Region:Global

Author(s):Dev

Product Code:KRAB0449

Pages:83

Published On:August 2025

By Type:The market is segmented into various types of surgical kits, including disposable surgical kits, reusable surgical kits, procedure-specific kits, custom procedure packs, and minor procedure and wound-closure kits. Among these,disposable surgical kitsare gaining significant traction due to their convenience and reduced risk of cross-contamination, supported by hospitals’ infection-prevention priorities and workflow efficiency needs.Reusable surgical kitsremain relevant in systems focused on cost control and waste reduction, though infection-control policies often favor single-use disposables for many procedures .

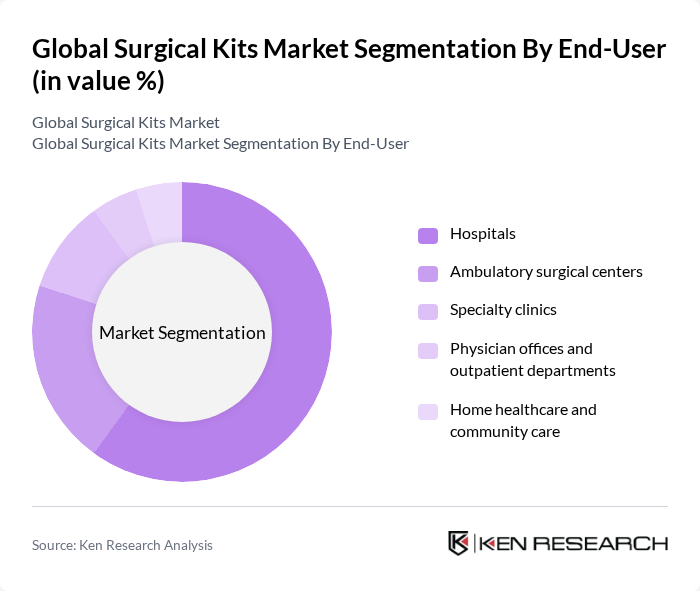

By End-User:The end-user segmentation includes hospitals, ambulatory surgical centers, specialty clinics, physician offices, and home healthcare.Hospitalsare the largest end-users given high surgical throughput and standardized preference cards driving broad use of custom and procedure packs.Ambulatory surgical centersare growing rapidly with the shift to outpatient surgeries and focus on OR efficiency and turnover times .

The Global Surgical Kits Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic, Johnson & Johnson (Ethicon; DePuy Synthes), Stryker, Cardinal Health (Medical segment; Presource Kits), B. Braun Melsungen AG, Smith & Nephew, Zimmer Biomet, CONMED Corporation, Terumo Corporation, 3M, Owens & Minor (HALYARD, AVANOS partnership kits), Olympus Corporation, Halyard Health (now part of Owens & Minor; HALYARD-branded), Integra LifeSciences, Mölnlycke Health Care contribute to innovation, geographic expansion, and service delivery in this space .

The future of the surgical kits market appears promising, driven by ongoing advancements in technology and an increasing focus on patient safety. As healthcare systems worldwide prioritize efficiency and quality, the integration of digital technologies and telemedicine will likely reshape surgical practices. Furthermore, the demand for customized surgical kits tailored to specific procedures is expected to rise, enhancing surgical outcomes and patient satisfaction, thereby fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Disposable surgical kits Reusable surgical kits Procedure-specific kits (e.g., orthopedic, cardiac, neuro, OB/GYN) Custom procedure packs (CPTs) Minor procedure and wound-closure kits |

| By End-User | Hospitals Ambulatory surgical centers Specialty clinics Physician offices and outpatient departments Home healthcare and community care |

| By Component | Instruments and handheld devices Consumables and disposables (drapes, gowns, sutures, staplers) Electrosurgical and energy components Sterile barriers and packaging Ancillary items (suction, irrigation, syringes) |

| By Distribution Channel | Direct sales to providers Group Purchasing Organizations (GPOs) Authorized distributors E-procurement and online tendering Retail and other channels |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy kits Mid-range kits Premium kits Value-based/contract bundles |

| By Application | General surgery Orthopedic and joint replacement Cardiovascular and cardiothoracic Neurosurgery and spine Plastic, reconstructive, and wound care |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Surgery Kits | 130 | Surgeons, Hospital Administrators |

| Orthopedic Surgical Kits | 100 | Orthopedic Surgeons, Procurement Officers |

| Cardiovascular Surgical Kits | 80 | Cardiothoracic Surgeons, Surgical Nurses |

| Minimally Invasive Surgery Kits | 70 | Surgeons, Medical Device Distributors |

| Pediatric Surgical Kits | 60 | Pediatric Surgeons, Hospital Supply Chain Managers |

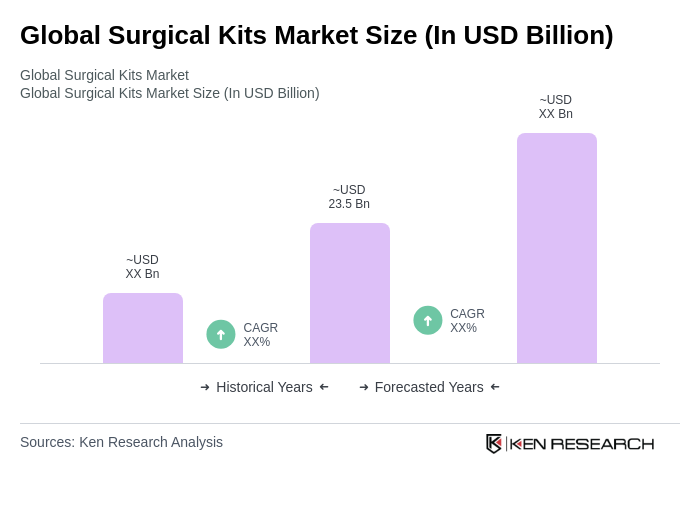

The Global Surgical Kits Market is valued at approximately USD 23.5 billion, reflecting steady demand from hospitals and ambulatory centers, particularly as elective procedures recover and infection prevention becomes a priority.