Region:Global

Author(s):Shubham

Product Code:KRAD0753

Pages:93

Published On:August 2025

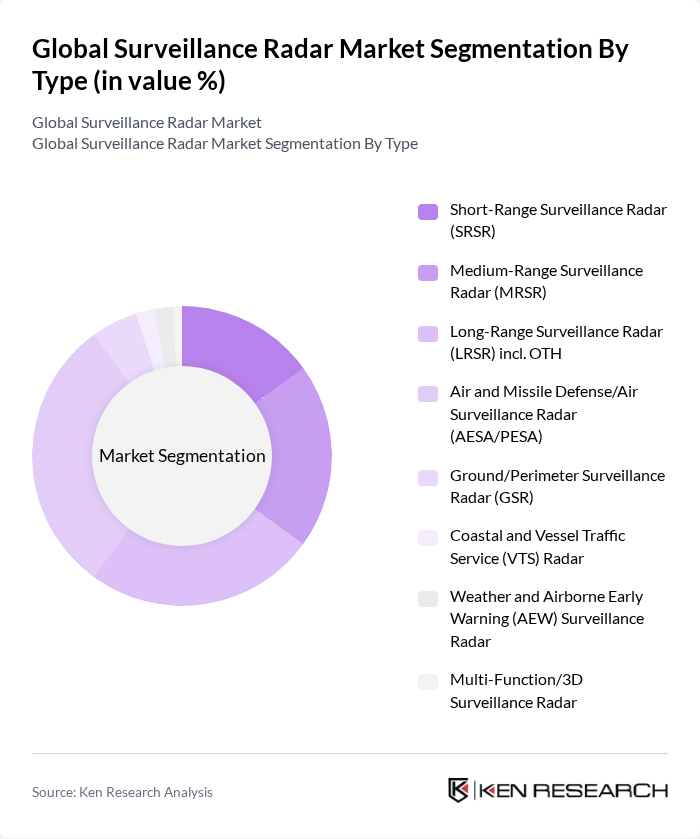

By Type:The market is segmented into various types of surveillance radars, including Short-Range Surveillance Radar (SRSR), Medium-Range Surveillance Radar (MRSR), Long-Range Surveillance Radar (LRSR) including Over-the-Horizon (OTH), Air and Missile Defense/Air Surveillance Radar (AESA/PESA), Ground/Perimeter Surveillance Radar (GSR), Coastal and Vessel Traffic Service (VTS) Radar, Weather and Airborne Early Warning (AEW) Surveillance Radar, and Multi-Function/3D Surveillance Radar. Among these, the Air and Missile Defense/Air Surveillance Radar segment is currently dominating the market due to the increasing focus on national security and the need for advanced defense systems. The growing geopolitical tensions and the need for effective airspace management have led to a surge in demand for these sophisticated radar systems.

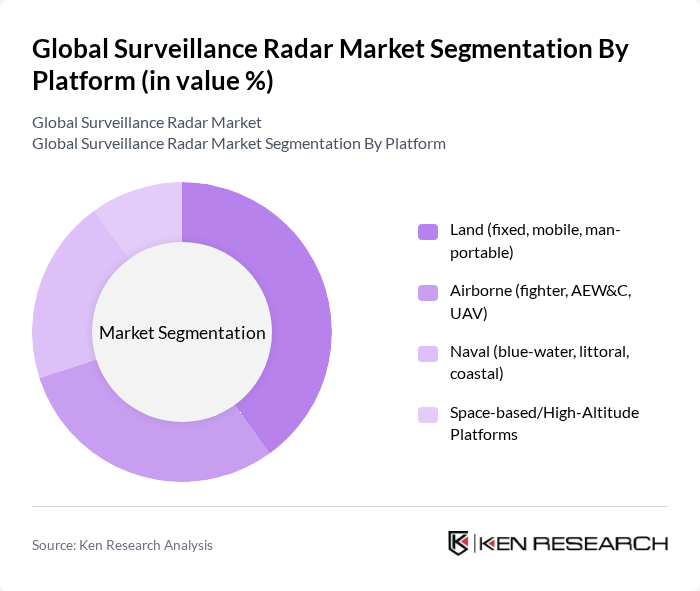

By Platform:The market is segmented by platform into Land (fixed, mobile, man-portable), Airborne (fighter, AEW&C, UAV), Naval (blue-water, littoral, coastal), and Space-based/High-Altitude Platforms. The Land platform segment is currently leading the market due to the increasing demand for mobile and man-portable radar systems for ground surveillance and defense applications. The versatility and adaptability of land-based systems make them essential for various military and security operations, contributing to their dominance in the market.

