Region:Global

Author(s):Geetanshi

Product Code:KRAC0032

Pages:97

Published On:August 2025

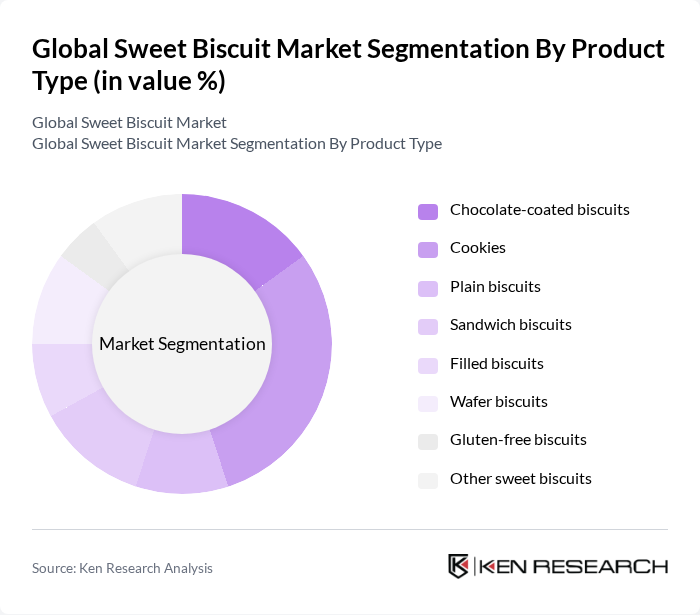

By Product Type:The product type segmentation includes various categories such as chocolate-coated biscuits, cookies, plain biscuits, sandwich biscuits, filled biscuits, wafer biscuits, gluten-free biscuits, and other sweet biscuits. Among these, cookies have emerged as the leading sub-segment due to their versatility and popularity across different age groups. The trend towards artisanal, multi-grain, and gourmet cookies has further fueled their demand, making them a staple in both retail and food service sectors .

By Source:The source segmentation includes wheat, oats, millets, and others. Wheat is the dominant source due to its widespread availability and cost-effectiveness, making it the primary ingredient in most sweet biscuits. The increasing trend towards health-conscious eating has also led to a rise in the use of oats and millets, as consumers seek alternatives that offer higher nutritional value .

The Global Sweet Biscuit Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mondelez International, Inc., Nestlé S.A., PepsiCo, Inc., Kellogg Company, General Mills, Inc., Britannia Industries Limited, Parle Products Pvt. Ltd., Campbell Soup Company, United Biscuits (McVitie's), Bahlsen GmbH & Co. KG, Lotus Bakeries NV, Tunnock's Ltd., Walkers Shortbread Ltd., Pepperidge Farm, Inc., Arnott's Biscuits Ltd., ITC Limited, Yildiz Holding A.S. (Ülker) contribute to innovation, geographic expansion, and service delivery in this space.

The sweet biscuit market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are increasingly adopting eco-friendly packaging solutions, which are expected to attract environmentally conscious consumers. Additionally, the rise of health-oriented innovations, such as protein-enriched and low-calorie biscuits, will cater to the growing demand for nutritious snacks. These trends indicate a dynamic market landscape that will continue to evolve in response to consumer needs and regulatory changes.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Chocolate-coated biscuits Cookies Plain biscuits Sandwich biscuits Filled biscuits Wafer biscuits Gluten-free biscuits Other sweet biscuits |

| By Source | Wheat Oats Millets Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience stores Specialty stores Online retail |

| By End-User | Retail consumers Food service industry Institutional buyers |

| By Region | North America (United States, Canada, Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Rest of Europe) Asia-Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, Rest of APAC) Latin America (Brazil, Argentina, Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria, Rest of ME&A) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Biscuit Sales | 100 | Category Managers, Retail Buyers |

| Consumer Preferences | 120 | Frequent Biscuit Consumers, Snack Enthusiasts |

| Manufacturing Insights | 80 | Production Managers, Quality Control Officers |

| Market Trends Analysis | 60 | Market Analysts, Industry Experts |

| Health and Wellness Impact | 40 | Nutritional Experts, Health-Conscious Consumers |

The Global Sweet Biscuit Market is valued at approximately USD 103 billion, driven by increasing consumer demand for convenient snacks and product innovations catering to health-conscious preferences.