Region:Global

Author(s):Shubham

Product Code:KRAC0759

Pages:89

Published On:August 2025

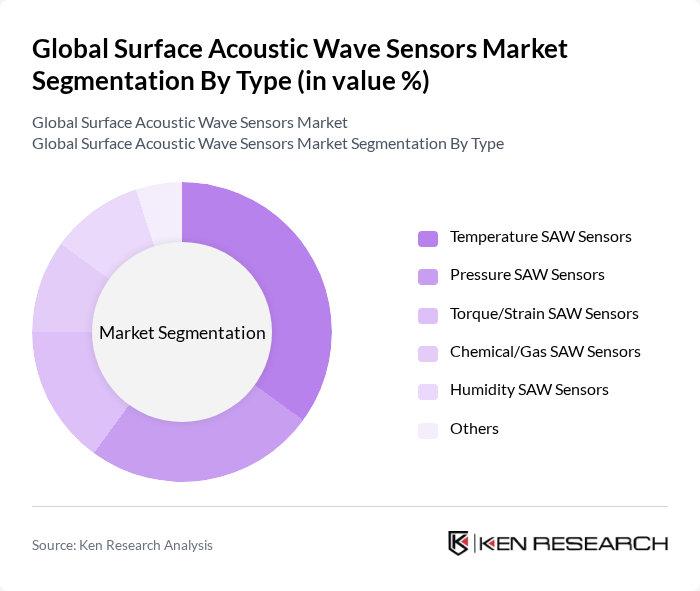

By Type:The market is segmented into various types of surface acoustic wave sensors, including Temperature SAW Sensors, Pressure SAW Sensors, Torque/Strain SAW Sensors, Chemical/Gas SAW Sensors, Humidity SAW Sensors, and Others. Among these, Temperature SAW Sensors are leading due to widespread use in automotive powertrain, e-mobility subsystems, and industrial process monitoring, where precise and passive temperature measurement is critical; pressure and torque/strain SAW solutions are also seeing strong uptake in automotive and rotating machinery monitoring. The increasing focus on automation, EV platforms, and harsh-environment sensing in smart factories further supports these categories.

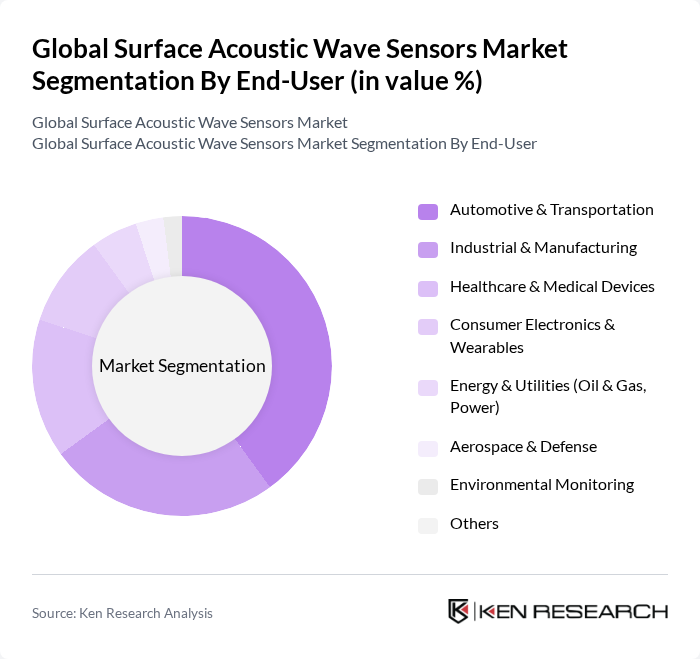

By End-User:The end-user segmentation includes Automotive & Transportation, Industrial & Manufacturing, Healthcare & Medical Devices, Consumer Electronics & Wearables, Energy & Utilities (Oil & Gas, Power), Aerospace & Defense, Environmental Monitoring, and Others. The Automotive & Transportation sector is the largest end-user, driven by integration in tire pressure monitoring, drivetrain torque/strain, and thermal/pressure sensing for efficiency and safety in conventional and electric vehicles; industrial and manufacturing follow with predictive maintenance and process control use cases. Expanding EV platforms, smart transportation, and broader IIoT deployments continue to enhance demand.

The Global Surface Acoustic Wave Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as SENSeOR (a SENSeOR – TTI company), Vectron International (Microchip Technology Inc.), Murata Manufacturing Co., Ltd., Qorvo, Inc., AVX Corporation (Kyocera AVX Components Corporation), TDK Corporation, RF SAW, Inc., Sensor Technology Ltd., Transense Technologies plc, H Bar Technologies, LLC, Hawk Measurement Systems (HAWK), Pro-Micron GmbH & Co. KG, Qualtre, Inc. (Acquired; legacy SAW/BAW IP holders), API Technologies Corp. (API), Rakon Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the SAW sensor market appears promising, driven by technological advancements and increasing integration with IoT devices. As industries continue to embrace digital transformation, the demand for real-time data analytics and smart sensor solutions is expected to rise. Furthermore, the development of smart cities will create new opportunities for SAW sensors, particularly in environmental monitoring and urban infrastructure management. These trends indicate a robust growth trajectory for the market, with significant potential for innovation and expansion in various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Temperature SAW Sensors Pressure SAW Sensors Torque/Strain SAW Sensors Chemical/Gas SAW Sensors Humidity SAW Sensors Others |

| By End-User | Automotive & Transportation Industrial & Manufacturing Healthcare & Medical Devices Consumer Electronics & Wearables Energy & Utilities (Oil & Gas, Power) Aerospace & Defense Environmental Monitoring Others |

| By Application | Tire Pressure Monitoring Systems (TPMS) Wireless Passive Temperature/Pressure Monitoring Structural Health Monitoring (bridges, turbines, pipelines) Medical Diagnostics and Biosensing Industrial Process Control and Asset Monitoring Environmental and Gas Sensing Others |

| By Device Architecture | SAW Resonators SAW Delay Lines SAW Tags/IDT-based Passive Sensors Others |

| By Substrate Material | Quartz (SiO2) Lithium Niobate (LiNbO3) Lithium Tantalate (LiTaO3) Langasite (La3Ga5SiO14) and Others |

| By Frequency Band | Up to 100 MHz –500 MHz Above 500 MHz |

| By Sales Channel | Direct (OEM) Distributors/Value-Added Resellers Online Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Applications | 100 | Biomedical Engineers, Hospital Procurement Managers |

| Automotive Sensors | 80 | Automotive Engineers, Quality Assurance Managers |

| Telecommunications Sector | 90 | Network Engineers, Telecom Equipment Buyers |

| Consumer Electronics | 70 | Product Managers, Electronics Designers |

| Industrial Applications | 60 | Manufacturing Engineers, Operations Managers |

The Global Surface Acoustic Wave Sensors Market is valued at approximately USD 1.1 billion, reflecting a consistent growth trend driven by the demand for advanced sensing technologies across various sectors, including automotive, healthcare, and industrial IoT applications.