Region:Global

Author(s):Dev

Product Code:KRAB0654

Pages:89

Published On:August 2025

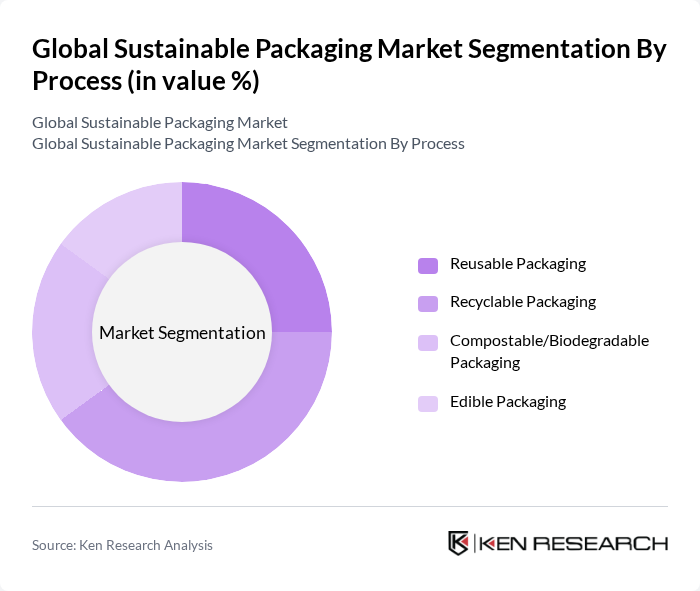

By Process:The sustainable packaging market is segmented by process into reusable packaging, recyclable packaging, compostable/biodegradable packaging, and edible packaging. Among these, recyclable packaging is currently the most dominant sub-segment due to increasing consumer demand for products that can be easily recycled and the growing emphasis on reducing waste in landfills. The trend towards sustainability has led to innovations in recyclable materials, making them more appealing to both consumers and manufacturers.

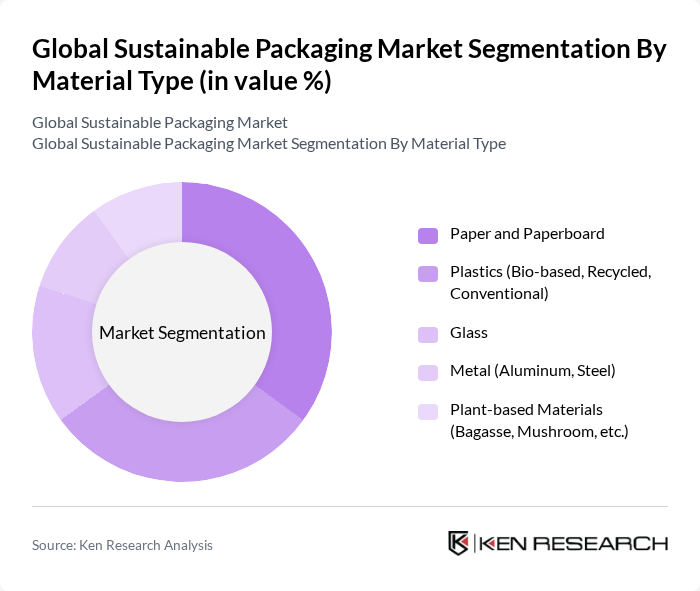

By Material Type:The market is also segmented by material type, including paper and paperboard, plastics (bio-based, recycled, conventional), glass, metal (aluminum, steel), and plant-based materials (bagasse, mushroom, etc.). Paper and paperboard are leading the market due to their biodegradability and recyclability, which align with consumer preferences for sustainable options. The increasing use of paper-based packaging in various sectors, especially food and beverage, is driving this trend.

The Global Sustainable Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Tetra Pak International S.A., Mondi Group, Smurfit Kappa Group plc, DS Smith Plc, Sealed Air Corporation, WestRock Company, Ball Corporation, Huhtamaki Oyj, International Paper Company, Novolex Holdings, LLC, Berry Global, Inc., Sonoco Products Company, Klabin S.A., Greif, Inc., Ranpak Holdings Corp, Uflex Ltd., Stora Enso Oyj, Crown Holdings, Inc., AptarGroup, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sustainable packaging market appears promising, driven by increasing consumer awareness and regulatory pressures. As companies adapt to the circular economy model, innovations in biodegradable and reusable packaging are expected to gain traction. Furthermore, partnerships between brands and sustainable packaging providers will likely enhance product offerings, catering to eco-conscious consumers. The market is poised for growth as technological advancements continue to lower costs and improve the performance of sustainable materials, fostering a more sustainable future.

| Segment | Sub-Segments |

|---|---|

| By Process | Reusable Packaging Recyclable Packaging Compostable/Biodegradable Packaging Edible Packaging |

| By Material Type | Paper and Paperboard Plastics (Bio-based, Recycled, Conventional) Glass Metal (Aluminum, Steel) Plant-based Materials (Bagasse, Mushroom, etc.) |

| By Packaging Format | Rigid Packaging Flexible Packaging |

| By Function | Primary Packaging Secondary Packaging Tertiary/Transport Packaging |

| By End-User | Food and Beverage Pharmaceutical and Healthcare Cosmetics and Personal Care E-commerce and Retail Consumer Electronics Others |

| By Geography | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Goods Packaging | 120 | Sustainability Managers, Product Development Leads |

| Food and Beverage Packaging | 100 | Packaging Engineers, Quality Assurance Managers |

| Pharmaceutical Packaging Solutions | 80 | Regulatory Affairs Specialists, Packaging Designers |

| Retail Packaging Innovations | 70 | Marketing Managers, Supply Chain Coordinators |

| Industrial Packaging Trends | 50 | Operations Managers, Procurement Specialists |

The Global Sustainable Packaging Market is valued at approximately USD 283 billion, reflecting a significant growth trend driven by consumer interest in sustainability and regulatory measures aimed at reducing packaging waste, particularly single-use plastics.