoption of high-SAP adult incontinence pads, which drive demand for baby diapers and adult incontinence products .

The Global Super Absorbent Polymer Sap Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Nippon Shokubai Co., Ltd., Evonik Industries AG, Sumitomo Seika Chemicals Co., Ltd., LG Chem Ltd., Sanyo Chemical Industries, Ltd., Formosa Plastics Corporation, SDP Global Co., Ltd., Yixing Danson Technology Co., Ltd., Zhejiang Satellite Petrochemical Co., Ltd., Shandong Nuoer Biological Technology Co., Ltd., Kao Corporation, Wanhua Chemical Group Co., Ltd., Chase Corporation, Archer Daniels Midland Company (ADM) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the super absorbent polymer market appears promising, driven by increasing demand for sustainable and innovative products. As consumer preferences shift towards eco-friendly solutions, manufacturers are likely to invest in biodegradable SAPs and advanced production technologies. Additionally, the expansion of e-commerce platforms for hygiene products will facilitate market access, particularly in emerging economies. This trend is expected to create new avenues for growth, enhancing the overall market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Sodium Polyacrylate Polyacrylate Copolymers Natural Polymers (e.g., cellulose-based SAPs, starch-based SAPs) Polyacrylamide-based SAPs Others |

| By End-User | Personal Care (baby diapers, adult incontinence, feminine hygiene) Agriculture (soil conditioning, water retention) Medical (wound dressings, surgical pads) Packaging Others |

| By Application | Diapers Adult Incontinence Products Feminine Hygiene Products Agricultural Water Management Medical Absorbents Packaging Absorbents Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales (B2B) Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Rest of Asia-Pacific) Latin America (Brazil, Rest of Latin America) Middle East & Africa |

| By Product Form | Granules Powder Sheets Liquid SAPs Others |

| By Pricing Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Applications of SAP | 100 | Agronomists, Farm Managers |

| Hygiene Products Market | 140 | Product Development Managers, Marketing Directors |

| Medical and Healthcare Uses | 80 | Healthcare Product Managers, Procurement Officers |

| Consumer Goods Sector | 120 | Brand Managers, Supply Chain Analysts |

| Research and Development Insights | 60 | R&D Scientists, Innovation Managers |

The Global Super Absorbent Polymer market is valued at approximately USD 9.7 billion, driven by increasing demand in personal care, agriculture, and medical applications. This growth reflects a robust historical analysis over the past five years.