Region:Global

Author(s):Geetanshi

Product Code:KRAA1230

Pages:83

Published On:August 2025

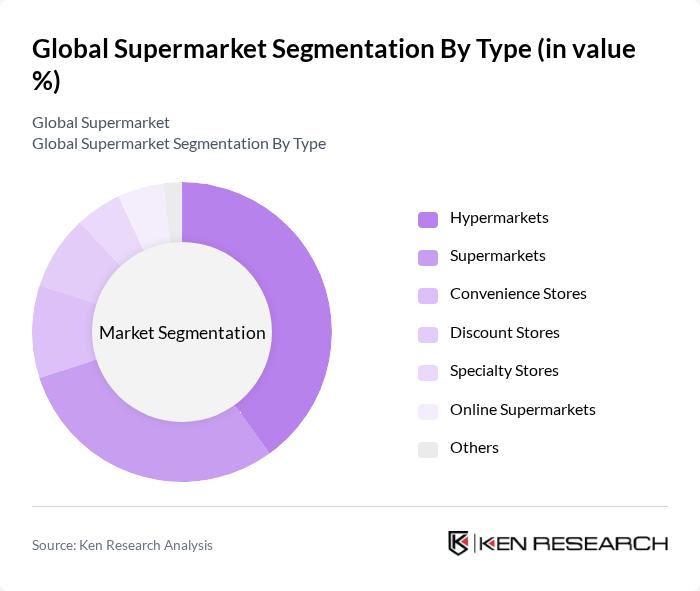

By Type:The supermarket market can be segmented into various types, including hypermarkets, supermarkets, convenience stores, discount stores, specialty stores, online supermarkets, and others. Among these, hypermarkets and supermarkets are the most dominant due to their extensive product offerings and ability to attract a wide range of consumers. Hypermarkets, in particular, benefit from economies of scale, allowing them to offer competitive pricing and a diverse selection of goods, which appeals to budget-conscious shoppers. The rise of online supermarkets is also notable, driven by increased adoption of digital platforms and consumer preference for home delivery and contactless shopping.

By Ownership:The ownership structure of supermarkets can be categorized into retail chains and independent retailers. Retail chains dominate the market due to their ability to leverage brand recognition, bulk purchasing, and extensive distribution networks. These chains often provide a consistent shopping experience across multiple locations, which enhances customer loyalty and drives sales. Independent retailers, while smaller in scale, cater to niche markets and local communities, offering personalized service and unique product selections.

The Global Supermarket market is characterized by a dynamic mix of regional and international players. Leading participants such as Walmart Inc., Costco Wholesale Corporation, The Kroger Co., Aldi Einkauf GmbH & Co. oHG, Tesco PLC, Carrefour S.A., Ahold Delhaize N.V., Target Corporation, Lidl Stiftung & Co. KG, Seven & I Holdings Co., Ltd., Metro AG, E.Leclerc, Sainsbury's Supermarkets Ltd., Auchan Holding S.A., Coles Group Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the supermarket industry is poised for transformation, driven by technological advancements and evolving consumer preferences. As omnichannel retailing becomes the norm, supermarkets will increasingly integrate online and offline shopping experiences. Additionally, the focus on sustainability will intensify, with consumers demanding eco-friendly practices. In future, supermarkets that leverage data analytics to personalize shopping experiences and enhance operational efficiency will likely gain a competitive edge, positioning themselves favorably in a rapidly changing market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Hypermarkets Supermarkets Convenience Stores Discount Stores Specialty Stores Online Supermarkets Others |

| By Ownership | Retail Chains Independent Retailers |

| By Application | Food and Beverage Personal Care Products Household Goods Consumer Electronics Clothing and Apparel Furniture and Home Textiles Toys and Stationery Others |

| By Product Category | Fresh Produce Packaged Foods Beverages Household Goods Ready-to-Eat and Prepared Foods |

| By Pricing Strategy | Premium Pricing Competitive Pricing Discount Pricing |

| By Geographic Presence | Urban Areas Suburban Areas Rural Areas |

| By Sales Channel | Direct Sales Online Sales Third-Party Retailers |

| By Customer Loyalty Programs | Membership Programs Reward Points Systems Subscription Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Shopping Behavior | 100 | Frequent Shoppers, Occasional Buyers |

| Supermarket Management Insights | 60 | Store Managers, Regional Directors |

| Product Category Preferences | 50 | Category Managers, Merchandising Specialists |

| Supply Chain Efficiency | 40 | Logistics Coordinators, Supply Chain Analysts |

| Technology Adoption in Retail | 50 | IT Managers, Digital Transformation Leads |

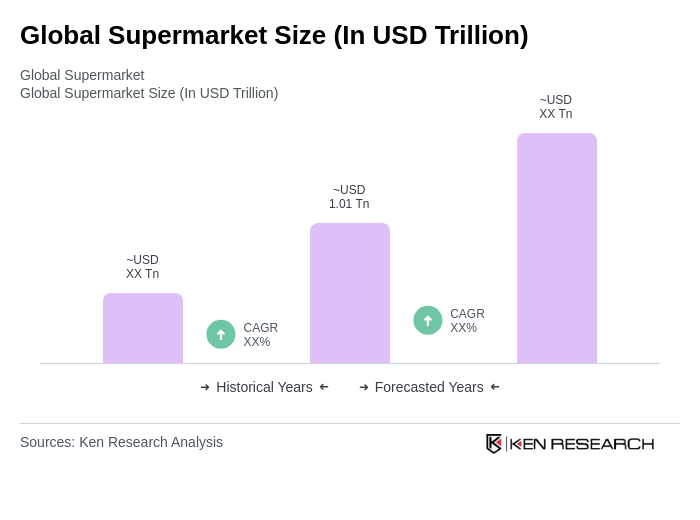

The global supermarket market is valued at approximately USD 1.01 trillion, driven by increasing consumer demand for convenience, organized retailing, and the expansion of e-commerce platforms. This growth is also supported by rising disposable incomes and urbanization.