Region:Global

Author(s):Geetanshi

Product Code:KRAD6045

Pages:91

Published On:December 2025

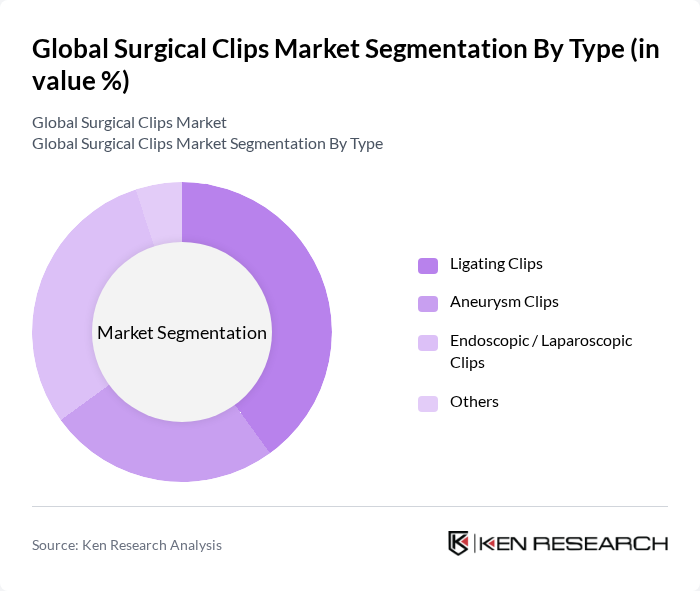

By Type:The market is segmented into various types of surgical clips, including Ligating Clips, Aneurysm Clips, Endoscopic / Laparoscopic Clips, and Others. Each type serves specific surgical needs and is designed to enhance the efficiency and safety of surgical procedures, with ligating and endoscopic clips being widely used for hemostasis and tissue closure in general, gastrointestinal, and laparoscopic surgeries, while aneurysm clips are primarily used in neurosurgical procedures.

The Ligating Clips segment is currently dominating the market due to their widespread use in various surgical procedures, particularly in laparoscopic and minimally invasive surgeries for vessel ligation and tissue approximation. Their ability to securely occlude blood vessels and tissues makes them essential in minimizing blood loss during operations. Additionally, advancements in materials and designs, including titanium, polymer, and bioabsorbable options, as well as compatibility with reusable and disposable clip appliers, have improved their effectiveness and safety, further driving their adoption in hospitals and surgical centers.

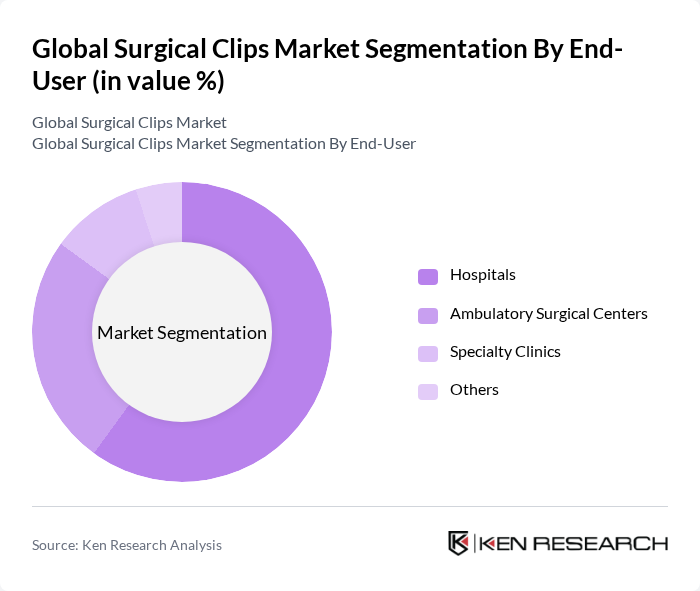

By End-User:The market is segmented based on end-users, including Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Others. Each end-user category reflects different operational needs and preferences in surgical practices, with varying levels of adoption of laparoscopic, endoscopic, and robotic-assisted procedures.

Hospitals are the leading end-user segment, accounting for a significant share of the market, in line with data showing that hospitals control the majority of surgical clip usage globally. This dominance is attributed to the high volume of complex surgical procedures performed in hospitals, coupled with the availability of advanced surgical technologies, such as laparoscopic towers and robotic platforms, and skilled healthcare professionals. The increasing number of surgical interventions, growing adoption of minimally invasive techniques, and expansion of large multi?specialty hospital networks, especially in urban areas, further solidify hospitals' position as the primary consumers of surgical clips, while ambulatory surgical centers are gaining share as more procedures shift to outpatient settings.

The Global Surgical Clips Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ethicon, Inc. (Johnson & Johnson MedTech), Medtronic plc, Teleflex Incorporated, B. Braun Melsungen AG (including Aesculap), Boston Scientific Corporation, Olympus Corporation, CONMED Corporation, Cook Medical LLC, Grena Ltd., Ackermann Instrumente GmbH, Peters Surgical, Stryker Corporation, Smith & Nephew plc, Zimmer Biomet Holdings, Inc., Medline Industries, LP contribute to innovation, geographic expansion, and service delivery in this space, offering portfolios that span ligating clips, endoscopic clips, and specialized vascular or neurovascular clip systems.

The future of the surgical clips market appears promising, driven by technological advancements and an increasing focus on patient-centric care. As healthcare systems worldwide invest in modernizing surgical facilities, the integration of innovative surgical clips will likely enhance procedural efficiency and patient outcomes. Additionally, the growing trend towards outpatient surgeries will further propel the demand for surgical clips, as they are essential for quick recovery and reduced hospital stays, aligning with evolving healthcare delivery models.

| Segment | Sub-Segments |

|---|---|

| By Type | Ligating Clips Aneurysm Clips Endoscopic / Laparoscopic Clips Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Others |

| By Application | General & Laparoscopic Surgery Cardiovascular & Thoracic Surgery Neurosurgery (Aneurysm Clipping) Gynecological & Obstetric Surgery Urological Surgery Others |

| By Material | Titanium Stainless Steel Polymers (including PEEK) Bioabsorbable Materials Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Distribution Channel | Direct Sales to Healthcare Providers Medical Device Distributors Group Purchasing Organizations (GPOs) Online / E?procurement Platforms Others |

| By Surgery Type | Manual Surgical Clips Automated / Disposable Clip Applier Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Surgery Practices | 120 | Surgeons, Surgical Assistants |

| Orthopedic Surgical Centers | 100 | Orthopedic Surgeons, Clinic Managers |

| Cardiothoracic Surgery Units | 80 | Cardiothoracic Surgeons, Anesthesiologists |

| Hospital Procurement Departments | 110 | Procurement Officers, Supply Chain Managers |

| Medical Device Distributors | 70 | Sales Representatives, Product Managers |

The Global Surgical Clips Market is valued at approximately USD 700 million, driven by factors such as the increasing prevalence of chronic diseases, advancements in surgical techniques, and a growing demand for minimally invasive surgeries.