The Global Surveillance Radar Market is characterized by a dynamic mix of regional and international players. Leading participants such as Raytheon (RTX) — Raytheon Missiles & Defense, Northrop Grumman Corporation, Thales Group, Lockheed Martin Corporation, BAE Systems plc, Leonardo S.p.A., Saab AB, Elbit Systems Ltd., Hensoldt AG, General Dynamics Mission Systems, Inc., Indra Sistemas, S.A., L3Harris Technologies, Inc., Rheinmetall AG, Mitsubishi Electric Corporation, Israel Aerospace Industries (IAI) — ELTA Systems, Terma A/S, Kelvin Hughes (HENSOLDT UK), NEC Corporation, Reutech Radar Systems (Reutech), Bharat Electronics Limited (BEL) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the surveillance radar market is poised for significant transformation, driven by technological advancements and increasing automation. As nations prioritize national security, the integration of artificial intelligence and machine learning into radar systems will enhance operational efficiency and data analysis capabilities. Furthermore, the shift towards digital radar solutions will facilitate real-time monitoring and improve response times, making these systems more effective in various applications, from defense to civilian safety.

| Segment | Sub-Segments |

|---|---|

| By Type | Short-Range Surveillance Radar (SRSR) Medium-Range Surveillance Radar (MRSR) Long-Range Surveillance Radar (LRSR) incl. OTH Air and Missile Defense/Air Surveillance Radar (AESA/PESA) Ground/Perimeter Surveillance Radar (GSR) Coastal and Vessel Traffic Service (VTS) Radar Weather and Airborne Early Warning (AEW) Surveillance Radar Multi-Function/3D Surveillance Radar |

| By Platform | Land (fixed, mobile, man-portable) Airborne (fighter, AEW&C, UAV) Naval (blue-water, littoral, coastal) Space-based/High-Altitude Platforms |

| By End-User | Defense Homeland Security/Border Agencies Civil Aviation/ATC Authorities Maritime/Coast Guard & Port Authorities Meteorological Agencies Critical Infrastructure & Industrial (airports, energy, utilities) |

| By Application | Airspace Surveillance & Air Traffic Control Border & Perimeter Security (counter-intrusion) Coastal/Maritime Domain Awareness & VTS Counter-UAS/Counter-Drone (C-UAS) Early Warning & Air/Missile Defense Disaster Management & Weather Monitoring Critical Infrastructure Protection & Traffic Monitoring |

| By Component | Antennas & Arrays Transmitters/Power Amplifiers Receivers/Duplexers Digital Signal Processors & Controllers Software (signal/data processing, tracking, fusion) Services (installation, integration, lifecycle support) |

| By Frequency Band | L-band S-band C-band X-band Ku/K/Ka-band UHF/VHF |

| By Sales Channel | Direct to Government/Defense Primes OEM/Prime Contractor Programs Distributors/Systems Integrators |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Surveillance Applications | 100 | Defense Analysts, Military Procurement Officers |

| Aviation Safety Systems | 80 | Aviation Safety Managers, Air Traffic Controllers |

| Maritime Radar Systems | 70 | Naval Engineers, Maritime Operations Managers |

| Commercial Radar Solutions | 60 | Product Managers, Sales Directors in Radar Firms |

| Research and Development in Radar Technology | 90 | R&D Engineers, Technology Innovators |

The Global Surveillance Radar Market is valued at approximately USD 10.5 billion, driven by increasing defense budgets, advancements in radar technology, and the rising need for surveillance across various sectors, including defense, aviation, and maritime applications.