Region:Global

Author(s):Shubham

Product Code:KRAA1784

Pages:85

Published On:August 2025

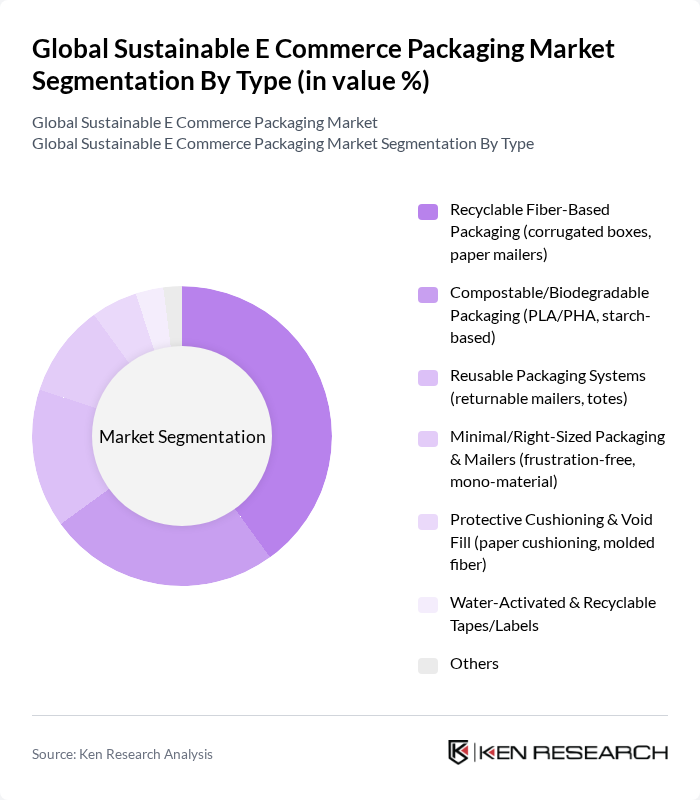

By Type:The market is segmented into various types of sustainable packaging solutions. The dominant sub-segment is Recyclable Fiber-Based Packaging, which includes corrugated boxes and paper mailers. This segment is favored due to its widespread acceptance and ease of recycling, aligning with consumer preferences for eco-friendly options. Compostable/Biodegradable Packaging is also gaining traction, particularly in food delivery services, as consumers seek alternatives to traditional plastics. Reusable Packaging Systems are becoming popular among brands aiming to reduce waste and enhance customer loyalty.

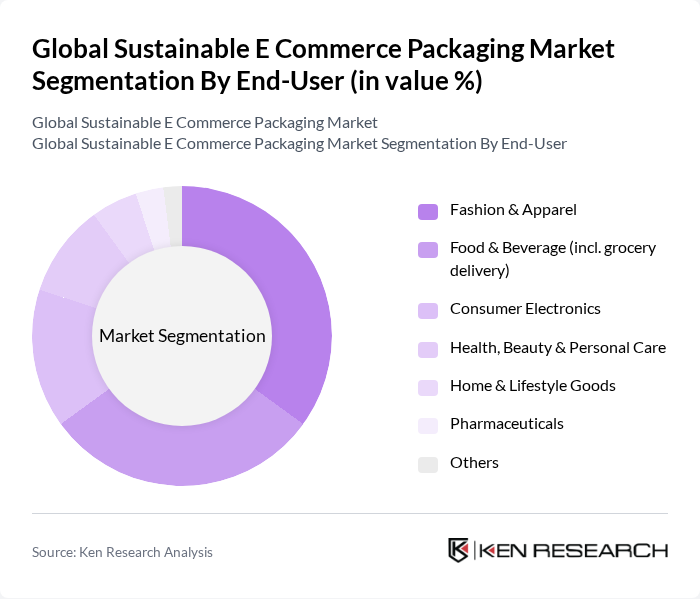

By End-User:The end-user segmentation reveals that the Fashion & Apparel sector is the largest consumer of sustainable packaging solutions, driven by increasing consumer demand for eco-friendly products. The Food & Beverage industry follows closely, with a growing emphasis on sustainable practices in packaging to meet regulatory requirements and consumer expectations. The Consumer Electronics sector is also adopting sustainable packaging to enhance brand image and reduce environmental impact.

The Global Sustainable E Commerce Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Smurfit Kappa Group plc, Mondi plc, DS Smith Plc, Sealed Air Corporation, WestRock Company, International Paper Company, Huhtamaki Oyj, Novolex Holdings, LLC, Berry Global, Inc., Tetra Pak International S.A., Sonoco Products Company, Pratt Industries, Inc., Ranpak Holdings Corp., Uline, Inc., Pact Group Holdings Ltd, Oji Holdings Corporation, Stora Enso Oyj, Smolpak (not applicable) — replaced by Pregis LLC, BioPak Pty Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of sustainable e-commerce packaging is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As companies increasingly adopt circular economy practices, the focus will shift towards innovative materials and reusable packaging solutions. Additionally, the integration of smart packaging technologies will enhance supply chain efficiency and consumer engagement. With ongoing government support and rising awareness, the market is expected to witness robust growth, fostering a more sustainable packaging ecosystem in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Recyclable Fiber-Based Packaging (corrugated boxes, paper mailers) Compostable/Biodegradable Packaging (PLA/PHA, starch-based) Reusable Packaging Systems (returnable mailers, totes) Minimal/Right-Sized Packaging & Mailers (frustration-free, mono-material) Protective Cushioning & Void Fill (paper cushioning, molded fiber) Water-Activated & Recyclable Tapes/Labels Others |

| By End-User | Fashion & Apparel Food & Beverage (incl. grocery delivery) Consumer Electronics Health, Beauty & Personal Care Home & Lifestyle Goods Pharmaceuticals Others |

| By Sales Channel | Direct to Brand (enterprise contracts) E-Marketplaces & Online Platforms Distributors/Value-Added Resellers Wholesale/Industrial Supply Others |

| By Material | Paper & Paperboard (kraft, corrugated, molded fiber) Bioplastics & Compostables (PLA, PHA, PBS) Recycled Plastics (PCR PE/PP films) Metals & Hybrid Materials Others |

| By Packaging Type | Corrugated Boxes & Mailers Paper Padded Mailers & Envelopes Protective Wraps & Void Fill Returnable/Reusable Shippers Labels, Tapes & Seals Others |

| By Distribution Mode | B2B B2C C2C Others |

| By Price Range | Value (cost-optimized) Mid-Range Premium (advanced sustainable formats) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Sustainable Packaging | 150 | Online Shoppers, Eco-conscious Consumers |

| Supplier Insights on Eco-friendly Materials | 100 | Packaging Manufacturers, Packaging Engineers |

| Retailer Adoption of Sustainable Practices | 80 | Retail Managers, Sustainability Coordinators |

| Impact of Regulations on Packaging Choices | 70 | Regulators, Compliance Officers |

| Trends in E-commerce Packaging Solutions | 90 | E-commerce Managers, Logistics Managers |

The Global Sustainable E Commerce Packaging Market is valued at approximately USD 5560 billion, driven by the increasing demand for eco-friendly packaging solutions as consumers and businesses prioritize sustainability in their purchasing decisions.