Region:Global

Author(s):Rebecca

Product Code:KRAA1350

Pages:92

Published On:August 2025

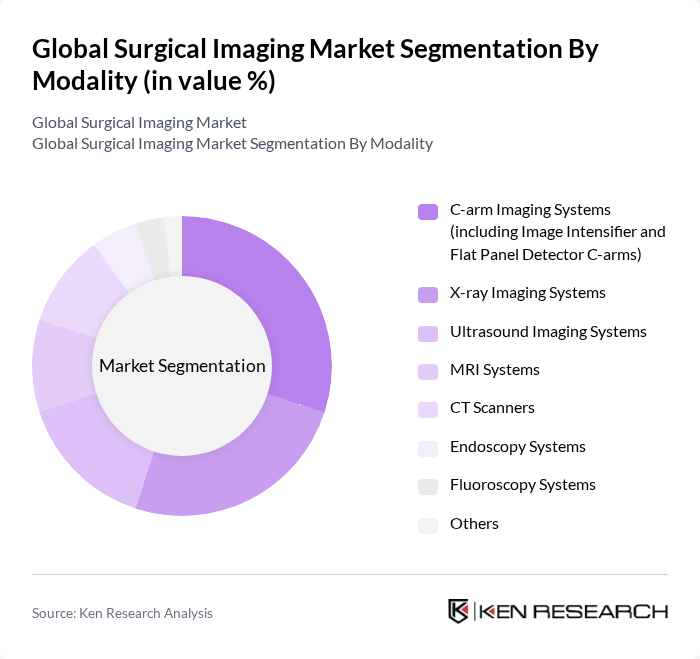

By Modality:The surgical imaging market is segmented by modality into various types, including C-arm Imaging Systems, X-ray Imaging Systems, Ultrasound Imaging Systems, MRI Systems, CT Scanners, Endoscopy Systems, Fluoroscopy Systems, and Others. Each modality serves specific surgical needs, with C-arm Imaging Systems and X-ray Imaging Systems being particularly prominent due to their versatility, real-time imaging capabilities, and widespread use in orthopedic, trauma, cardiovascular, and neurosurgical procedures. Technological advancements, such as flat panel detectors and 3D imaging, are further enhancing the utility of these modalities .

By Application:The market is also segmented by application, which includes Orthopedic & Trauma Surgery, Cardiovascular Surgery, Neurosurgery, General Surgery, Gynecological Surgery, Thoracic Surgery, Urological Surgery, and Others. The demand for surgical imaging is particularly high in orthopedic and trauma surgery due to the increasing incidence of sports injuries, accidents, and degenerative bone diseases, all of which require precise intraoperative imaging for effective treatment and improved surgical outcomes. Cardiovascular and neurosurgical applications are also significant due to the complexity of procedures and the need for advanced imaging guidance .

The Global Surgical Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems Corporation, Fujifilm Holdings Corporation, Hitachi Medical Corporation, Medtronic plc, Stryker Corporation, Hologic, Inc., Varian Medical Systems, Ziehm Imaging GmbH, Carestream Health, Agfa-Gevaert Group, Mindray Medical International Limited, and EIZO Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the surgical imaging market appears promising, driven by technological advancements and demographic shifts. The integration of artificial intelligence in imaging systems is expected to enhance diagnostic accuracy and operational efficiency. Additionally, the rise of telemedicine is likely to facilitate remote surgical consultations, expanding access to imaging services. As healthcare systems adapt to these trends, investments in innovative imaging solutions will be crucial for improving patient outcomes and operational effectiveness in surgical environments.

| Segment | Sub-Segments |

|---|---|

| By Modality | C-arm Imaging Systems (including Image Intensifier and Flat Panel Detector C-arms) X-ray Imaging Systems Ultrasound Imaging Systems MRI Systems CT Scanners Endoscopy Systems Fluoroscopy Systems Others |

| By Application | Orthopedic & Trauma Surgery Cardiovascular Surgery Neurosurgery General Surgery Gynecological Surgery Thoracic Surgery Urological Surgery Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Diagnostic Imaging Centers Research Institutions Others |

| By Component | Hardware Software Services |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | North America (U.S., Canada) Europe (UK, Germany, France, Italy, Spain, Nordics) Asia-Pacific (Japan, China, India, Australia, South Korea, Thailand) Latin America (Brazil, Mexico, Argentina) Middle East & Africa |

| By Price Range | Low-End Systems Mid-Range Systems High-End Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Imaging Departments | 120 | Radiology Directors, Imaging Technologists |

| Outpatient Surgical Centers | 80 | Facility Managers, Surgical Coordinators |

| Medical Device Distributors | 60 | Sales Managers, Product Specialists |

| Healthcare IT Solutions Providers | 50 | Product Managers, IT Directors |

| Academic Medical Institutions | 40 | Research Directors, Clinical Educators |

The Global Surgical Imaging Market is valued at approximately USD 5.4 billion, driven by advancements in imaging technologies, the demand for minimally invasive surgeries, and the rising prevalence of chronic diseases requiring surgical interventions.